French borrowing costs spike amid political turbulence • FRANCE 24 English

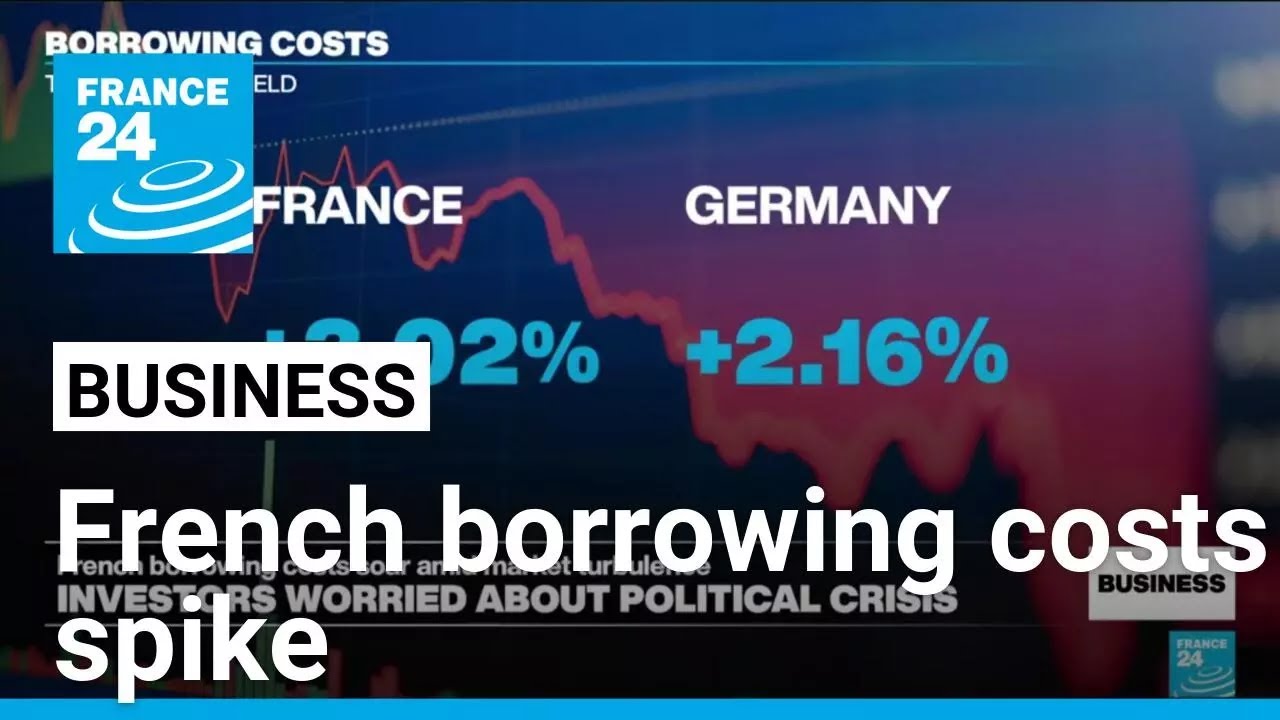

Another looming political crisis is battering France’s reputation on global markets. Borrowing costs spiked as investors looked to a possible vote of no confidence over the government’s budget proposal. That led the spread between French and German bond yields to hit its highest level since 2012. Also in the show: Ursula von der Leyen vows to increase the EU’s defence spending, as Russia ramps up its own defence budget.

Read more about this story in our article: https://f24.my/Am0a.y

🔔 Subscribe to France 24 now: https://f24.my/YTen

🔴 LIVE – Watch FRANCE 24 English 24/7 here: https://f24.my/YTliveEN

🌍 Read the latest International News and Top Stories: https://www.france24.com/en/

Like us on Facebook: https://f24.my/FBen

Follow us on X (Twitter): https://f24.my/Xen

Browse the news in pictures on Instagram: https://f24.my/IGen

Discover our TikTok videos: https://f24.my/TKen

Get the latest top stories on Telegram: https://f24.my/TGen

10 comments

By contrast with the US, the world's largest economy, the French are doing well. The US 10 year is about 4.25% today.

This is a real issue, I am glad it is reported on. I also have to wonder about the Americans. They have not passed a budget for the current fiscal year, which should have been done last spring. If the US Congress is too dysfunctional to pass a budget, why is that not news?

That there is still a "spread" between France and Germany says all you need about the failure of the EU to create a single financial market.

Too many people "working" for the state in France. And this now for a very long time since the 70s.

France is a lost cause.

The US Israel tariffs on France and Germany will make Israel great again 😂😂😂

Russia's GDP is 2.18 Tn. Someone send her bk to school pls.

Contrary to what is said here, France and Germany are paying impossibly low rates considering the high inflation. The problem is that there is a debt crisis, and European countries can no longer pay reasonable interest rates. Fortunately for them, the ECB is not focused on keeping inflation in check. The ECB is focused on accommodating government overspending, by lowering interest rates. It will keep the ship afloat in the short term, but it will be disastrous in the long term.

Is it any wonder that investors don`t want to know seeing how the country has been run into the ground since the last two terms of presidency.

France must decide if it wants to track to the hard and fail, or not. The pension age must be increased to 67.

Comments are closed.