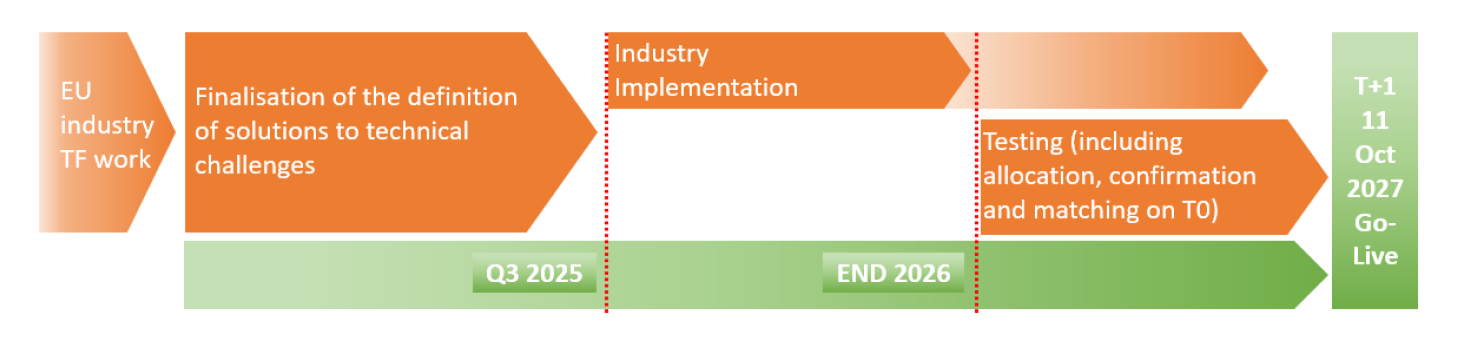

Figure 1: Three phases of the operationalisation of T+1

Source: ESMA assessment of the shortening of the settlement cycle in the European Union

ESMA has recommended 11 October 2027 as an optimal date for the transition to T+1 in the EU and a three-phase approach to its operationalisation (see Figure 1). However, the Task Force has not recommended an explicit date as there were mixed views from the consultation process. As noted above, a coordinated approach across Europe is important. ESMA has recognised the need for specific governance to be implemented, to cater to the complexity of trading and post-trading in EU capital markets.

Hence, amendments can be expected to article 5 para 2 of the CSDR.5 It mandates the settlement of transactions in transferable securities which are traded on a trading venue ‘no later than on trade date plus 2’ which should be changed to ‘no later than trade date plus 1’ going forward as proposed by ESMA in its T+1 report. The current scope of asset classes and transaction types is proposed to remain unchanged, e.g. Exchange Traded Funds (ETFs) and Securities Financing Transactions (SFTs) remain in scope. This would provide legal certainty that all EU markets migrate at the same time with the same scope of asset classes and transaction types to T+1.

With regards to the CSDR cash penalties and provided substantial evidence from market participants shows that settlement efficiency could significantly deteriorate by the shift to T+1, ESMA proposes the consideration of a time-limited suspension of the application of cash penalties by the European Commission to alleviate the potential increase of the overall level of cash penalties.

Moreover, respondents to ESMA’s October 2023 Call for Evidence on Shortening the Settlement Cycle encouraged the body to engage with APAC stakeholders (who would be particularly affected by the EU’s adoption of T+1 due to time zone discrepancies,6) and study lessons learned from North America’s adoption of T+1 in May 2024.

In the meantime, market participants will need to examine their readiness for T+1. The transition may require significant investment in areas including technology, systems and controls, staff training and compliance. Deutsche Bank’s McNally notes that smaller firms could find this more of a challenge, while larger, global organisations might be better placed, due to existing processes and infrastructure, and lessons learned from the US transition. Despite the challenges posed, the shortening of the settlement cycle in Europe presents firms with a unique opportunity to harness the long-term benefits of automation and cost reduction while embedding lasting efficiencies.

Header picture ©ESMA