The Bank of Japan left interest rates unchanged Thursday in a move widely expected by the market due to a lack of clarity over wage trends at home and caution over the outlook for the U.S. economy under incoming President Donald Trump.

The central bank decided to keep its key short-term rate on hold at around 0.25 percent at the end of a two-day policy meeting. The policy rate has been kept at that level for the three consecutive meetings.

“The recent data on the economy and prices are largely moving in line with our expectations,” Governor Kazuo Ueda said at a press conference. “But we need to see more data, such as momentum in wage hikes into the next year’s spring wage negotiations, to examine if there is a positive cycle of wages and prices.”

Sustained wage growth is one of the key factors that the BOJ said will influence its decision. Japanese firms offered a historic increase in this year’s annual wage talks, but it is unclear whether the current trend will continue as some smaller firms are struggling to pass on higher costs to consumers.

Bank of Japan Governor Kazuo Ueda holds a press conference at the central bank’s headquarters in Tokyo on Dec. 19, 2024, after the BOJ kept its key interest rate unchanged at around 0.25 percent during a two-day policy-setting meeting. (Kyodo) ==Kyodo

The bank’s Policy Board is also examining potential impacts on global financial markets and the U.S. economy from Trump’s policies, especially his protectionist approach to international trade as he has pledged to raise tariffs on imports.

“The fiscal, trade and immigration policies under the next administration could significantly impact not only on the economy and prices in the United States but also on the global economy and the financial and capital markets worldwide,” the governor said.

Ueda said he expects to assess more data on wages and the U.S. economy by the next meeting in January. However, he avoided commenting on the likelihood of a rate hike, saying the decision will be made based on a comprehensive evaluation then.

“The BOJ seems to be trying to find a strong enough reason to convince the general public that (Japan) is ready for a rate hike,” said Shinichiro Kobayashi, senior economist at Mitsubishi UFJ Research and Consulting, adding that some economic data such as real wages are still not strong enough.

“They are probably hoping to raise rates under conditions where many people accept such a change.”

Eight of the nine board members voted in support of Thursday’s decision, with Naoki Tamura opposing it and proposing to raise the overnight call rate to around 0.5 percent to address upside risks to inflation.

Japan’s core consumer prices, a key economic indicator for inflation monitored closely by the BOJ, have been at or above the bank’s 2 percent target since April 2022.

BOJ board members have repeatedly said the bank will tighten its monetary policy further if it confirms the economy and prices are moving in line with expectations.

Hours before the BOJ’s decision, the U.S. Federal Reserve cut its benchmark interest rate for a third straight meeting but suggested there may be fewer reductions in borrowing costs next year amid rising inflation risks.

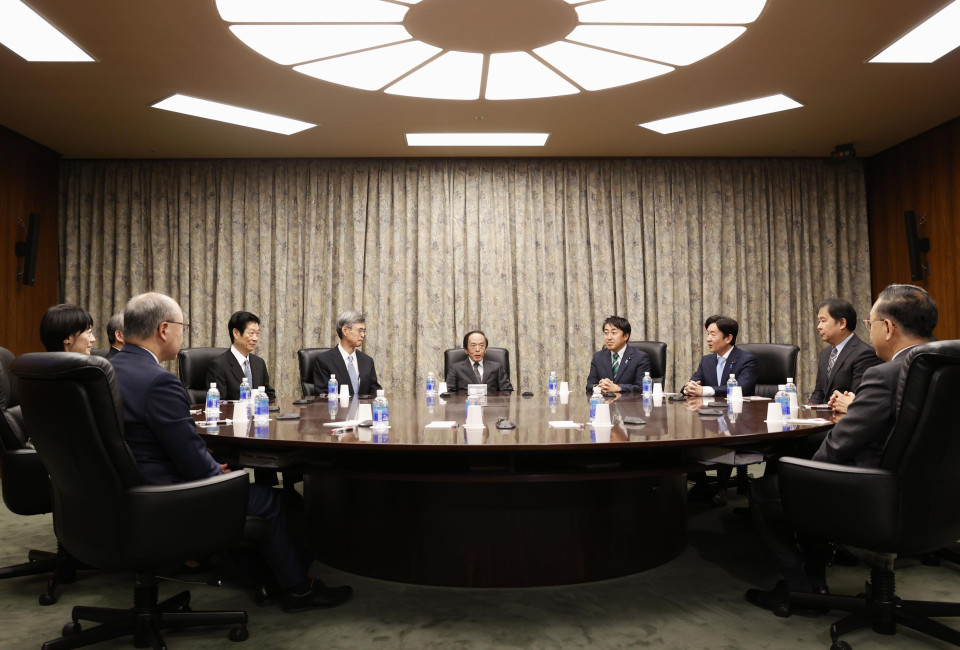

The Bank of Japan holds a session on the second day of its two-day policy-setting meeting at its headquarters in Tokyo on Dec. 19, 2024, with Governor Kazuo Ueda seated at the center. (Kyodo) ==Kyodo

The move by the Fed prompted buying of the dollar in the currency market on the view that U.S. interest rates will be kept at an elevated level for longer. The yen, which had already been under pressure, met selling in a development that the BOJ sees as an upside risk to inflation.

With Ueda’s remarks at the press conference seen by some market players as suggesting that he is not in a rush to raise rates, the Japanese currency further weakened to the 157 range against the dollar, a level unseen since late July.

The BOJ also released results of a review on its monetary policy over the past 25 years, during which it deployed various unconventional easing measures to battle the country’s chronic deflation.

The review concluded that the BOJ’s ultraloose policy, introduced in 2013 and involving massive purchases of government bonds to increase the monetary base, helped lift the economy to some extent, but that the policy was not as effective as initially expected in achieving the bank’s 2 percent inflation target.

Such unorthodox measures should not be ruled out as an option in future policy decisions, but policymakers should take extra care as their effects are less clear compared with traditional measures such as guiding short-term interest rates, it said.

Under Ueda, the BOJ has been overseeing a shift away from a decade of unorthodox monetary easing. He took the helm in April 2023.

The bank ended its negative rate policy in March in its first rate increase in 17 years. It then raised rates in July to around 0.25 percent from the range of zero to 0.1 percent.

Related coverage:

Japan big manufacturers’ confidence improves as auto output recovers: BOJ

Japan July-Sept. GDP growth revised up to 1.2% on private investment