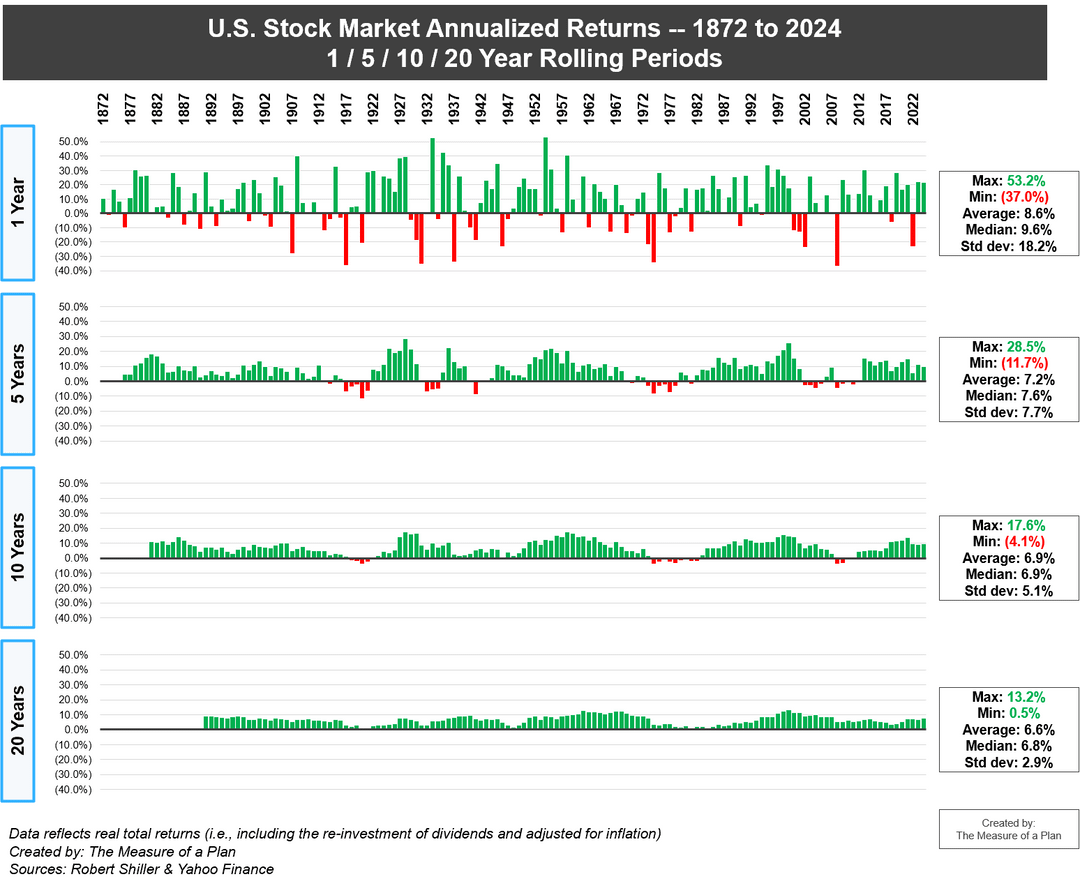

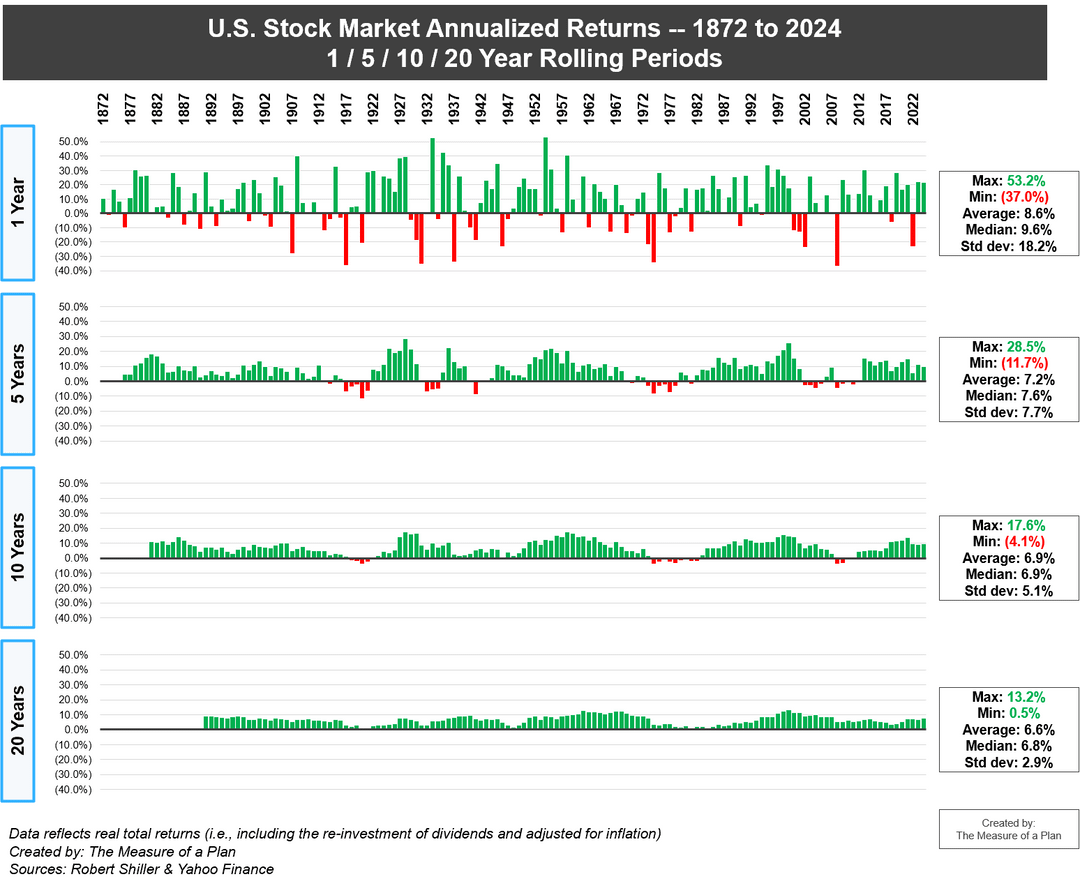

US stock market returns (1872 to 2024) — annualized real total returns over 1 / 5 / 10 / 20 year periods [OC]

Posted by getToTheChopin

![US stock market returns (1872 to 2024) -- annualized real total returns over 1 / 5 / 10 / 20 year periods [OC]](https://www.europesays.com/wp-content/uploads/2025/01/eaiqa1s5msae1.png)

US stock market returns (1872 to 2024) — annualized real total returns over 1 / 5 / 10 / 20 year periods [OC]

Posted by getToTheChopin

5 comments

*[Sorry for the re-post to anyone who saw my original post this morning. It was removed for using a title that did not describe the data plainly. I’ve re-posted with a purely factual title instead]*

All charts and analysis: [https://themeasureofaplan.com/us-stock-market-returns-1870s-to-present/](https://themeasureofaplan.com/us-stock-market-returns-1870s-to-present/)

Key insights:

* Simple Average: the average return of the U.S. stock market has been 8.6% per year over the past ~150 years (1872 to 2024)

* Annualized Average: the return of the U.S. stock market has been 7.1% per year on an annualized average basis, over the past ~150 years

* The market has grown in 69% of all years, and declined in 31% of all years on record

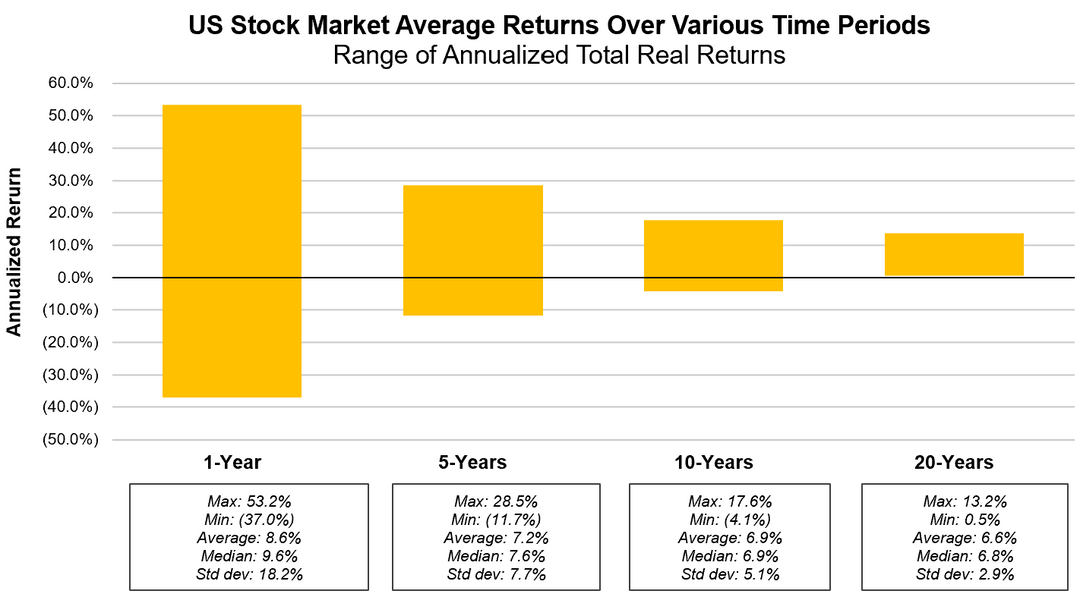

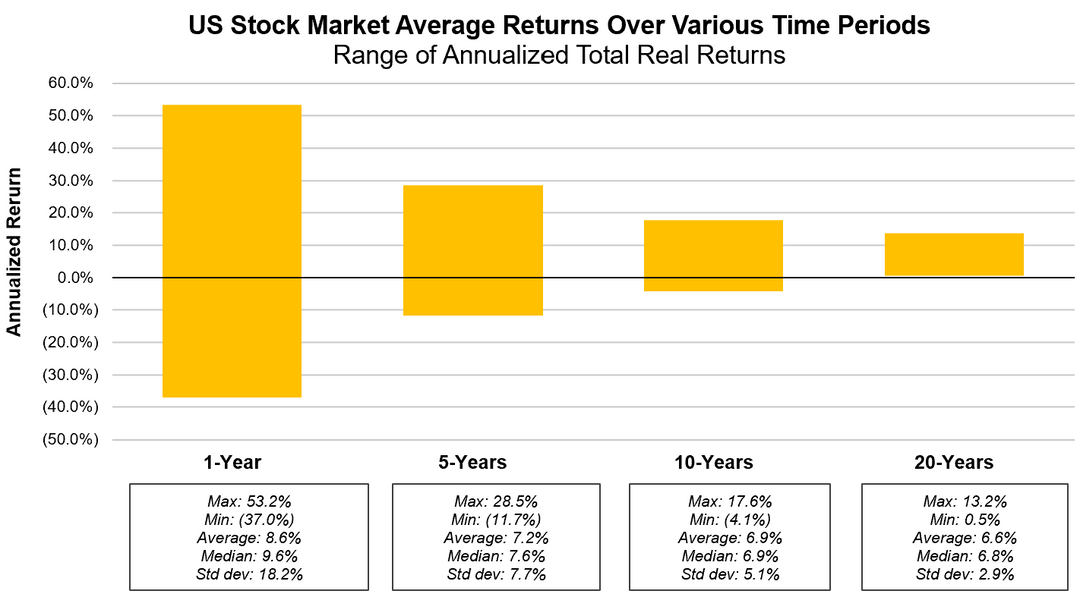

* While the range of returns across 1-year periods has varied significantly (from negative 37.0% to +53.2%), the annualized returns across 20-year periods have a much tighter range (from +0.5% to +13.2%)

* The U.S. stock market has never declined over any 20-year period in history

Tools used: excel, powerpoint

Data sources: Robert Shiller dataset, Yahoo Finance

Time in the market beats timing the market!

Nice work. Clearly shows that a longer investment holding period gives better signal / reduced noise.

Every 50 years or so something bad happens like depression or stagflation.

And the last major downturn was… the 1970s.

Not holding my breath on a good next 5-10 years.

These charts are always made incorrectly and overestimate stock investment risks. They assume that someone invests $X and then waits N years. But real people don’t do that. They invest some fraction of their salary every month. If you counted it like that, chances to be at a loss will reduce dramatically (because every major drop is usually preceded by a crazy, unsustainable rally).

Comments are closed.