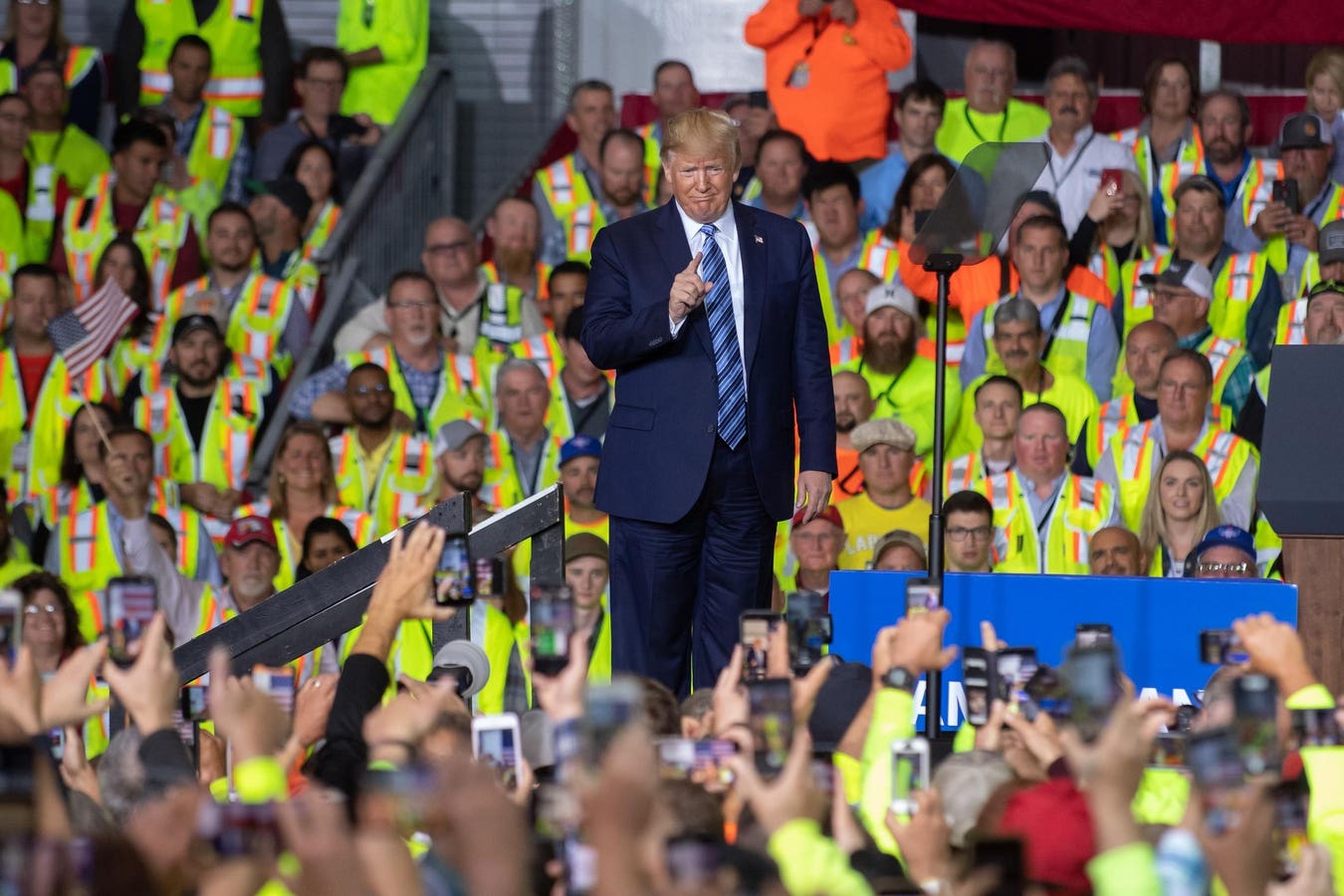

US President Donald Trump speaks to contractors at the Shell Chemicals Petrochemical Complex during … [+] his first term in Monaca, Pennsylvania. Trump has long made the connection between America’s natural resource wealth and the economy and jobs. (Photo by Jeff Swensen/Getty Images)

Getty Images

Media reports have begun coalescing around the belief that the incoming Trump administration’s “energy dominance” agenda—particularly its promises of significantly expanding U.S. oil and natural gas production—will be impossible to fulfill. Skeptics argue that President-elect Donald Trump’s plans will slam into real-world constraints: U.S. output is already at record highs, the shale basins that propelled America to the top tier of global energy producers over the past 15 years are now mature, and the federal government simply cannot compel private companies to drill when market conditions are unfavorable.

While it’s true that the era of annual one-million-barrel-per-day growth in U.S. oil output—witnessed during most of Trump’s first term—is behind us, there are still concrete ways for the administration to facilitate higher production than currently projected. Market forces remain the prime driver of drilling decisions, and U.S. shale resources have become more expensive to develop as the best acreage has been exhausted.

According to the U.S. Energy Information Administration (EIA), domestic oil production is projected to increase by about 300,000 barrels per day in 2025—reaching 13.52 million barrels per day—before leveling off in 2026. A similar trend is expected for natural gas output.

However, the challenge for policymakers has less to do with resource availability and far more to do with industry profitability. Energy companies won’t invest in exploration and production if it’s not profitable for their shareholders.

TGS Well Economics Data places breakeven prices in the Permian and Eagle Ford Basins—two of the most prolific oil-producing regions in the United States—between $56 and $66 per barrel. U.S. benchmark West Texas Intermediate (WTI) crude averaged $76 per barrel in 2024. The EIA expects prices to drop to $70 this year, putting increasing pressure on profitability. In such a tight margin environment, any deviation from capital discipline and robust financial returns can trigger negative reactions from investors.

Nevertheless, government policy can meaningfully shift the economics of oil and gas exploration. Here are the most critical policy levers the new administration can pull.

Roll Back Biden-Era Regulations

Deregulation was a hallmark of Trump’s first administration, which rewrote or revoked dozens of energy- and climate-related rules. The Biden White House, meanwhile, raised federal royalty rates from 12.5% to 16.66%, hiked bonding requirements on oil and gas leases, and instituted new limits and fees on methane emissions—all measures that eat into industry profits.

Starting next year, operators could face a $900-per-metric-ton fee for methane emissions exceeding statutory limits detailed in the 2022 Inflation Reduction Act (IRA). The Trump administration, which will have narrow Republican majorities in both chambers, could attempt to revise or eliminate those methane rules. While Congress may overturn recently finalized regulations, fully removing the new methane charge will still require amending the IRA itself. One possible workaround is to rewrite relevant regulations and introduce broad exemptions that lessen the financial burden on producers.

Reducing Biden-era bonding requirements—particularly the offshore drilling bonding rule that threatens to saddle the industry with nearly $7 billion in obligations—would likewise free up capital. The Trump administration can also ease merger and consolidation rules, which the Biden-era Federal Trade Commission tightened, to help streamline dealmaking and bolster the industry’s financial resiliency.

Reform the Permitting System

Another top priority for a Republican-controlled Congress is to advance permitting reforms for fossil fuel projects. While new regulations alone can’t force energy companies to drill, smoother permitting can facilitate pipeline construction and other midstream projects that expand market access. This matters for both oil and gas producers: gassier wells—especially in the mature Permian Basin—need sufficient pipeline capacity to ensure associated gas can fetch adequate prices. In a recent Dallas Federal Reserve Bank survey, 35% of respondents said low regional natural gas prices caused them to curtail production. Faster permitting for pipelines and other infrastructure would help alleviate bottlenecks, thereby improving the economics of drilling in maturing shale basins.

Accelerate LNG Export Approvals

On the campaign trail, Trump pledged to speed up approvals for liquefied natural gas (LNG) export projects—overturning what he called the Biden administration’s “freeze” on permits. That policy shift would instantly boost investor confidence and create additional demand for U.S. natural gas, shoring up prices and profits for upstream producers.

Workers watch as US President Donald Trump tours the Cameron LNG Export Facility May 14, 2019, in … [+] Hackberry, Louisiana. (Photo by Brendan Smialowski / AFP)

AFP via Getty Images

Though legal and environmental reviews still have to be satisfied, reversing the current posture on LNG export permits would spark development of planned export facilities—Sempra Energy, for instance, expects a prompt green light for its Port Arthur project this year under Trump’s Department of Energy.

Open More Federal Lands and Waters to Drilling

Trump will likely move quickly to open additional onshore and offshore acreage to drilling. Even if private operators don’t immediately bid on every tract offered for lease, resuming federal oil and gas auctions signals that Washington is again friendly to the energy industry—an abrupt shift from Biden’s efforts to throttle lease sales. Although the bottom-line impact will hinge on whether the acreage on offer is financially attractive, a more welcoming stance from Washington strengthens industry sentiment and clarifies America’s commitment to long-term oil and gas development.

Exercise Caution with Tariffs

Tariffs loom as a key plank of Trump’s overall economic strategy, but the administration should be surgical when applying them to avoid hampering U.S. energy producers. Consulting firm Wood Mackenzie warns that broad-based tariffs could depress global oil demand enough to reduce crude prices by $5 to $7 a barrel, while also driving up steel costs for rigs and pipelines. Similarly, tariffs on imported oil would harm U.S. refiners that depend on foreign heavy, sour crude for roughly 40% of their feedstock. A tariff that raises refiners’ input costs would push up prices for gasoline and diesel—undercutting Trump’s pledge to lower retail energy prices.

Beyond the White House: Market Realities

Even if the Trump administration executes all of these moves, market forces will ultimately dictate future drilling programs and production growth. Energy executives in boardrooms—and their investors—are influenced by global economic conditions, OPEC+ policy decisions, and Asian consumption trends. Lower demand or new OPEC+ supply increases could weigh down prices and forestall investment, no matter how favorable U.S. policy becomes.

Still, by diligently rolling back regulations, reforming the permitting process, expediting LNG export approvals, expanding federal lease sales, and handling tariffs with care, the Trump administration can significantly improve the domestic industry’s profitability. That may not recreate the heady days of million-barrel-per-day annual growth in oil production. But smart policies can still unlock meaningful new reserves and give U.S. producers a competitive edge—helping extend America’s energy dominance for years to come.