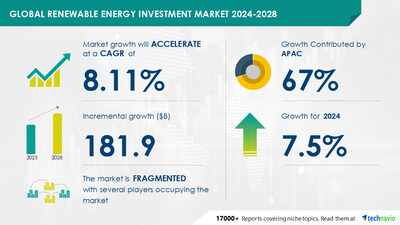

NEW YORK, Jan. 29, 2025 /PRNewswire/ — Report on how AI is redefining market landscape – The global renewable energy investment market size is estimated to grow by USD 181.9 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 8.11% during the forecast period. Supportive government policies is driving market growth, with a trend towards increased spending on utility-scale renewable energy projects . However, competition from fossil fuels poses a challenge. Key market players include AZORA CAPITAL SL, Bank of America Corp., Berkeley Partners LLP, BlackRock Inc., BNP Paribas SA, Capital Dynamics Holding AG, Centerbridge Partners LP, CHN ENERGY Investment Group Co. Ltd., Citigroup Inc., Deloitte Touche Tohmatsu Ltd., EKF, ESFC Investment Group, General Electric Co., KfW Bankengruppe, Macquarie Group Ltd., Mitsubishi UFJ Financial Group Inc., Nebras Power, Positive Energy Ltd., State Power Investment Corp., TerraForm Power Operating LLC, and The Goldman Sachs Group Inc..

Technavio has announced its latest market research report titled Global renewable energy investment market 2024-2028

Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View Free Sample PDF

Renewable Energy Investment Market Scope

Report Coverage

Details

Base year

2023

Historic period

2018 – 2022

Forecast period

2024-2028

Growth momentum & CAGR

Accelerate at a CAGR of 8.11%

Market growth 2024-2028

USD 181.9 billion

Market structure

Fragmented

YoY growth 2022-2023 (%)

7.5

Regional analysis

APAC, North America, Europe, South America, and Middle East and Africa

Performing market contribution

APAC at 67%

Key countries

China, US, Japan, Germany, and Brazil

Key companies profiled

AZORA CAPITAL SL, Bank of America Corp., Berkeley Partners LLP, BlackRock Inc., BNP Paribas SA, Capital Dynamics Holding AG, Centerbridge Partners LP, CHN ENERGY Investment Group Co. Ltd., Citigroup Inc., Deloitte Touche Tohmatsu Ltd., EKF, ESFC Investment Group, General Electric Co., KfW Bankengruppe, Macquarie Group Ltd., Mitsubishi UFJ Financial Group Inc., Nebras Power, Positive Energy Ltd., State Power Investment Corp., TerraForm Power Operating LLC, and The Goldman Sachs Group Inc.

Market Driver

The renewable energy investment market is experiencing significant growth due to the energy crisis and increasing affordability concerns. The EU is leading the way in deployment with solar technology and wind technology seeing record capacity additions. Biofuels are also in demand due to energy security concerns and decarbonization efforts. Policy developments, such as renewable portfolio standards and clean energy laws, are driving investment in utility-scale solar and wind projects. However, challenges like labor costs, capital costs, interconnection and permitting delays, transmission limitations, and regulatory hurdles persist. Renewable energy sources, including hydrogen, are becoming more competitive as fossil fuel alternatives. Rising interest rates and electricity prices are impacting project economics, but federal investments and infrastructure spending offer opportunities for growth. Offshore wind is experiencing a rebound, but delayed projects and onshore wind growth remain strong. Workforce reskilling and regulatory boosts are essential for continued progress. Generative artificial intelligence is playing a role in optimizing renewable energy systems and reducing greenhouse gas emissions. The tax-credit transfer market and grid resilience are also key areas of focus. Overall, the market is facing numerous challenges and opportunities as it transitions to a clean energy future.

Story Continues