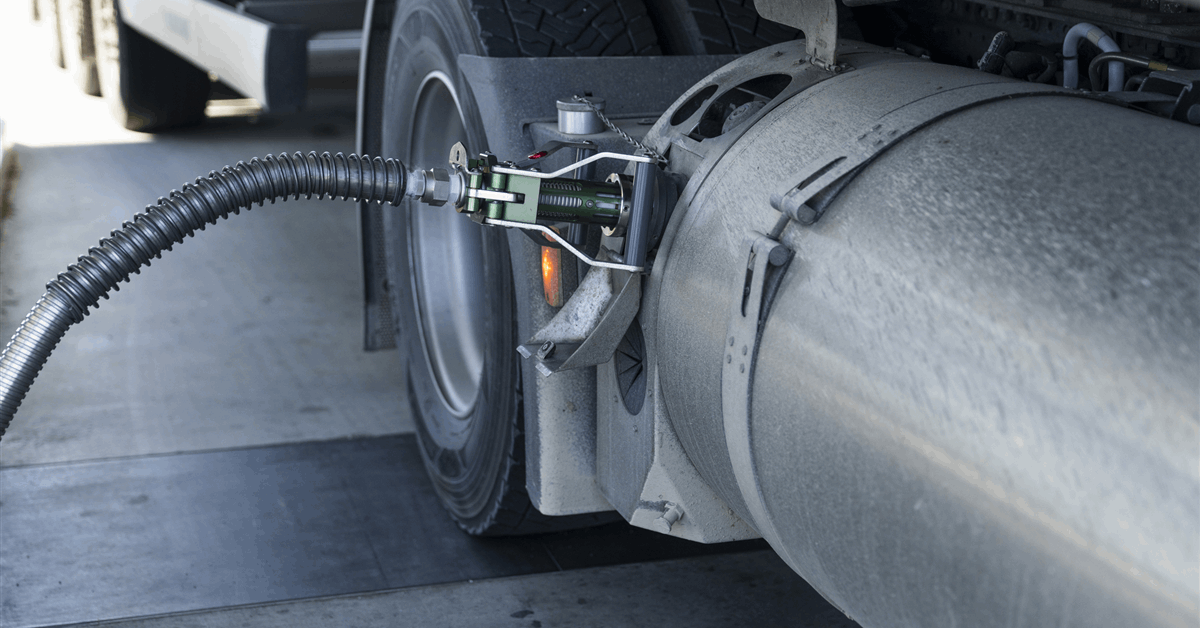

Uniper SE has divested a subsidiary operating liquefied natural gas (LNG) filling stations in Germany and France to EnviTec Biogas AG.

LIQVIS GmbH, founded 2015, runs a total of 18 LNG stations “at strategic traffic hubs with particularly high truck traffic”, according to German gas and power utility Uniper.

EnviTec Biogas, based in Lohne, Germany, plans to use the stations to exclusively sell bio-LNG produced from its facilities.

“With regard to sales volumes, LIQVIS is a perfect match for the current production volumes of fuel-grade biomethane, including biomethane from our own plants in Forst, Friedland, and Güstrow among others”, Jörg Fischer, chief financial officer of EnviTec Biogas, said in a joint press release.

The two firms had a deal for Uniper to sell Envitec Biogas bio-LNG at the stations from 2022, as announced May 27, 2021.

The announcement of Envitec Biogas’ takeover did not disclose the financial details of the transaction.

Earlier in 2025 Uniper said it had completed the sale of a natural gas-fired power plant in Gönyu, Hungary, to the local subsidiary of France’s Veolia SA.

“The sale of this non-strategic investment is part of the conditions that Uniper must fulfill under EU state aid law”, Uniper said January 7. Uniper had agreed to make divestments for the European Commission to grant clearance for the German government’s bailout of the company in 2022.

Commissioned 2011, the power plant generates up to 430 megawatts, according to Uniper.

The new owner is Veolia Invest Hungary Zrt. Uniper and Veolia had agreed not to disclose the financial terms of the transaction, according to the announcement of the sale agreement February 19, 2024.

In another sale aimed toward the fulfillment of the bailout conditions, Uniper announced December 10, 2024, the launch of bidding for its 18.26 percent stake in AS Latvijas Gaze, which is involved in natural gas trading and sales to Baltic consumers primarily in Latvia.

In late 2022 the German government took over about 99 percent of Uniper’s shareholding and agreed to a capital injection of EUR 25 billion ($25.62 billion). The state’s takeover from ex-majority owner Fortum Oyj served to prevent Uniper from collapsing from war-induced losses including from the purchase of substitute gas after Russia’s Gazprom PJSC allegedly failed to deliver contracted supply from mid-2022, according to online information from Uniper.

For the bailout to satisfy EU state aid rules, Uniper agreed to several divestments that must be completed by 2026.

The other assets in the divestment package are an 84 percent stake in Unipro in Russia, a 20 percent stake in the OPAL pipeline, a 20 percent indirect stake in the BBL pipeline, a hard coal-fired power plant in Germany, Uniper’s German district heating business, part of Uniper’s power operations in North America, its Middle Eastern marine fuels unit Uniper Energy DMCC and its international helium business, Uniper says on its website.

To contact the author, email jov.onsat@rigzone.com

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ‘‘ +

‘‘ +

‘‘;

var initJobSearch = function () {

//console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 79 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});