One of the supposed divides amongst traders is that between those who rely on technical analysis, the study of charts and price action, and those for whom fundamentals, the basics of supply and demand in the case of a commodity such as oil, are more important. In reality, traders, or at least those that are successful, use both. Most start with a base case formed by studying fundamentals, then use chart analysis to establish entry and exit points. The exceptions would be those who trade with very short time horizons, where chart reading is far more important than fundamental analysis. If you are looking at the next few minutes, chart levels that prompt responses by human and algorithmic traders are far more influential than fluctuations in fundamental

That said, though, there are times when a position taken with a longer time horizon and based on fundamental analysis has to be cut or adjusted because of what the chart tells you. That is why I am taking a profit on a longer-term short crude position, and am considering reversing it to a long.

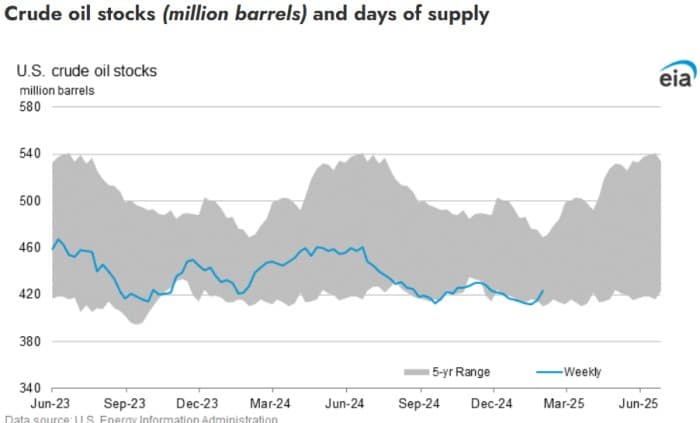

Three weeks ago, I wrote in these pages that even though crude was popping on the back of US inflation data that the market saw as a positive for the economy, or more accurately for interest rates in the US, I remained convinced that the logical path for oil prices in the coming weeks was downwards. There was a counterargument to that, of course…there always is. In this case it was that US inventories were low, creating tight…