(Bloomberg) — The UK economy may have shrunk in the fourth quarter, putting Britain back on the brink of recession and piling more pressure on Chancellor Rachel Reeves and her promise to turbocharge growth.

Most Read from Bloomberg

Economists reckon GDP fell 0.1% following a stagnant third quarter, amid the fallout from Reeves’ tax-raising budget. With surveys pointing to a slow start to 2025, the Bank of England estimates there is a 40% chance that Britain is already in a technical recession — two consecutive quarters of contraction — for the second time in just over a year.

Flat-lining growth and renewed cost-of-living pressures are deepening the problems facing Reeves ahead of new official forecasts next month. The Office for Budget Responsibility is now set to follow the BOE by downgrading its economic projections, raising the prospect that the chancellor will have to cut spending on public services or welfare to avoid breaking her fiscal rules.

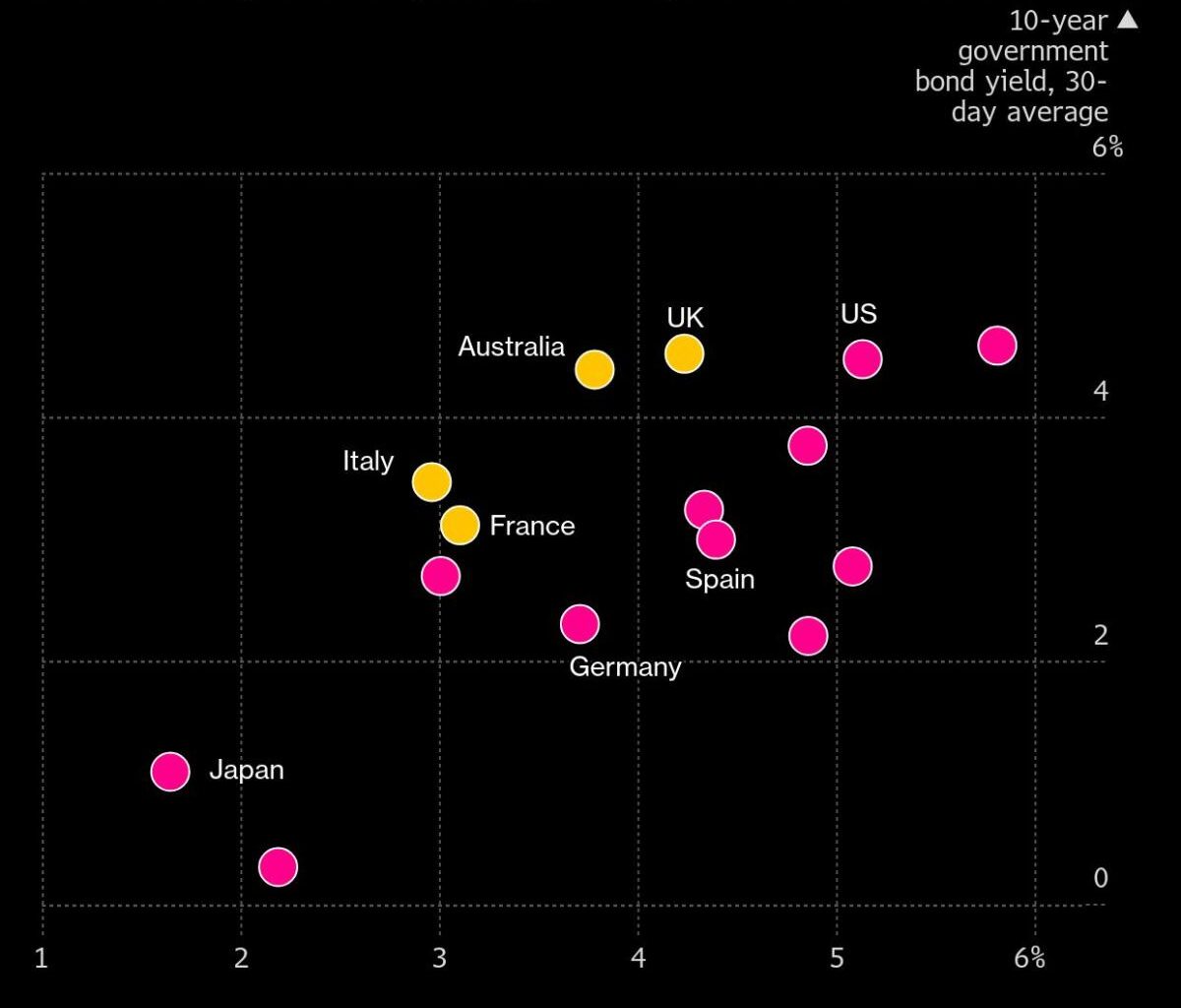

The UK is facing the worst of both worlds. Government borrowing costs are akin to those in the fast-expanding US economy but growth is closer to the struggling eurozone, where the European Central Bank has slashed interest rates to well below UK levels. It makes stabilizing the public finances a particular challenge for Reeves, with investors already jittery about a government debt mountain that’s the highest as a share of the economy since the early 1960s.

According to EY Item Club calculations, Britain pays more to borrow relative to its nominal growth rates than most advanced economies.

“Unless governments manage to reduce their sizeable primary deficits, market concerns about public-sector debt sustainability are likely to grow,” said Ruth Gregory, deputy chief UK economist at Capital Economics. “This means there is little room for complacency.” A primary deficit is the amount a government need to borrow to fund its spending excluding debt-interest costs.

The Office for National Statistics is due to announce fourth-quarter GDP figures on Thursday, along with a new estimate for December alone. Bloomberg Economics reckons output stagnated during the month, leaving the economy no bigger than when Labour took office seven months ago. Consumers and businesses are continuing to reel from the £40 billion ($49.5 billion) of tax increases announced in the budget and threats to the world economy from tariffs being imposed by US President Donald Trump.

Story Continues