Last Energy has formally launched the UK’s nuclear site licensing (NSL) process for plans to develop four 20-MWe microreactors in South Wales, becoming the first small modular reactor (SMR) developer to make the move.

The UK Office for Nuclear Regulation (ONR) on Feb. 17 confirmed the U.S.-based nuclear technology firm’s entry into the critical licensing process, which is set out under the country’s Nuclear Installations Act 1965 (NIA65). A nuclear site license is a legal document ONR issues for the full lifecycle of a nuclear installation from design and construction to operation and decommissioning. It includes the storage of radioactive waste and spent fuel. The license contains site-specific information, defines permitted installations, and includes 36 standard license conditions covering various aspects of nuclear safety

More granular than the Generic Design Assessment (GDA)—a four-step technology-neutral assessment focused on reducing project risk through generic design evaluation—the process of obtaining the NSL is envisioned as a site-specific safety review, involving a population density review and verification there are no defense, civil aviation, or seismic issues. The process is required before construction can begin, which requires separate ONR regulatory approval. “The [NSL] licensing process is fundamental in ensuring that prospective licensees of a nuclear site are ready and able to meet their obligations under the nuclear site licence to protect their workforce and the public,” an ONR spokesperson explained.

South Wales Project Aims for 2027 Delivery of First Unit

The milestone marks a big step for Last Energy, which unveiled plans in October 2024 to deploy four 20-MWe pressurized water reactor (PWR) power plants at the vacant site that housed the Llynfi Power Station, a coal-fired power plant in South Wales that operated from 1951 to 1977. Last Energy is working to deliver its first microreactor in Wales in 2027, pending the licensing, permitting, and planning processes.

The “Prosiect Egni Glan Llynfi” project under development by Last Energy subsidiary Last Energy UK will deploy the PWR-20, which is a 20-MWe (80-MWth) single-loop PWR that has a 300C continuous output. The “plug-and-play” design uses standard full-length PWR fuel enriched to 4.95% and closed-cycle air cooling. Last Energy has said it can deploy modules within a construction timeframe of between six and 24 months.

Last year, the company said the overall capital investment for the Welsh project, estimated at £300 million ($393 million)—including for equipment, services, and other development activities—is expected to be fully privately funded and will not require public funding. In December 2024, the U.S. Export-Import Bank issued a letter of intent confirming its willingness to provide $103.7 million in debt financing to cover end-to-end delivery for its first installation, pending final commitment. In January, the company accepted a grid connection offer from National Grid Electricity Distribution—the UK’s largest electricity distribution network that serves nearly 8 million customers across the Midlands, South West, and Wales—for 22 MW of export capacity and 3 MW of import capacity for its first unit in South Wales.

ONR’s NSL acceptance notice, which became effective on Jan 1, 2025, “follows seven months of early engagement with Last Energy and is a critical accelerator for the company’s deployment progress in the UK,” Last Energy said in a statement. “Last Energy’s entry into licensing also underscores the viability of privately-financed projects, and puts the UK on a near-term path toward its first-ever commercial nuclear microreactor.”

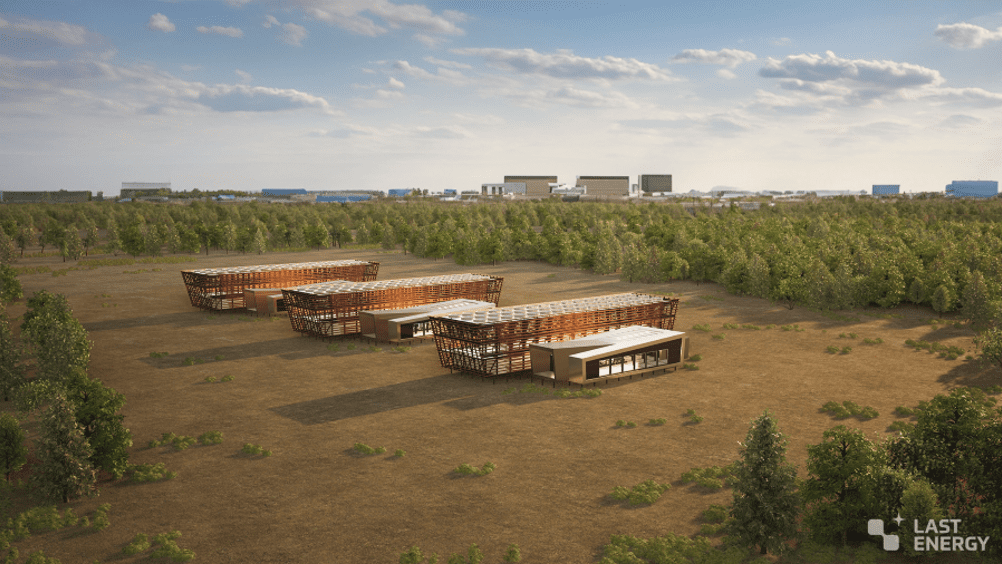

Last Energy’s modular PWR-20 microreactors are designed for efficient factory fabrication, rapid on-site assembly, and flexible deployment. Courtesy: Last Energy

Last Energy’s modular PWR-20 microreactors are designed for efficient factory fabrication, rapid on-site assembly, and flexible deployment. Courtesy: Last Energy

UK Government Working to Streamline Nuclear Planning to Boost Capacity

The licensing milestone marks progress for the UK’s strategy to integrate more nuclear into its power profile to meet an oncoming demand surge that could double by 2050, even with improvements in energy efficiency. While nuclear energy provides 23% of the country’s low-carbon power generation, the UK government set ambitious targets in January 2024 to increase its capacity from the current 5.9 GW to 24 GW by 2050.

The strategy includes both large-scale reactors and smaller, more flexible options like SMRs and microreactors. Large-scale projects remain a priority. The UK’s only nuclear project currently under construction by French firm EDF, the 3.2-GW twin-EPR Hinkley Point C in Somerset, southwest England, is now expected to be in service in 2031 with a total price tag of between £31 billion and £34 billion in 2015 values. Sizewell C, a second 3.2-GW EPR project proposed in Suffolk, eastern England, remains in advanced planning stages. The project received its NSL from the ONR in May 2024.

“Although the granting of a site licence is a significant step, it does not permit the start of nuclear-related construction on the site,” ONR explained when it issued the license. “ONR’s regulatory responsibility starts at the point of granting of a nuclear site licence. Now granted, it is able to use the powers within that licence to require Sizewell C Ltd to request our permission for starting nuclear-related construction. Similarly, the licensee is required to seek our regulatory permission to proceed to subsequent key construction and commissioning stages up to the start of commercial operation and beyond.”

Beyond Sizewell C and Hinkley Point C, the government is eyeing a potential third plant at Wylfa in Anglesey, North Wales. In December 2024, meanwhile, EDF and Centrica announced extensions to the operational lifespans of its four advanced gas-cooled reactors—a combined 4.6 GW. Heysham 1 and Hartlepool are now expected to generate electricity until March 2027, one year later than expected. Heysham 2 and Torness have been extended by two years and are now expected to generate until March 2030. Separately, EDF said it is considering plans to extend Sizewell B’s operational life by 20 years, out to 2055.

To boost progress for SMRs, the government launched a competition in July 2023 to negotiate potentially multi-billion-pound nuclear technology development contracts aimed at delivering an operational SMR by the mid-2030s. It narrowed a shortlist to four candidates in September 2024: Westinghouse, GE-Hitachi Nuclear Energy (GEH), Holtec Britain, and Rolls-Royce SMR. Great British Nuclear (GBN)—the government body tasked with delivering the UK’s fourfold nuclear power expansion—indicated in November that it expects final decisions to be made in the spring of 2025. In early 2024, it also pledged £300 million for domestic production of high-assay low-enriched uranium (HALEU) to establish a reliable supply of the specialist fuel that will be required for advanced nuclear reactors.

In February 2025, UK Prime Minister Keir Starmer announced more measures to streamline the nuclear planning process, including allowing new plants to be built across England and Wales, well beyond its previously designated eight sites. As outlined in a draft National Policy Statement (EN-7), the change seeks to enable more flexible siting near industrial hubs and data centers. The reforms also include establishing a Nuclear Regulatory Taskforce that will work on accelerating reactor design approvals and simplifying regulatory processes while maintaining stringent safety standards. In addition, the government said it expects to remove expiration dates on planning rules to enable long-term project planning and reduce uncertainty for investors.

“This is the latest refusal to accept the status quo, with the government ripping up archaic rules and saying no to the NIMBYs, to prioritise growth,” the Prime Minister’s office said in a statement on Feb. 6. “It comes after recent changes to planning laws, the scrapping of the 3-strike rule for judicial reviews on infrastructure projects, and application of common-sense to environmental rules.”

It added: “For too long the country has been mired by delay and obstruction, with a system too happy to label decisions as too difficult, or too long term. The UK was the first country in the world to develop a nuclear reactor, but the last time a nuclear power station was built was back in 1995. None have been built since, leaving the UK lagging behind in a global race to harness cleaner, more affordable energy.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).