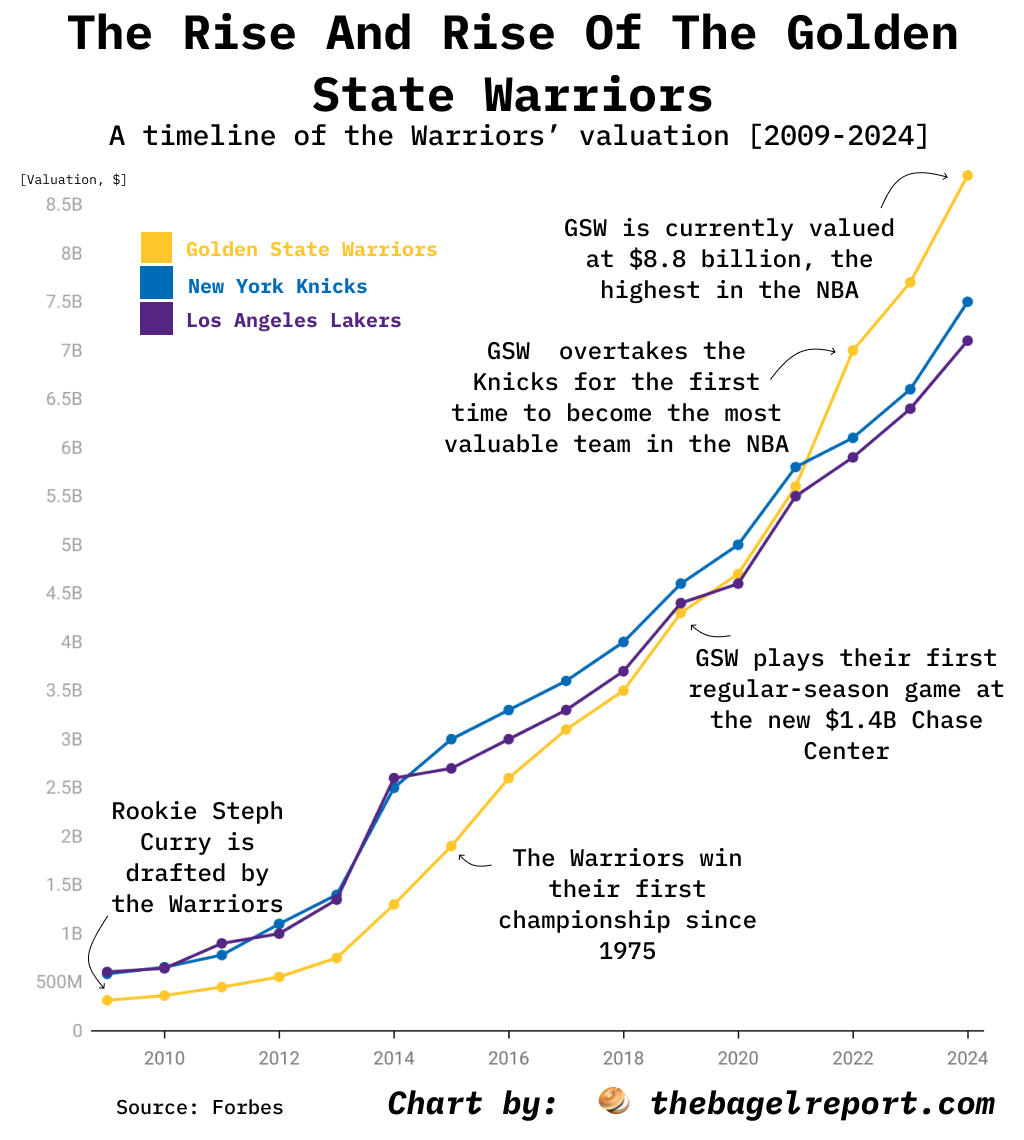

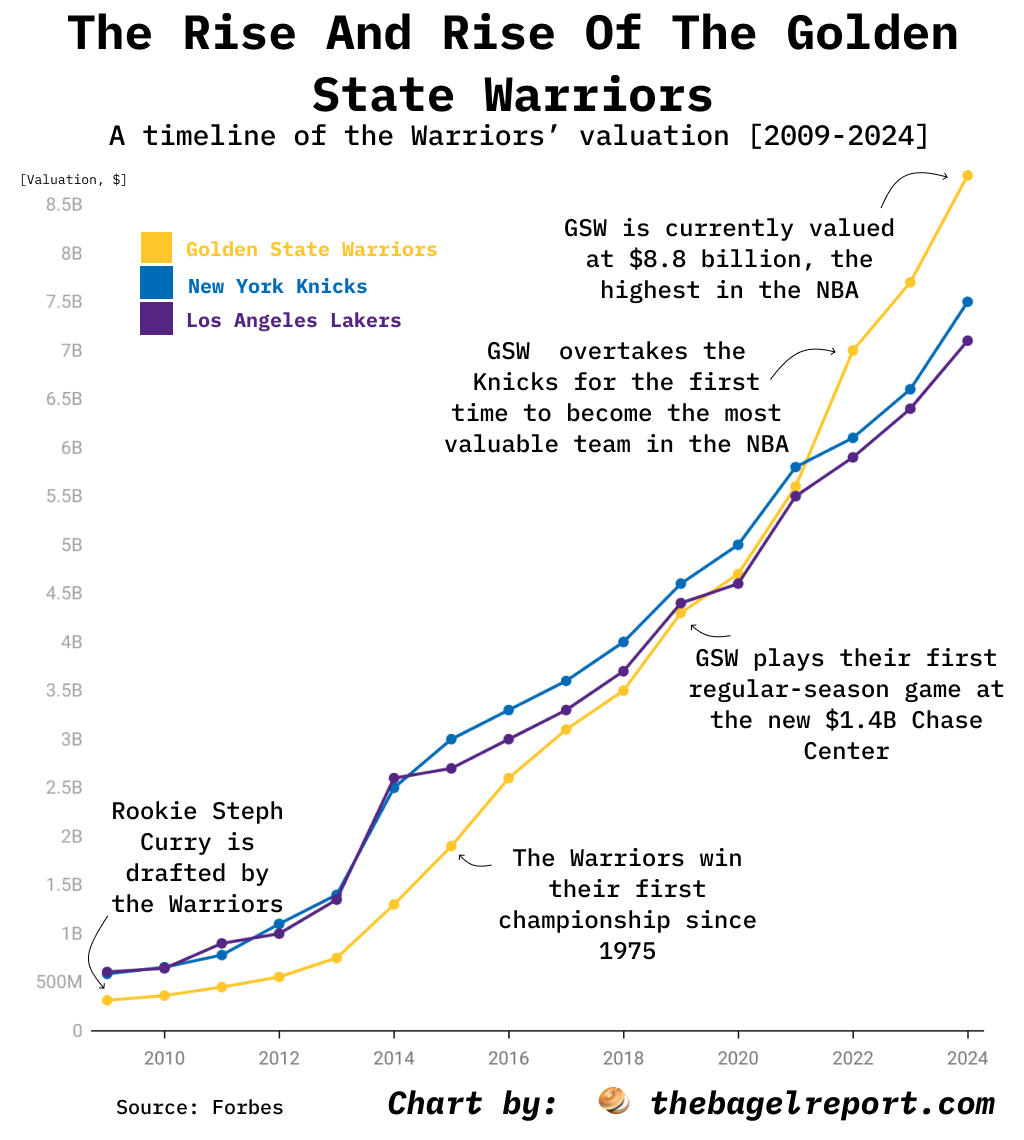

[OC] Since drafting Steph Curry in 2009, the Warriors’ valuation has grown from $315 million to $8.8 billion to become the most valuable team in the league today.

Posted by frayedreality

![[OC] Since drafting Steph Curry in 2009, the Warriors' valuation has grown from $315 million to $8.8 billion to become the most valuable team in the league today.](https://www.europesays.com/wp-content/uploads/2025/02/3ja02k59wjle1-1024x1024.png)

[OC] Since drafting Steph Curry in 2009, the Warriors’ valuation has grown from $315 million to $8.8 billion to become the most valuable team in the league today.

Posted by frayedreality

13 comments

How are the Knicks worth anything?

Teams in the US need to implement relegation. The best way to get rid of stupid owners

Source : Forbes

Tools used: Excel

Building Chase Center was one of the big turning points. The Warriors paid $1.4 billion out of their own pockets to build Chase Center in 2019, and the return on investment has been very high. According to a 2024 report by Accenture, the 18,000-seat arena has generated $4.2 billion since its opening in 2019, including over $2.9 billion in direct spending and more than $1 billion in recirculated spending. The Warriors remain one of the only NBA teams that fully own their arena.

This chart first featured on my newsletter [The Bagel Report](https://thebagelreport.com)

It helps when your building is in one of the most expensive property markets in the world

As Simon Kuper and Stefan Szymanski demonstrated in their masterpiece Soccernomics, best investment is convincing star players at your hand to remain with decent contracts.

GSW is a living experiment.

This chart just shows the NBA valuation has gone way up. Curry hardly matters here.

I don’t understand the Knicks line – how have they added that much value? Or have we actually had the dollar devalued that much in that time period?

Causation is not correlation

This chart would be more convincing if talked about how winning championships (GSW won in ’22) can improve the valuation but as others have said, NBA team valuations as a whole have gone up and building a stadium in one of the most competitive real estate markets in the world may have more to do with it than Steph Curry.

Knicks like the cowboys no championship in decades but still highly valuable

Thats why Steph gets his own jet

Will the team’s value plummet when Curry hangs it up?

I mean you can do the same thing with the New England Patriots before Tom Brady to today

Would be interesting to see this normalized in some way for the local markets. How much of this is just a reflection of the local property markets and general inflation and how much is really because of the team. The gap in recent years implies that some might be team based, but the longer term trend is likely just general asset inflation.

Sports teams are interesting in that they are an extremely limited resource that (in many cases) the existing owners have control over “making more”, turning them into a very unique asset class that is based primarily around their rarity and not the underlying fundamentals of the income streams. These are collectible items for billionaires that can already buy everything else they want.

Throw in nearly 15 years of low to zero interest rates and you have a recipe for some insane valuation growths. (Not unlike the magnificent 7, though different rarity dynamics built more around market monopolies/duopolies)

Comments are closed.