Author: flowie, ChainCatcher

It’s still Trump. After a continuous waterfall decline, Trump’s commitment to cryptocurrency has brought a significant turnaround in the market.

Last night, Trump posted on social media, stating that he instructed the presidential task force to advance a cryptocurrency strategic reserve that includes XRP, SOL, and ADA. He later added that BTC and ETH are also included, leading to a surge in the mentioned tokens.

As of the time of writing, according to Binance market data:

BTC has risen from below $70,000 to break through $95,000, currently reported at $92,600, with a 24-hour increase of 7.82%.

ETH has risen from below $2,200 to break through $2,550, currently reported at $2,434, with a 24-hour increase of 39%.

SOL has risen from around $140 to nearly $180, currently reported at $169, with a 24-hour increase of 11%.

XRP has risen from around $2 to nearly $3, currently reported at $2.79, with a 24-hour increase of 23.94%.

ADA has risen from around $0.65 to break through $1.70, currently reported at $1.07, with a 24-hour increase of 59.60%.

According to Coingecko data, the total market capitalization of cryptocurrencies has also returned to $3 trillion, currently reported at $3.22 trillion, with an 8% increase in the past 24 hours.

The sudden reversal has caught many contract users off guard. In the past 12 hours, the total liquidation amount has exceeded $770 million, with shorts dominating, amounting to $520 million, while long liquidations reached $253 million.

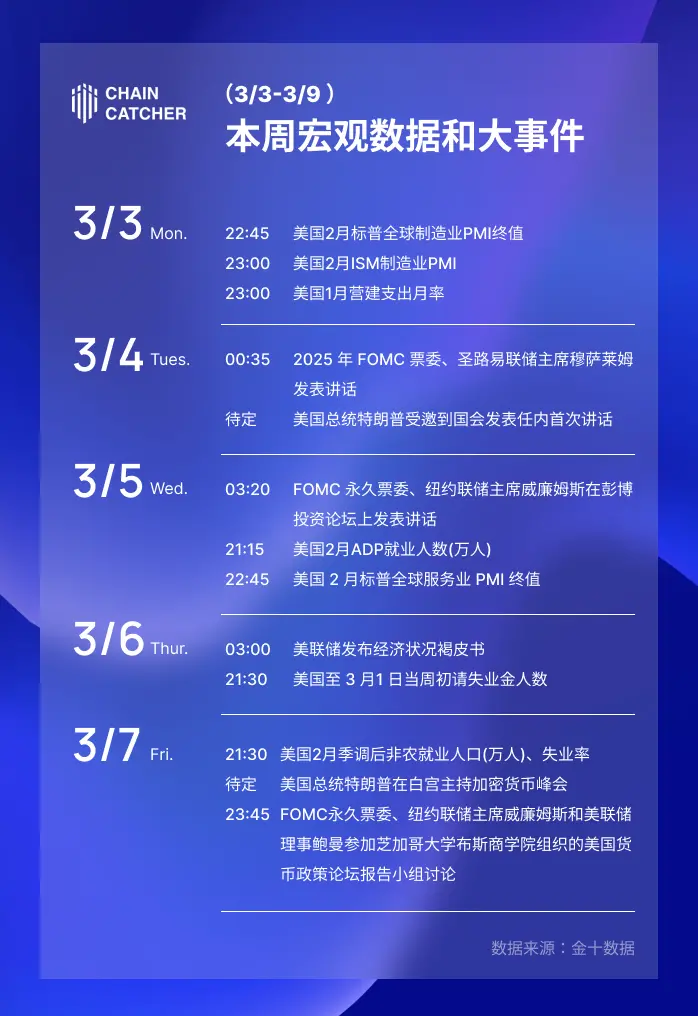

Next, the cryptocurrency market trend enters the most critical week. Several macro data points that influence market direction, as well as the first White House cryptocurrency summit hosted by Trump, will be released or take place this week.

How will the macro big week and the White House cryptocurrency summit affect the market?

This week, there are significant macro data and events affecting the cryptocurrency market almost every day.

Particularly noteworthy is this Friday, when Trump will host a cryptocurrency summit at the White House. Additionally, the unemployment rate and non-farm payroll data will also be released on the same day.

This is Trump’s first time hosting a cryptocurrency summit at the White House, which will gather well-known founders, CEOs, and investors from the cryptocurrency industry, as well as members of the presidential digital asset task force, to discuss regulatory policies, stablecoin regulation, and the potential role of Bitcoin in the U.S. financial system.

Trump and the actions taken at the summit are expected to bring significant volatility to the cryptocurrency market.

Macro-focused crypto KOL @Phyrex_Ni predicts that Trump will likely address the issue of cryptocurrency strategic reserves at the summit, with BTC being the main focus, possibly including ETH, but “American” SOL, ADA, and XRP may not necessarily be mentioned. Additionally, stablecoins will definitely be a part of the summit.

Currently, there is no confirmed list of participating cryptocurrency founders, CEOs, and investors.

The previous list of sponsors for Trump’s inauguration and cryptocurrency ball may provide some references, including: TRON, Ripple, Anchorage, Kraken, Sui, MetaMask, Galaxy, Ondo (ONDO), Solana, Etoro, Uniswap, and publicly listed cryptocurrency companies like Coinbase, MicroStrategy, Marathon Digital, Nano Labs, Exodus, Metaplanet, etc.

Recommended reading: “Exclusive Reveal of the Presidential Inauguration Cryptocurrency Ball – Political and Industry Bigwigs Gather, Core Influencers in the Crypto World Begin to Emerge”

In addition to the cryptocurrency summit on Friday, Trump has also been invited to Congress on Tuesday to deliver his first speech during his term, which will be his first formal address to Congress in his second term, and whether he will mention cryptocurrency is also worth noting.

Additionally, several Federal Reserve officials, including Chairman Powell, FOMC voting members, St. Louis Fed President Bullard, and New York Fed President Williams, will also deliver public speeches this week, and the Federal Reserve will release its Beige Book on economic conditions, which investors need to closely monitor.

On Tuesday, the U.S. plan to impose tariffs on Mexico and Canada will also officially take effect, although the specific tariff levels have not yet been finalized. Earlier in early February, the preliminary announcement of the tariff plan caused a significant plunge in the cryptocurrency market, dropping below the $100,000 mark.

In terms of macro data, non-farm payroll data, and the ISM report on manufacturing and service sector activity for February will also reflect and influence market sentiment.

According to Jin10 data analysis, non-farm payroll data may be a key indicator affecting the direction of U.S. interest rates. Economists estimate that the U.S. economy added 133,000 jobs in February, down from 143,000 in January; the unemployment rate is expected to remain unchanged at 4%, while average hourly earnings are expected to increase by 0.3% month-on-month, down from 0.5% in January.

If non-farm employment increases significantly and the unemployment rate decreases, it indicates a strong economy; conversely, if the data is poor, it may trigger market panic, leading to fluctuations in cryptocurrency prices.

Is “American Coin” once again the main investment theme?

Despite the market showing some bearish sentiment towards Trump’s “call to action” for the market, “American Coin” may once again become the main investment theme.

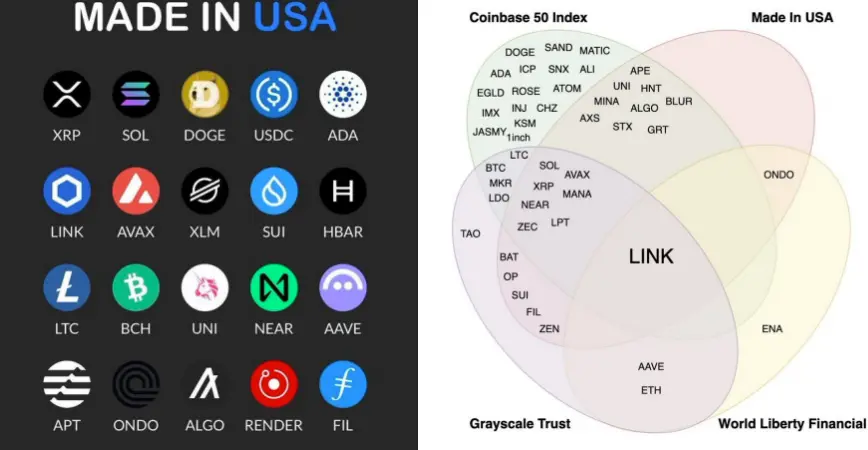

Binance founder Changpeng Zhao (CZ) also posted early this morning, stating that the market is clearly dominated by “U.S. crypto assets” (US Coins).

“American Coin” can be roughly understood as cryptocurrency projects initiated by Americans in the U.S. with a certain trading history.

In addition to the BTC, ETH, XRP, SOL, and ADA that Trump has explicitly mentioned, other “American Coins” identified by cryptocurrency community users are also worth noting, such as UNI, DOGE, LINK, AVAX, XLM, SUI, HBRA, LTC, NEAR, AAVE, APT, ONDO, ALGO, RENDER, FIL, etc. Recommended reading: “After Bitcoin hits 100k, what coins to buy? —— Buy American Coins”

(Original contributions are welcome to ensure accurate sourcing)

Additionally, the Trump family, newly appointed government concept coins, and U.S. capital coins can also be focused on. (This is just a summary of related concept coins and not investment advice)

Trump Family: Official meme TRUMP, DeFi project World Liberty Financial token WLFI, and purchased tokens such as ONDO, ENA, ETH, LINK, AAVE, etc.

New Government Concept Coins: Elon Musk-related concept Dogecoin DOGE, meme coin Department Of Government Efficiency (DOGE) named after the government efficiency department, PNUT; AI and crypto director at the White House David Sacks-related concepts DYDX, HNS, ZRX; newly appointed SEC Chairman Paul Atkins-related concepts RSR.

U.S. Capital Coins: ChainCatcher has previously listed token projects associated with traditional asset management firms like BlackRock, mainly including Ondo, CRV, ENA, LINK, XLM, VELO, SUI, APT, Avax, PUFFER, etc. Additionally, Grayscale holdings and tokens selected by the Coinbase 50 index are also worth noting.

ChainCatcher reminds readers to view blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice. If you find sensitive information in the content, please click “Report”, and we will handle it promptly.