(Bloomberg) — President Donald Trump’s frenzied tariff barrage has been marked by reversals and faulty rollouts, baffling US trading partners and businesses while raising questions about the aims of his signature policy.

Most Read from Bloomberg

Following a tumultuous few days of delays and exemptions, Trump introduced another variable at the end of the week by saying he may implement reciprocal tariffs on Canadian lumber and dairy products as soon as Friday. The president spoke after a report showed the US job market softened in February as unemployment unexpectedly rose.

Separately, the European Central Bank lowered interest rates for the sixth time since June and indicated that its cutting phase may be drawing to a close as inflation cools and the economy digests seismic shifts in geopolitics. Officials are bracing for tough negotiations over whether to cut interest rates further or hold off when they next set borrowing costs in April, according to people familiar with their thinking.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

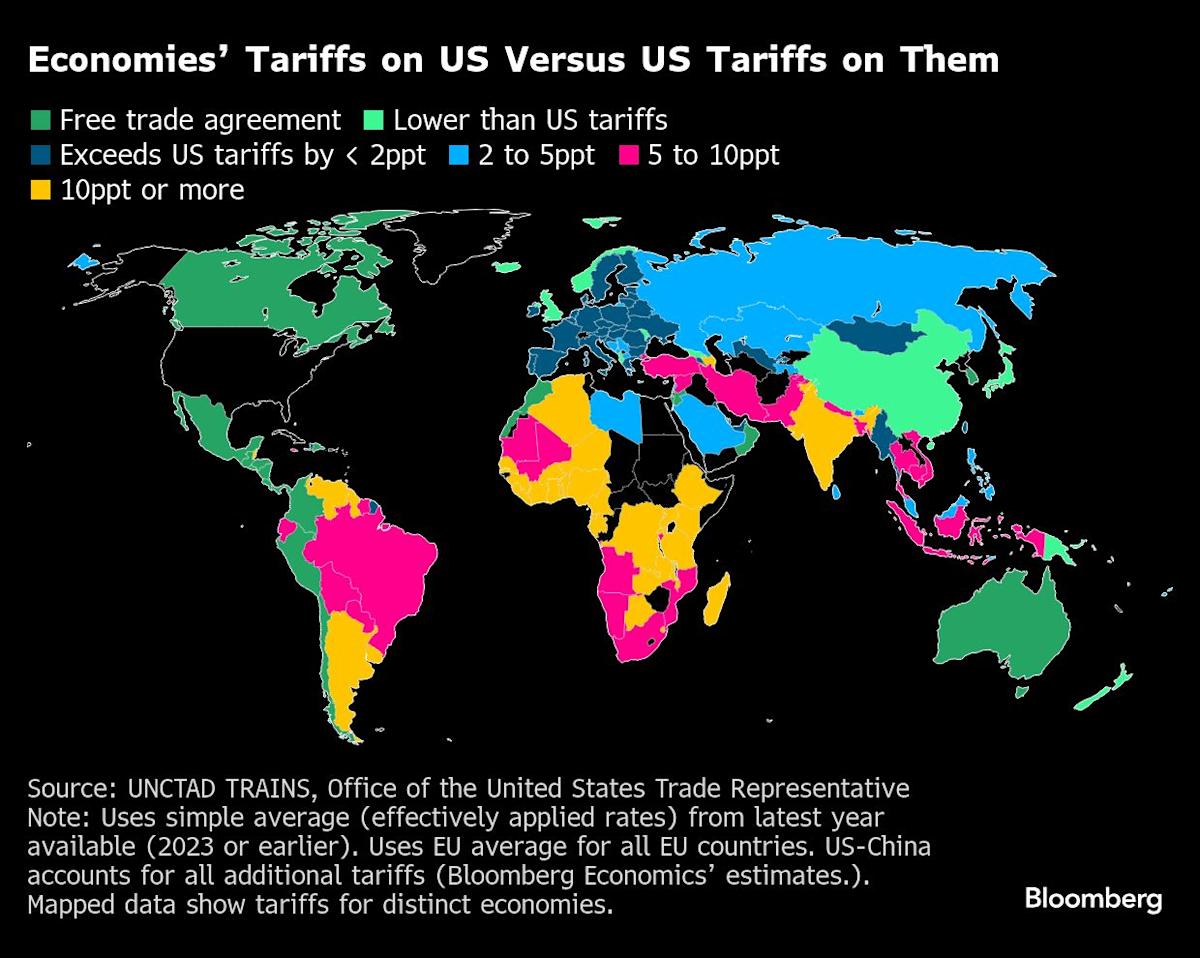

Trump’s supporters say his rapid tariff rollout reflects the president’s urgency to address trade inequities, lure more investment and stem the flow of fentanyl into the US. Even so, the pace has fed confusion, coming on top of regulatory pivots and uncertainty about the future of tax cuts. US equities have taken a beating and consumer confidence has eroded, economic warning signs that pose political risks for the president.

US job growth steadied last month while the unemployment rate rose — a mixed snapshot of a job market hanging in the balance of quickly changing government policy. Friday’s report is the latest evidence that the labor market is softening, with more people permanently out of work, fewer workers on federal government payrolls and a jump in those working part-time for economic reasons.

US factory activity last month edged closer to stagnation as orders and employment contracted, while a gauge of prices paid for materials surged to the highest since June 2022 as tariff concerns mounted. Rising input costs represent a challenge for manufacturers against a backdrop of shrinking orders that suggests demand is at risk of retrenching as businesses weigh the implications of tariffs from the Trump administration.

Story Continues