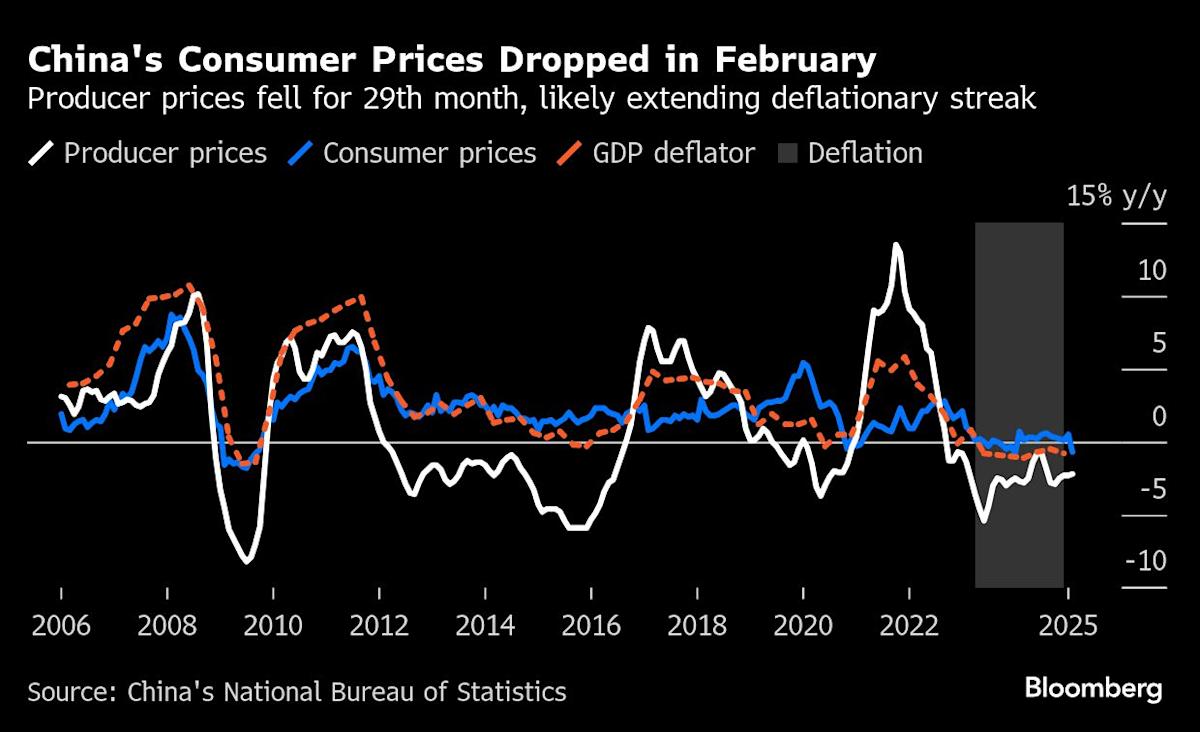

(Bloomberg) — Equities declined on Monday as increasing concerns about economic growth in the US weigh on investors and China’s inflation dipped below zero for the first time in a year.

Most Read from Bloomberg

Benchmarks in Japan and South Korea declined, dragging a gauge of Asian equities lower. Contracts for the S&P 500 declined as much as 1.1% in early trading while those for the tech-heavy Nasdaq 100 sank even more. Treasury yields slipped across maturities.

Oil fell on Monday after posting a seventh weekly loss, and Bitcoin extended its drop to a fifth session. A gauge of the dollar declined for a sixth consecutive day, the longest losing streak in a year.

A myriad of headlines around the economy, tariffs and geopolitical developments combined for a roller-coaster week for markets. Bond traders are signaling an increasing risk that the US economy will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to further restrain the pace of growth. The president said the economy faces “a period of transition.”

“It’s getting harder to make out the shape of the economy through the fog of Trump 2.0’s firings and tariffs,” said Ed Yardeni, president of Yardeni Research. “No wonder the stock market’s default position is risk-off and stocks have been correcting.”

Traders have been piling into short-dated Treasuries, pulling the two-year yield down sharply since mid-February, on expectations the Federal Reserve will resume cutting interest rates as soon as May to keep the economy from deteriorating. The movement marks an abrupt about-face for the Treasuries market, where the dominant driver of the last few years had been the surprising resilience of the US economy even as growth weakened overseas.

Federal Reserve Bank of San Francisco President Mary Daly said growing uncertainty among businesses could slow demand in the US economy but doesn’t require a change in interest rates. Fed Chair Powell also acknowledged a rise in uncertainty for the US economic outlook on Friday. Furthermore, he expected the path to 2% inflation to continue, suggesting price hikes from tariffs may be temporary.

“We turn tactically cautious on risk assets,” JPMorgan Chase & Co analysts led by Fabio Bassi wrote. “The increase in policy uncertainty over the past couple of weeks, the volatility around a potential Russia/Ukraine ceasefire, and the unprecedented new information around the German/EU fiscal plans triggered an extremely volatile fortnight with abrupt adjustment of positions.”

Story Continues