Whitecap Resources, (OTCPK: SPGYF), and Veren Inc, (NYSE:VRN) agreed to a no-cash, all-stock merger the other day, finalizing a long-rumored notion making the rounds in chatrooms. Both companies have previously been active in Canadian M&A, with Whitecap acquiring XTO Canada in 2022 for $1.9 bn. Formerly known as Crescent Point, Veren Inc. made a similar move with its $1.7 bn pickup of Spartan Delta’s Montney acreage in 2023 and followed that quickly with another multi-billion dollar deal taking out Hammerhead Energy later the same year. With the rumor mill swirling last winter around the two companies, talks between the two began in earnest.

Whitecap CEO Grant Fagerheim, who will stay on as CEO of the combined entity, was quoted in an article carried in the Calgary Herald as saying-

“Whitecap will be more resilient and better able to manage the current macro (economic) environment, including the ongoing threat of tariffs and commodity price volatility. We started these conversations in the fall (about) how we could bring them together. It makes sense operationally, from a land fit, from a production fit.”

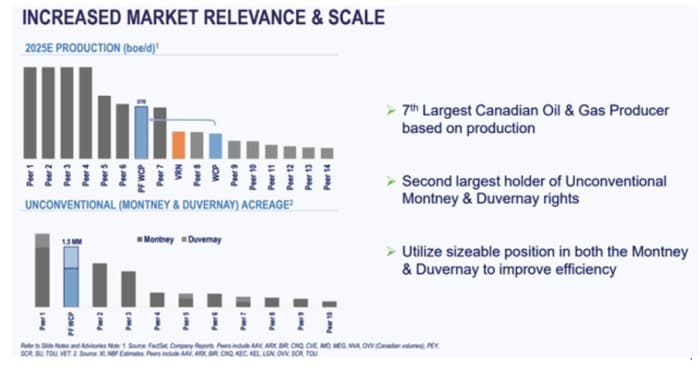

The Industrial Logic is fairly obvious as highlighted in the slide below. The acreage positions of both are advantaged as an outcome of the merger. Substantial cost will be wrung out of the combined business, as increased scale lowers unit costs.

This lowers capex to maintain or grow output and drives cash flow to the bottom line, which should drive valuations higher. All music to investor’s ears. The market viewed the combo as a wash with VRN rallying about 16% and Whitecap dropping a commensurate amount in Monday’s trading. Analyst firm Raymond James lauded the deal with their analyst Luke Davis, making the following comment-

“The merger positions the new company among larger-cap peers, which is the clearest path to valuation upgrades, and the match is a good one that has “seemed like a logical transaction for more than a decade has finally come to fruition.”

It’s really not a lot more complicated than that and as noted, the combined company has a lot more “throw weight,” or relevance than either could ever hope to have on their own. The slide below provided by Whitecap shows the position of the combined company relative to peers in the Western Canada Sedimentary Basin-WCSB.

What’s happening in Canadian energy?

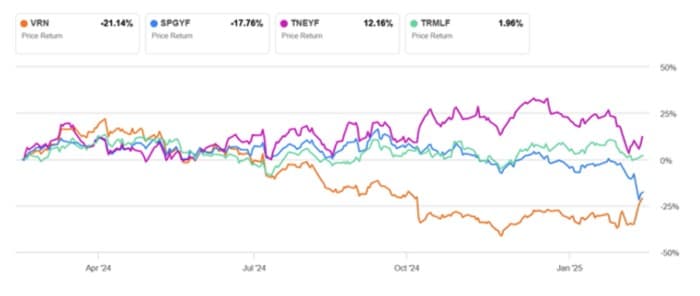

It wasn’t supposed to be like this. The advent of the TMX pipeline provided another ~600K BOPD of demand for export to points East around the world. Then there was the 2-BCF/day requirement to feed the startup of LNG Canada. This was supposed to narrow the WCS discount-which it did, and improve AECO pricing for gas. AECO pricing has remained bogged down by the huge Canadian stockpile, but is forecast to rise by mid-year 2025. All of this was supposed to drive margins and cash flow in the Canadian cohort, which would improve multiples, and result in higher stock prices. A sampling of Canadian producers reveals that the last part of this rationale just hasn’t played out. The stock prices have tanked, although there is an intriguing blip higher the last few days.

So what’s up? It’s hard not to see the drown draft in July across the board, where thanks to an assassination attempt, the betting markets started increasing the odds of President Trump winning the election. His stated policies of increasing American production and driving down prices have just crushed the share prices of these companies. There is a pretty good correlation with WTI pricing consistent with this notion, peaking in early July in the low $80’s, and largely working their way down to present levels. There are other well-known reasons for the down draft in WTI, inventories, economic worries and the like. None of which have been supportive for the Canadian upstream operators. You could call it a perfect storm.

The tariff imbroglio now running its course between the U.S. and Canada isn’t helping anything either. The bottom line until sentiment improves there is just no catalyst for these companies to rally substantially. Until then, Canadian companies must, like U.S. companies look for ways to cut costs and maximize scale.

The deal between Whitecap and Veren

There are all kinds of ways to look at the performance of corporate entities. One that I’ve been using is Return On Capital Employed-ROCE. This is a metric that describes how well the company is using its resources to produce a profit. In this metric using data from GuruFocus, at 16.9% ROCE, Whitecap Resources has been demolishing the competition and outperforming Veren, coming in at 6.5% ROCE. That’s almost a 3:1 comparison and suggests to me that Whitecap is doing something right in this market that perhaps VRN is not. To tie a ribbon on this point, SPGYF reported $0.82 of free cash per share vs. $0.59 for VRN on a TTM basis.

By rationalizing the two companies’ capital outlay and growth plans, resources can be better utilized. The payoff for investors is a less rapid pace of development that grows output more slowly in the term while preserving top-tier inventory for a hopefully more lucrative market into which to sell a few quarters hence.

The deal gives VRN shareholders 1.05 shares of WCP for each of VRN-owned. This equates to about a 39% premium to VRN shareholders, factoring in VRN’s relatively higher debt as a percentage of its EV and the share price arbitrage as of the deal announcement date. The combined company will have the dominant land positions in the key Montney and Duvernay plays where they have adjacent properties. There are also about $200 mm in synergies that will help the bottom line of the combined company. VRN shareholders will also benefit from the more generous dividend of $0.73 CAD per share paid by WCP.

Your takeaway

The Industrial Logic and cost savings are persuasive to me as favoring this deal. When you add in their increased clout as a larger company and the contracting advantages that come with size, the deal is a no-brainer. I don’t see any real arbitrage between owning one or the other. We are ambivalent as to the way to play this deal as long as the shares roughly track the range noted in the deal. We do think investors interested in well-funded quarterly dividends and the prospect of capital growth once the current volatility subsides, should carefully take a position in one or the other.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com