Mar 15, 2025

IndexBox has just published a new report: World – Petroleum Bitumen – Market Analysis, Forecast, Size, Trends And Insights.

The demand for petroleum bitumen is on the rise globally, leading to an expected increase in market consumption over the next decade. Despite a forecasted market performance deceleration, the market is projected to expand with a CAGR of +0.5% in volume and +1.9% in value from 2024 to 2035.

Market Forecast

Driven by increasing demand for petroleum bitumen worldwide, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +0.5% for the period from 2024 to 2035, which is projected to bring the market volume to 133M tons by the end of 2035.

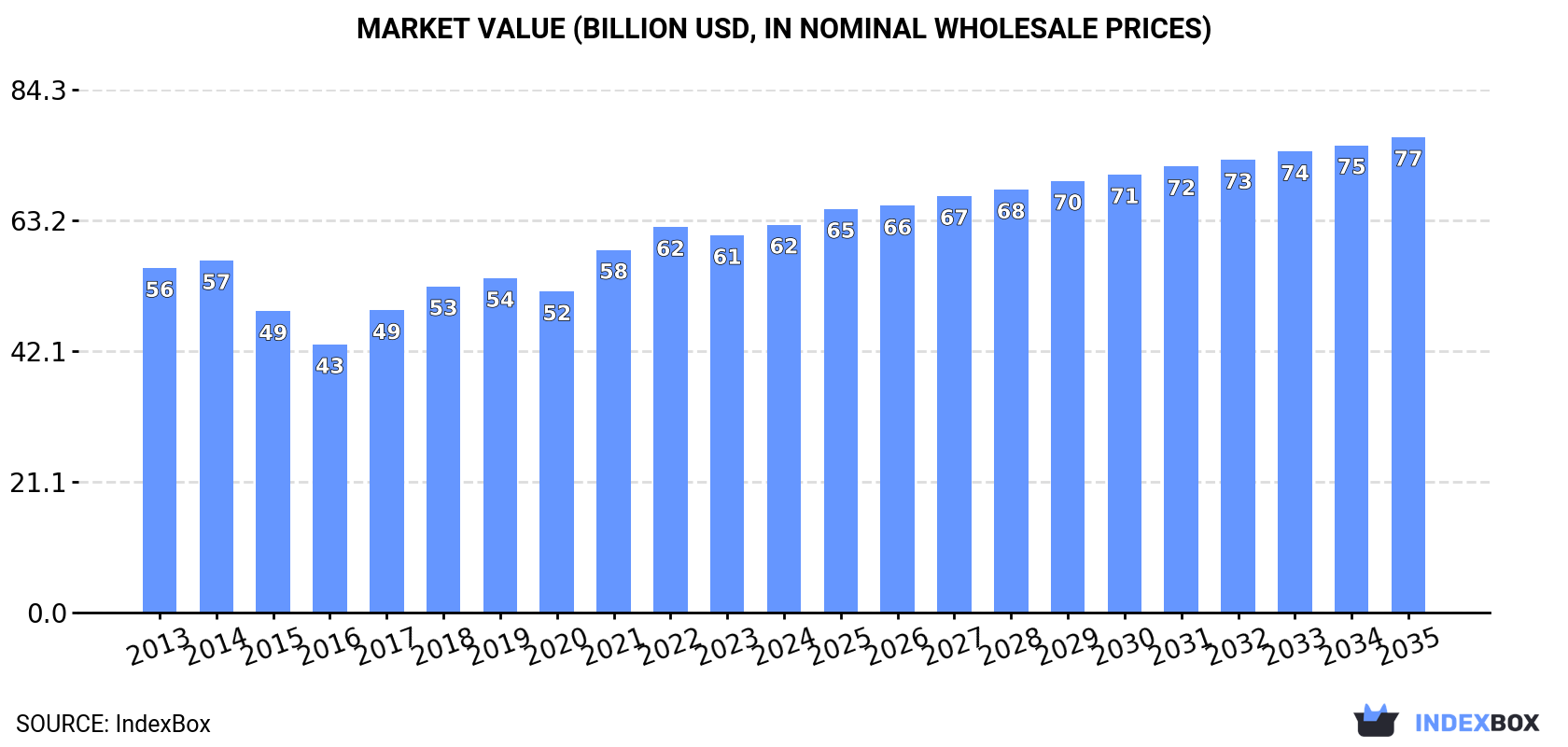

In value terms, the market is forecast to increase with an anticipated CAGR of +1.9% for the period from 2024 to 2035, which is projected to bring the market value to $76.6B (in nominal wholesale prices) by the end of 2035.

ConsumptionWorld’s Consumption of Petroleum Bitumen

ConsumptionWorld’s Consumption of Petroleum Bitumen

In 2024, approx. 126M tons of petroleum bitumen were consumed worldwide; stabilizing at the previous year. The total consumption volume increased at an average annual rate of +1.5% from 2013 to 2024; the trend pattern remained consistent, with somewhat noticeable fluctuations in certain years. Over the period under review, global consumption attained the peak volume at 128M tons in 2021; however, from 2022 to 2024, consumption remained at a lower figure.

The global petroleum bitumen market revenue was estimated at $62.5B in 2024, growing by 2.8% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). The market value increased at an average annual rate of +1.1% over the period from 2013 to 2024; the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. Global consumption peaked in 2024 and is expected to retain growth in the near future.

Consumption By Country

The countries with the highest volumes of consumption in 2024 were China (34M tons), the United States (24M tons) and India (8.5M tons), with a combined 52% share of global consumption. Russia, South Korea, Germany, Japan, Saudi Arabia, Brazil and Turkey lagged somewhat behind, together comprising a further 18%.

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the key consuming countries, was attained by South Korea (with a CAGR of +7.2%), while consumption for the other global leaders experienced more modest paces of growth.

In value terms, China ($19.9B) led the market, alone. The second position in the ranking was held by the United States ($9.9B). It was followed by India.

In China, the petroleum bitumen market expanded at an average annual rate of +3.5% over the period from 2013-2024. The remaining consuming countries recorded the following average annual rates of market growth: the United States (+1.0% per year) and India (+5.5% per year).

The countries with the highest levels of petroleum bitumen per capita consumption in 2024 were South Korea (77 kg per person), the United States (70 kg per person) and Saudi Arabia (61 kg per person).

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the key consuming countries, was attained by South Korea (with a CAGR of +7.0%), while consumption for the other global leaders experienced more modest paces of growth.

ProductionWorld’s Production of Petroleum Bitumen

In 2024, production of petroleum bitumen decreased by -0.7% to 127M tons for the first time since 2021, thus ending a two-year rising trend. The total output volume increased at an average annual rate of +1.4% over the period from 2013 to 2024; the trend pattern remained consistent, with somewhat noticeable fluctuations being recorded in certain years. The growth pace was the most rapid in 2015 when the production volume increased by 6% against the previous year. Global production peaked at 128M tons in 2020; however, from 2021 to 2024, production remained at a lower figure.

In value terms, petroleum bitumen production expanded to $62.5B in 2024 estimated in export price. Overall, production, however, continues to indicate a relatively flat trend pattern. The most prominent rate of growth was recorded in 2022 when the production volume increased by 16%. As a result, production attained the peak level of $64.7B. From 2023 to 2024, global production growth remained at a lower figure.

Production By Country

The countries with the highest volumes of production in 2024 were China (31M tons), the United States (19M tons) and Russia (6.9M tons), together comprising 45% of global production.

From 2013 to 2024, the most notable rate of growth in terms of production, amongst the leading producing countries, was attained by China (with a CAGR of +5.0%), while production for the other global leaders experienced more modest paces of growth.

ImportsWorld’s Imports of Petroleum Bitumen

In 2024, global petroleum bitumen imports reduced modestly to 30M tons, stabilizing at 2023. The total import volume increased at an average annual rate of +3.2% from 2013 to 2024; however, the trend pattern indicated some noticeable fluctuations being recorded in certain years. The pace of growth appeared the most rapid in 2021 when imports increased by 30%. As a result, imports reached the peak of 37M tons. From 2022 to 2024, the growth of global imports remained at a lower figure.

In value terms, petroleum bitumen imports shrank slightly to $14.2B in 2024. Overall, total imports indicated a mild increase from 2013 to 2024: its value increased at an average annual rate of +1.2% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, imports decreased by -9.0% against 2022 indices. The growth pace was the most rapid in 2017 with an increase of 43%. Over the period under review, global imports attained the maximum at $15.6B in 2022; however, from 2023 to 2024, imports remained at a lower figure.

Imports By Country

In 2024, the United States (5.8M tons), distantly followed by China (3.5M tons) and India (3.3M tons) were the key importers of petroleum bitumen, together mixing up 42% of total imports. The following importers – Turkey (1,042K tons), Malaysia (1,037K tons), Vietnam (890K tons), the UK (857K tons), Australia (776K tons), Indonesia (637K tons) and France (604K tons) – together made up 19% of total imports.

From 2013 to 2024, the biggest increases were recorded for India (with a CAGR of +31.4%), while purchases for the other global leaders experienced more modest paces of growth.

In value terms, the United States ($2.5B), China ($1.4B) and India ($1.3B) constituted the countries with the highest levels of imports in 2024, together comprising 37% of global imports.

India, with a CAGR of +27.9%, recorded the highest growth rate of the value of imports, in terms of the main importing countries over the period under review, while purchases for the other global leaders experienced more modest paces of growth.

Import Prices By Country

In 2024, the average petroleum bitumen import price amounted to $472 per ton, dropping by -2.4% against the previous year. Overall, the import price recorded a pronounced downturn. The growth pace was the most rapid in 2022 when the average import price increased by 54%. Global import price peaked at $589 per ton in 2013; however, from 2014 to 2024, import prices stood at a somewhat lower figure.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was France ($552 per ton), while Indonesia ($354 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by the UK (-0.8%), while the other global leaders experienced a decline in the import price figures.

ExportsWorld’s Exports of Petroleum Bitumen

In 2024, overseas shipments of petroleum bitumen decreased by -3.3% to 31M tons, falling for the third year in a row after five years of growth. The total export volume increased at an average annual rate of +2.5% over the period from 2013 to 2024; however, the trend pattern indicated some noticeable fluctuations being recorded in certain years. The pace of growth was the most pronounced in 2021 with an increase of 14%. As a result, the exports reached the peak of 35M tons. From 2022 to 2024, the growth of the global exports remained at a lower figure.

In value terms, petroleum bitumen exports shrank to $14.4B in 2024. Overall, exports, however, saw a relatively flat trend pattern. The pace of growth appeared the most rapid in 2021 when exports increased by 60%. Over the period under review, the global exports hit record highs at $16.9B in 2022; however, from 2023 to 2024, the exports stood at a somewhat lower figure.

Exports By Country

In 2024, Canada (5.4M tons), distantly followed by Singapore (2.6M tons), Iran (2.6M tons), Iraq (2.5M tons), the United Arab Emirates (2.3M tons), Turkey (1.4M tons) and Greece (1.4M tons) represented the major exporters of petroleum bitumen, together constituting 59% of total exports. The following exporters – the United States (1.2M tons), South Korea (1.1M tons) and Germany (1M tons) – together made up 11% of total exports.

Exports from Canada increased at an average annual rate of +8.9% from 2013 to 2024. At the same time, Turkey (+63.1%), Iraq (+50.8%), Greece (+13.7%), the United Arab Emirates (+12.9%), Singapore (+2.1%) and Iran (+1.1%) displayed positive paces of growth. Moreover, Turkey emerged as the fastest-growing exporter exported in the world, with a CAGR of +63.1% from 2013-2024. The United States experienced a relatively flat trend pattern. By contrast, Germany (-1.2%) and South Korea (-8.8%) illustrated a downward trend over the same period. From 2013 to 2024, the share of Canada, Iraq, the United Arab Emirates, Turkey and Greece increased by +8.6, +8.1, +4.8, +4.7 and +3.1 percentage points, respectively. The shares of the other countries remained relatively stable throughout the analyzed period.

In value terms, the largest petroleum bitumen supplying countries worldwide were Canada ($2.5B), Singapore ($1.3B) and Iraq ($1.1B), with a combined 34% share of global exports.

Iraq, with a CAGR of +63.0%, recorded the highest growth rate of the value of exports, in terms of the main exporting countries over the period under review, while shipments for the other global leaders experienced more modest paces of growth.

Export Prices By Country

In 2024, the average petroleum bitumen export price amounted to $467 per ton, growing by 1.7% against the previous year. In general, the export price, however, saw a mild slump. The growth pace was the most rapid in 2017 when the average export price increased by 41% against the previous year. Over the period under review, the average export prices hit record highs at $559 per ton in 2013; however, from 2014 to 2024, the export prices remained at a lower figure.

Average prices varied somewhat amongst the major exporting countries. In 2024, major exporting countries recorded the following prices: in Germany ($522 per ton) and Greece ($484 per ton), while Iran ($376 per ton) and the United States ($422 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Iraq (+8.1%), while the other global leaders experienced a decline in the export price figures.