A revolutionary new technology comes along and infatuates investors with its seemingly limitless possibilities. Euphoria sparks a stock market rally. Eventually things get overheated and share prices become ridiculous. Then it all collapses.

Sound familiar?

It happened exactly 25 years ago when the roughly five-year dot-com bubble popped, leaving trillions of dollars of investment losses in its wake. On March 24, 2000, the S&P 500 Index posted a record level it wouldn’t see again until 2007. Three days later, the tech-heavy Nasdaq 100 Index also closed at an all-time high, the last time it would do that for more than 15 years.

Those peaks marked the end of an electric run that started with the blowout initial public offering for Netscape Communications Corp., which started trading in August 1995. Between then and March 2000, the S&P 500 would almost triple, while the Nasdaq 100 soared 718%. And then it ended. By October 2002, more than 80% of the Nasdaq’s value was gone, and the S&P 500 was essentially cut in half.

Echoes of that era are reverberating now. The technology this time is artificial intelligence. After a wild stock market rally that sent the S&P 500 soaring 72% from its trough in October 2022 to its peak last month, adding more than $22 trillion of market value in the process, signs of trouble are emerging. Stocks are starting to sink, with the Nasdaq 100 losing more than 10% to fall into a correction and S&P 500 briefly dropping to that level. And the symmetry is raising frightening memories from a quarter century ago.

“Investors have two emotions: fear and greed,” said Vinod Khosla, billionaire venture capitalist and co-founder of Khosla Ventures, who was a key rainmaker during the internet boom and remains one today. “I think we’ve moved from fear to greed. When you get greed, you get I would say indiscriminate valuations.”

Difference of degrees

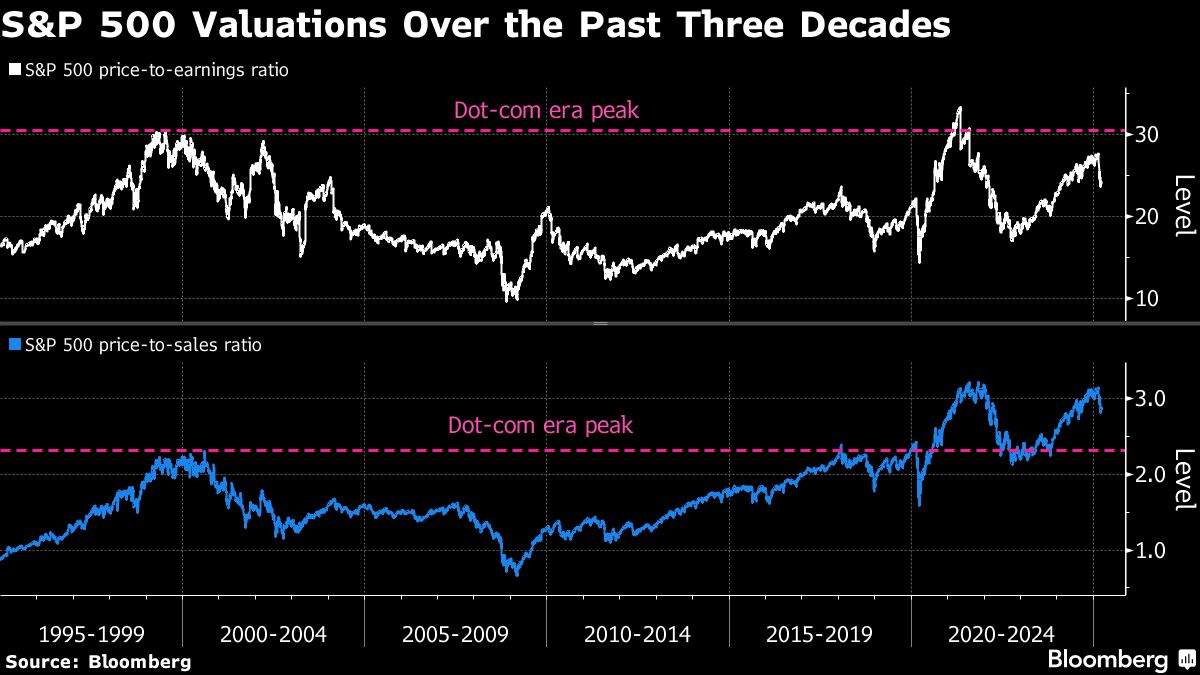

The main difference between the dot-com and AI eras, however, is degrees. The most recent boom has been eye-popping, but it pales in comparison to the extremes of the internet bubble.

“The internet was such a big idea, had such a transformative impact on society, on business, on the world, that those who played it safe generally got left behind,” said Steve Case, the former chairman and CEO of AOL. “That leads to this kind of focus on massive investments to make sure you’re not left behind, some of which will work, many of which won’t work.”

Case would know a thing or two about technology investments that don’t work out, considering he became a face of the dot-com boom when he bought Time Warner in January 2000, right at the peak of the bubble as AOL’s stock price was flying high. But the deal quickly went sour as the combination that made sense on paper didn’t in reality, something Case himself has acknowledged. The combined AOL Time Warner’s shares tanked as earnings worsened, and the combination was finally unwound in 2009.

This is the kind of thing Wall Street is worried about now.

“There was a lot of hype around the internet, which materialized well before anybody had a business model for making money from the internet,” Nobel Prize-winning MIT economist Daron Acemoglu said. “That’s why you had the internet boom and the internet bust.”

The companies involved in the AI boom are also very different from the firms that dominated the dot-com era. The internet bubble was largely built on unprofitable startup businesses, some of which capitalized on the mania by appending a “.com” to their names so they could sell stock to the public. The euphoria surrounding AI, on the other hand, is centered around a a small group of tech companies that are among the most profitable and financially stable corporations in the world, like Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp. and Nvidia Corp.

For example, look at the amount of capital generated by today’s tech giants. This year alone, Alphabet, Amazon, Meta and Microsoft are expected to plow a combined $300 billion into capital expenditures to develop their AI capabilities, according to analyst estimates compiled by Bloomberg. And even with all that spending, they’re still projected to generate $234 billion in combined free cash flow.

Burn rate

The dot-com boom had nothing like that, since it was more about speculative investments in emerging companies that had no profits.

“You had a huge number of companies in the top 200 market cap that had a negative burn rate,” said billionaire investor Ken Fisher, chairman of Fisher Investments. “The thing that makes a bubble a bubble is the negative burn rate. Companies in 2000 were just accepted as good, there was a ‘it’s different this time’ mentality because of the internet.”

The differences between the companies driving the euphoria makes it difficult to compare equity valuations between the two periods using traditional measures like price-to-earnings ratios. In 1999, the Nasdaq Composite Index, which housed most of the companies in the internet boom, saw its p/e ratio reach roughly 90 times, based on estimates at the time. Today, it’s roughly 35.

But really, the entire concept of valuing share prices on p/e ratios seemed passe during the internet bubble because so many of the hottest companies were unprofitable. So Wall Street even invented new metrics, like “mouse clicks” and “eyeballs,” to try to measure their growth without involving money.

While that may seem crazy now, many investors at the time didn’t mind because they were betting on the limitless future baked into the internet’s growth assumptions. Plus, the stocks kept rising.

“I remember brokers spending as much time on their personal accounts as their clients’,” said Anthony Saglimbene, chief market strategist at Ameriprise Financial. “They were making as much from their own investments as their salary.”

By March 2000, at least 13 companies in the Nasdaq 100 had burned cash over the previous year — including Amazon.com, XO, Dish, Ciena, Nextel, PeopleSoft and Inktomi, according to data compiled by Bloomberg. That’s why investors had few qualms about buying shares in money-losing companies like Pets.com and Webvan.

“It was a land grab,” said Julie Wainwright, former CEO of Pets.com, the now defunct online pets store famous for its commercials featuring a dog sock puppet. The company received a big boost in June 1999 when a group of investors including Amazon invested $50 million in it. “Very shortly after that, I think seven other pets companies were funded. That absolutely made no sense.”

Pets.com went public in February 2000, just as the internet IPO craze was peaking, and by November it was out of business. Wainwright eventually found success in the ecommerce landscape, founding the online luxury goods marketplace RealReal Inc., which went public in 2019.

Right call, wrong time

In time, a confluence of factors ended the dot-com bubble. The Federal Reserve began raising interest rates aggressively, in part to slow the stock market’s exuberance. Meanwhile, Japan slumped into a recession, which raised fears of a global slowdown. With markets booming to all-time highs, investors suddenly turned skeptical about stocks that had no profits.

“They were right to be bullish on the business prospects for the internet,” said Jim Grant, founder of Grant’s Interest Rate Observer. “Were they right to pay, you know, 10 times revenues for Sun Microsystems and lose like 95% of their money? No.”

To Grant’s point, many of today’s corporate giants – Alphabet, Meta, Apple, Microsoft — were built on or turbocharged by the internet boom. And for each of those, there are dozens of companies like Uber Technologies Inc. or ServiceNow Inc. that harnessed the technology in new ways that few imagined at the turn of the millennium.

“It happened gradually, that is to say the embrace of the internet,” said Rob Arnott, founder and chairman of Research Affiliates. “Human beings are creatures of habit, and the embrace of the internet for most of us was gradual. Today, we use the internet for everything. Back in 2000, that wasn’t as true.”

But that doesn’t make the roughly $5 trillion dot-com wipeout any less painful. In so many ways, the internet turned out to be the right investment, but at the wrong time.

AI dreams

The risk for investors today is that scenario could be playing out again. AI inspires dreams of computerized personal assistants intertwined in every facet of our lives. The new technology will handle our transportation, help teach our children, provide routine medical care, create entertainment, and manage daily household errands and chores.

And all that may turn out to be true. But when it comes to tech-driven bubbles, the real winners are rarely revealed right away. The idea that the biggest beneficiaries from AI may not even exist yet is a dot-com lesson that Wainwright, the former CEO of Pets.com, thinks about a lot these days.

“All the innovation came from very small companies,” she said. “That may still be happening.”

The emergence of an advanced chatbot built in China called DeepSeek exposed this risk just a few months ago. The revelation sparked a $589 billion rout in Nvidia’s shares on fears that cheaper AI models would sap demand for computing gear. For investors, it was a stark reminder that dominance in AI is far from assured.

This also explains why tech giants have been willing to pour so much money into developing the technology, even at the expense of hurting profit margins. The challenge is making sure they’re constantly on top of a rapidly evolving revolutionary industry. And that’s the price they’re willing to pay.

“I’ve seen almost every phase of technology change since 1980,” said Khosla, who made one of the shrewdest investments of the dot-com era in Juniper Networks and more recently was an early investor in OpenAI. “And I can’t see a change that’s larger in the past than AI.”