I ran an original analysis exploring how EUR/USD relates to:

• Nominal interest rate spreads (Germany vs. U.S.)

• Real interest rate differentials

• Breakeven inflation (inflation expectations)

Using Pearson, Spearman, and Normalized Mutual Information (NMI), the results show:

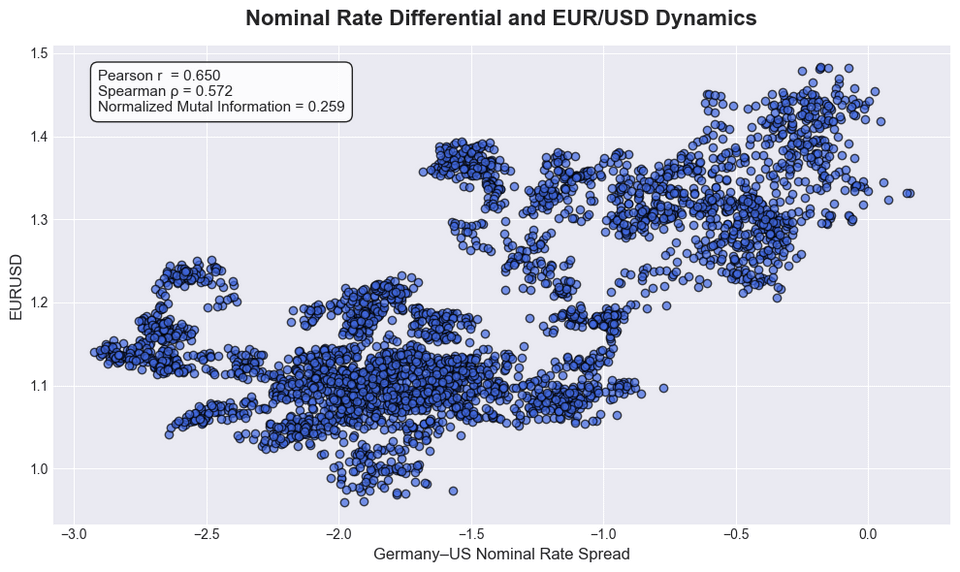

🔹 Nominal Rate Spread

• Pearson: 0.65

• Spearman: 0.572

• NMI: 0.259

➡️ A moderate to strong linear relationship, but the NMI reveals it’s not consistently predictive — likely due to nonlinear market regimes.

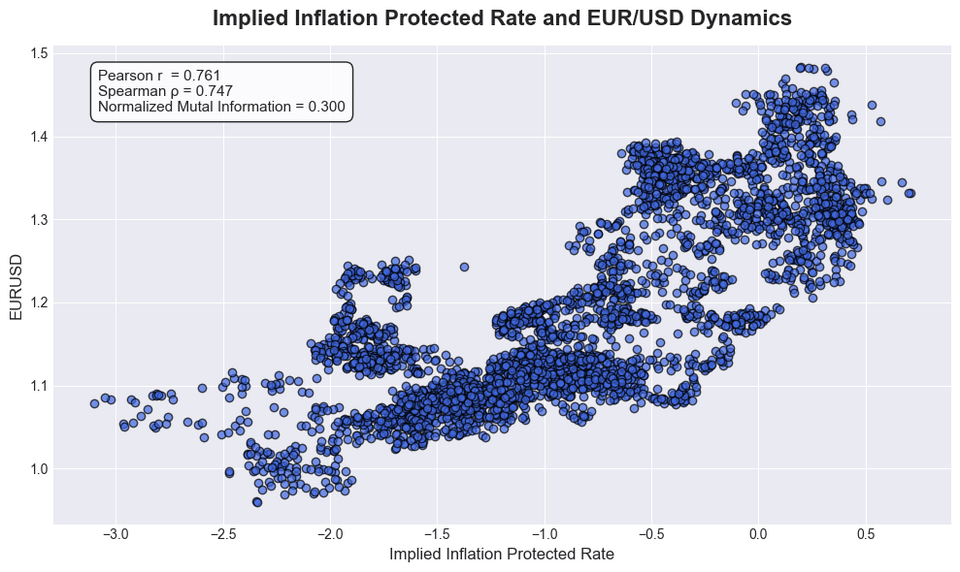

🔹 Real Rate Differential

• Strong Pearson/Spearman

• NMI: 0.30

➡️ More stable than nominal spreads — investors seem to react more to real returns than to headline rates.

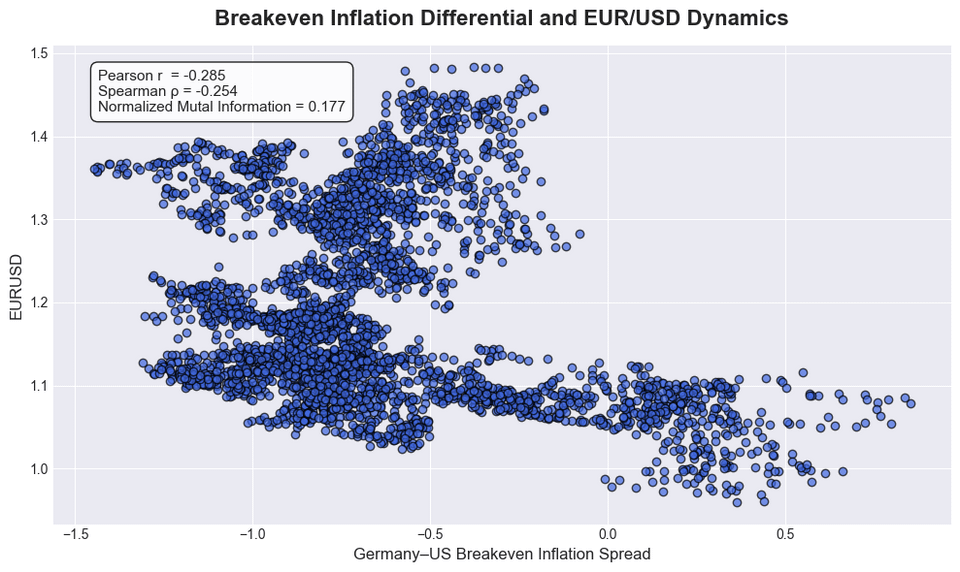

🔹 Breakeven Inflation

• Weak Pearson (-0.28), Spearman (-0.25)

• NMI: 0.177

➡️ Little to no predictive power for EUR/USD in isolation.

🧠 TL;DR

Real interest rates appear to be the most meaningful driver of EUR/USD over time — more than nominal spreads or inflation expectations.

📎 Full analysis & visuals:

👉 https://yellowplannet.com/interest-rate-gaps-a-key-driver-of-eur-usd-trends/ (Original research)

🧾 Data Sources:

• U.S. 10-Year Constant Maturity Rate: FRED DGS10

• U.S. 10-Year Breakeven Inflation: FRED T10YIE

• German Real & Nominal Bond Data: Bundesrepublik Deutschland Finanzagentur

Would love to hear from others doing macro/FX analysis — how do you incorporate real yield spreads in your models?

Posted by kevinlim186

5 comments

Where is the EIL5 conclusion

Can someone explain this to me like I’m a 10-year old? Or as a 40-year old who has forgotten all his statistics classes…

Not really macro analysis, just a logical construct.

Start with the proposition that other nations use USD as a vehicle of international trade between each other (I encountered a small number of very successful financial advisors who credit Paul Volcker for securing this arrangement, but I’m attracted to more straightforward idea that it’s a logical consequence of of using USD as a reserve currency). Given that the previous statement is correct (it’s consistent with my extremely limited experience in international finance), then it follows that their liquid currency reserves would be affected by the inflation of the dollar. European nations also have their own currency (marks, pounds, francs, euros). They experience their own inflation on their internal markets. Consequently, any goods traded internally in local currency which were acquired via payments in USD would be affected by both the local inflation and USD inflation. Conclusion: by remaining in a position of hegemony in international trade, USA is effectively exporting inflation to foreign markets.

I would look in terms of deltas for the exchange rate instead of levels given how the data appears to cluster. The level of the exchange rate is somewhat arbitrary and may be subject to jumps/regime changes, which will obfuscate any analysis of the change due to inflation or interest rates.

In other words, inflation and interest rate differentials will impact how the exchange rate *changes*, and not the direct “level” of the exchange rate.

Can I ask why the Bund was chosen and not a broader basket of European fixed income?

Comments are closed.