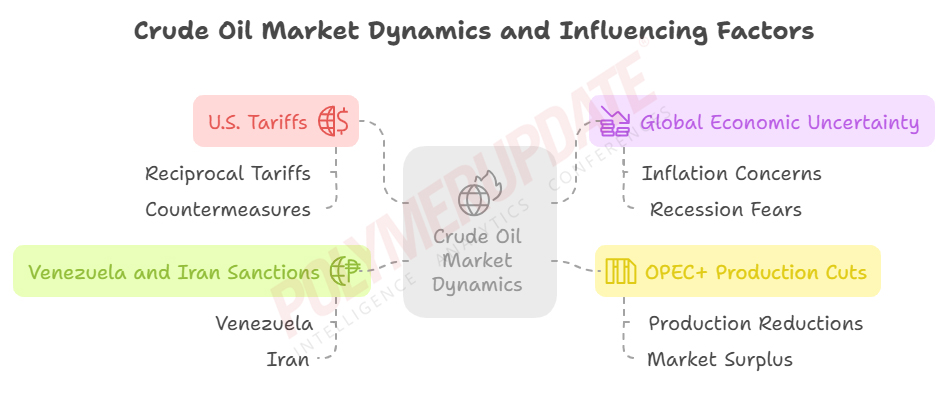

Crude oil prices drifted lower on Friday amid concerns that reciprocal U.S. tariffs on imported goods could provoke counter-tariffs from trade partner nations, raising fears of higher global inflation and a potential global recession. In addition to the already announced measures, U.S. President Donald Trump is poised to introduce new tariffs on trade partner countries, which may compel them to adopt proactive countermeasures.

Data compiled by Polymerupdate Research revealed that benchmark Brent crude futures for near-month delivery on the InterContinental Exchange (ICE) declined by 0.54 percent, or US$ 0.40 a barrel, to US$ 73.63 a barrel on Friday, down from US$ 74.03 a barrel the previous day. Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) fell by 0.80 percent, or US$ 0.56 a barrel, to US$ 69.36 a barrel on Friday, compared to US$ 69.62 a barrel on Thursday.

An analyst from Kedia Stocks & Commodities Research stated, “The movement in crude oil prices was influenced by market participants weighing the impact of new U.S. auto tariffs on global economic growth and fuel demand. President Donald Trump’s announcement of a 25 percent tariff on all auto imports heightened transatlantic trade tensions, fuelling concerns about an economic slowdown and its effect on oil consumption. However, factors such as a significant drop in U.S. crude inventories, which indicates strong domestic demand, also played a role.”

All eyes on April 2

All eyes on April 2

Oil industry stakeholders and analysts are eagerly awaiting President Trump’s April 2 announcement regarding new tariffs, which are expected to be in addition to those already imposed on Canada, China, Mexico, Iran, and Venezuela. The previously announced 25 percent tariffs on all merchant goods, except for a 10 percent tariff on petroleum imports from Canada and Mexico, were deferred by one month but are now set to take effect on April 2. Both Canada and Mexico have announced countermeasures against the United States.

China faces 20 percent tariffs on goods exported to the United States, comprising a 10 percent reciprocal tariff and an additional 10 percent punitive tariff. In response, China has levied 30 percent counter-tariffs on merchant imports from the United States, which include 15 percent preliminary levies and another 15 percent in additional counter-tariffs. Bilateral trade between the United States and China remains skewed in favour of China. In 2024, U.S. goods exports to China totalled US$ 143.5 billion, a 2.9 percent (US$ 4.2 billion) decrease from 2023.

Meanwhile, U.S. goods imports from China in 2024 reached US$ 438.9 billion, a 2.8 percent (US$ 12.1 billion) increase from 2023. Consequently, the U.S. goods trade deficit with China rose to US$ 295.4 billion in 2024, reflecting a 5.8 percent (US$ 16.3 billion) increase from the previous year.

Now, U.S. President Donald Trump is scheduled to announce a new set of tariffs on April 2, which will reportedly target countries worldwide, including Europe, Asia, and the Middle East. However, experts speculate that the President may exclude India and Vietnam, two significant trade partners, as both nations have taken measures to narrow their bilateral trade deficits with the United States. In 2024, the U.S. trade deficit is estimated to have reached approximately US$ 1 trillion, nearly equivalent to the trade surplus recorded by China in the same year. In response to U.S. tariffs, China is now exploring new trade opportunities with Central Asian countries.

US pressure on Venezuela and Iran

On Monday, President Trump announced a 25 percent tariff on imports from countries that purchase crude oil from Venezuela. This move could significantly impact oil-import-reliant nations such as India and China. President Trump accused the Latin American country of “purposefully and deceitfully sending criminals to the United States, including violent offenders and members of organizations such as Tren de Aragua.”

While announcing the tariff plan, President Trump stated, “Venezuela has been very hostile to the United States and the freedoms we espouse. Therefore, any country that purchases oil and/or gas from Venezuela will be required to pay a tariff of 25 percent to the United States on any trade they conduct with our country.”

Venezuela is recognized as having the world’s largest proven crude oil reserves, estimated at approximately 303 billion barrels. Despite this vast resource, the country faces significant challenges, including economic difficulties, international sanctions, and a decline in technical expertise. Sanctions have limited the participation of international oil companies in Venezuela’s oil sector, further contributing to declining production. Crude oil exports constitute approximately 54 percent of Venezuela’s economy. In 2024, India imported 22 million barrels of crude oil from Venezuela, accounting for 1.5 percent of New Delhi’s total oil imports.

Previously, the United States imposed sanctions on China’s Shandong Shouguang Luqing Petrochemical Co. Ltd. for importing Iranian crude oil. This marked the first direct measure targeting China’s refinery value chain, as President Trump intensified efforts to pressure Tehran into negotiating a new nuclear deal. The U.S. aims to compel Iran to permanently cease its nuclear activities. In February, Iran was estimated to have exported 1.8 million barrels per day (bpd) of crude oil. However, the latest U.S. sanctions are expected to reduce these exports by 1 million bpd.

Supply balance

The International Energy Agency (IEA) forecasts that global oil demand growth will accelerate to just over 1 million bpd this year, up from 830,000 bpd in 2024, reaching a total of 103.9 million bpd. Asia is expected to account for nearly 60 percent of this increase, driven primarily by China, where petrochemical feedstocks will contribute entirely to the growth. Amid an unusually uncertain macroeconomic environment, recent delivery data have fallen short of expectations, prompting slightly lower estimates for year-on-year (YoY) growth during the October–December 2024 and January–March 2025 periods, at 1.2 million bpd.

Meanwhile, in a reversal of its previous stance, OPEC+ announced a cumulative production cut schedule on Thursday, citing unfavourable market dynamics following a virtual meeting of its ministers. The schedule outlines additional oil output cuts by seven member nations to offset excess production above agreed levels. The new plan specifies monthly oil output reductions ranging from 189,000 to 435,000 bpd, to be implemented until June 2026.

Earlier, on March 3, eight members of the OPEC+ coalition — Saudi Arabia, Russia, Iraq, the United Arab Emirates (UAE), Kuwait, Kazakhstan, Algeria, and Oman — reaffirmed their commitment to a monthly output increase of 138,000 bpd starting in April, citing improved market fundamentals. However, the IEA projects a global oil surplus of 600,000 bpd in 2025, with an additional surplus of 400,000 bpd likely if OPEC+ fails to address overproduction.

Outlook

U.S. President Trump has been the most influential driver of the oil market in March. The President intensified sanctions on Venezuela and curtailed approximately 20 million barrels of Iranian oil exports, depriving China of discounted crude and fuelling bullish sentiment in the oil market. Meanwhile, the long-term effects of tariff wars could significantly impact oil consumption, as the proposed US$ 100 billion in car import tariffs may provoke retaliatory measures from Europe or Japan.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com