Capital naturally flows from areas of abundance to areas of scarcity. New economy companies, such as Microsoft, Alphabet (Google’s parent company) and Amazon, have access to relatively cheap capital, enabling them to drive innovation and expansion. However, to ensure their continued growth and operational efficiency, these companies are compelled to invest in the old economy, particularly in sectors that have experienced significant capital flight, such as energy infrastructure and data centres.

The paradox here is striking: while the new economy thrives on technological advancements and efficiency gains, it cannot function without the robust support of the old economy’s infrastructure. Reliable power and state-of-the-art data centres are indispensable for the seamless operation of these tech giants.

This phenomenon is captured in Jevons Paradox, which suggests that technological advancements enhancing energy efficiency paradoxically lead to an overall increase in energy consumption. In this case, advancements in data centre efficiency and AI technologies lower the cost per unit of computing power, thereby incentivising greater usage and escalating total energy demand. Consequently, substantial investment in energy infrastructure becomes imperative to accommodate the increased load.

The question then arises: if leading technology companies recognise the necessity of investing in power and data centres, why shouldn’t investors follow suit?

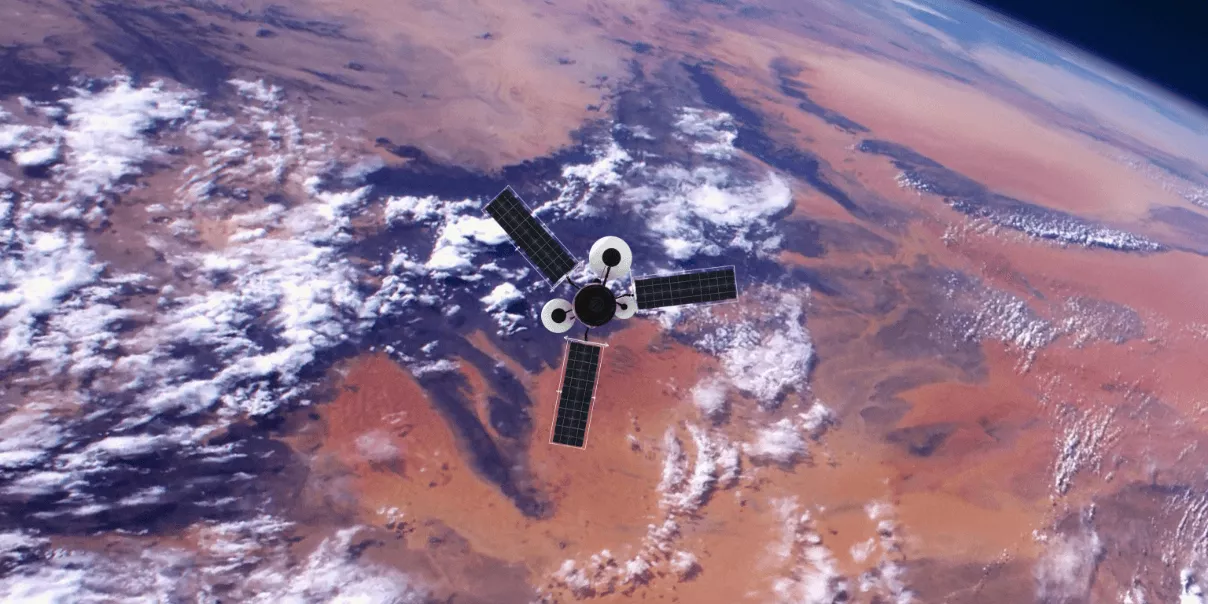

Global listed infrastructure, which offers exposure to the multi-decade themes, requires trillions of investment dollars to drive economic growth and prosperity. Much like Sputnik catalysed a transformative era of capital expenditure and infrastructure investment, the Jevons paradox indicates that increased efficiency can paradoxically drive higher overall consumption, thus necessitating substantial further investment in foundational infrastructure.

By recognising the cyclical nature of infrastructure investment and the symbiotic relationship between technological advancements and foundational infrastructure, investors can position themselves to capitalise on the opportunities presented by this evolving landscape.