Bored on a Thursday afternoon.

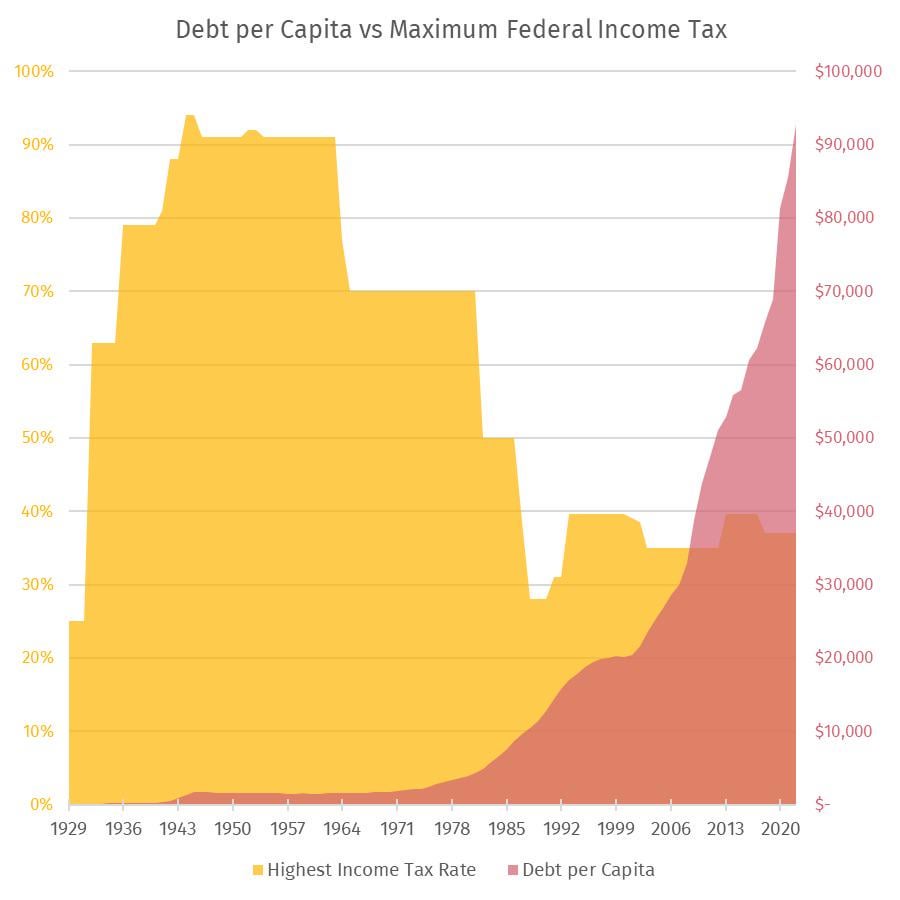

Population: Statista.com

Debt: fiscal data.treasury.gov

Tax Rates: tax foundation.org

Posted by Worried-Rough-338

![Correlation or Causation: Historic US Highest Tax Rate vs Public Debt per Capita [OC]](https://www.europesays.com/wp-content/uploads/2025/04/elnxz1vrlose1.jpeg)

Bored on a Thursday afternoon.

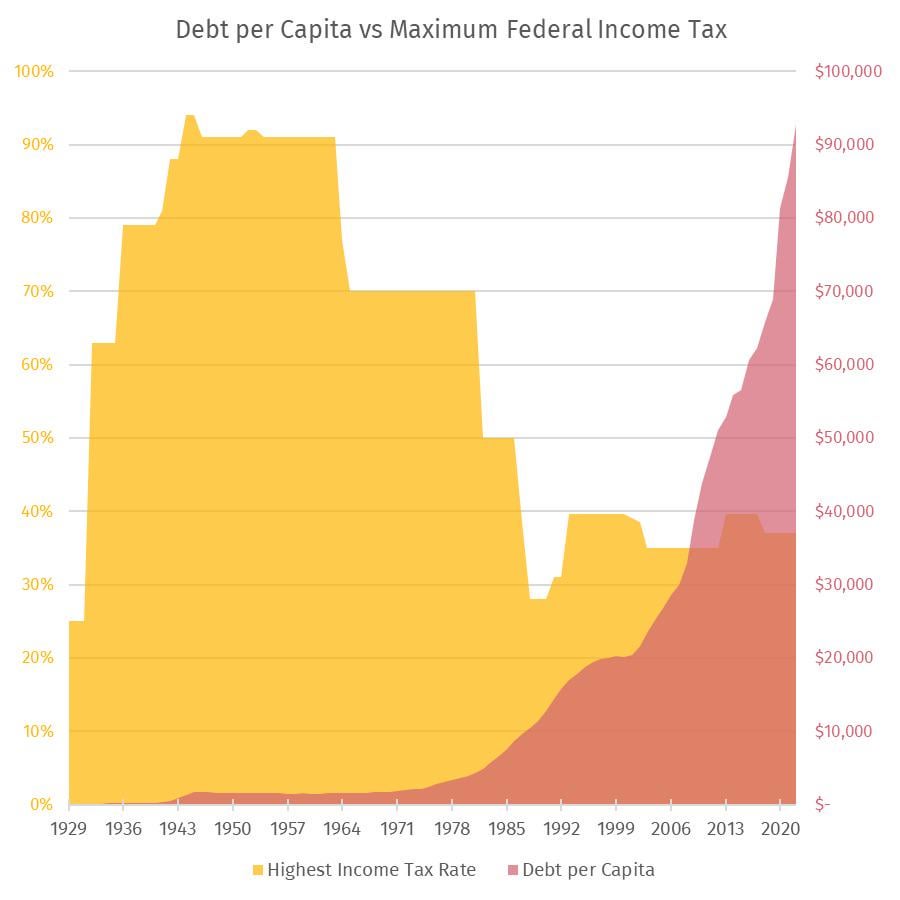

Population: Statista.com

Debt: fiscal data.treasury.gov

Tax Rates: tax foundation.org

Posted by Worried-Rough-338

13 comments

The answer is probably neither, and I also notice that one of these measures would significantly benefit from being adjusted for inflation.

Profits for billionaires today, and deep debt for future generations tomorrow. That is the GOP plan.

is the debt per capital done with inflation-adjusted dollars?

This is obviously not causal evidence in any way, shape or form – the question itself feels disingenuous.

Maybe include direct links to the data sources rather than just the sites you got them from. That way if someone wants to investigate an aspect of it, they don’t have to start with an easter egg hunt.

As always, this deserves a link to [Spurious Correlations](https://www.tylervigen.com/spurious-correlations).

If you wanted to compare, compare spending in 1950 vs spending in 2020, corrected for inflation. Then use actual intake of funds from the top 1%, not the marginal percentage. There were a lot more loopholes back then. You’ll be able to see where the gulfs between intake and spending start actually growing.

Also, you’re comparing something per capita from right when the baby boom started to when we hit a big population bottleneck. Our population has not had steady growth.

Debt is high because the concept of debt has changed entirely under our current currency/economic system. The US is in high debt, but because of the way modern national debts work for countries like the US, it is almost meaningless. National/international governmental debt doesn’t operate like a normal person’s debt, or even like a business/corporate debt. It’s an entirely different animal, and there is really no current reason why a country like the US needs to be especially concerned about the bulk of the debt they hold. It’s just a number, effectively.

Obv not a direct causation, but the lowering of the top tax rate coincides with the Reagan era.

Not only are the debt numbers misleading, using the top income tax rate on paper is also misleading. Before the reforms in the 80s, rates were higher, but there were more deductions. A much less misleading measure is tax collection as a fraction of GDP, which is far closer to stable over time.

Another factor is that government revenues and expenses work differently than businesses. Yes, governments choose how much to spend, but unlike businesses, they _also_ choose how much revenue to raise and how to raise it. So incurring more debt relative to tax income for a government is more like a business choosing more debt financing relative to raising capital through equity than it is to a business facing falling revenue from operations. It’s a strategic choice with a lot more moving parts than just “who is paying their fair share.”

Oooof, a lot of angry Americans commenting here. Whether there is a correlation or not, the data is interesting to see. Seems like most of American wealth is based on debt they can’t afford. Plenty of downvotes coming my way I’m sure just for not being butthurt about a graph.

Income tax is only one type of tax increase. For example yesterday we saw one of the largest tax increases in decades with tariff tax increases.

It will change spending a ton but wouldn’t be reflected in the data on this chart.

Privatize profits…

Socialize losses…

SMH

We have Public Debt, because we tell people we will pay them interest, risk free. The only reason we sell bonds, at all, is so central banks can maintain a non-zero overnight interest rate, no matter if we have a quadrillion in deficit or a trillion in surplus. They are sold for monetary reasons, not fiscal.

You can get in on the action yourself at [www.treasurydirect.gov](http://www.treasurydirect.gov)

Therefore, they are obviously not correlated or causative.

Comments are closed.