Key Takeaways:

Palantir Technologies (PLTR, Financial) enters a crucial contract with NATO, boosting share price by 6%. Analysts set a diverse range of price targets for PLTR, reflecting varied market perspectives. GF Value analysis points to potential overvaluation based on current metrics.

Palantir Technologies (PLTR) has successfully clinched a pivotal contract with NATO, poised to integrate its cutting-edge Maven Smart System into the heart of Allied Command Operations. This strategic move aims to elevate operational capabilities by leveraging artificial intelligence, resulting in a notable uptick of 6% in Palantir’s shares during pre-market trading.

Insights from Wall Street Analysts

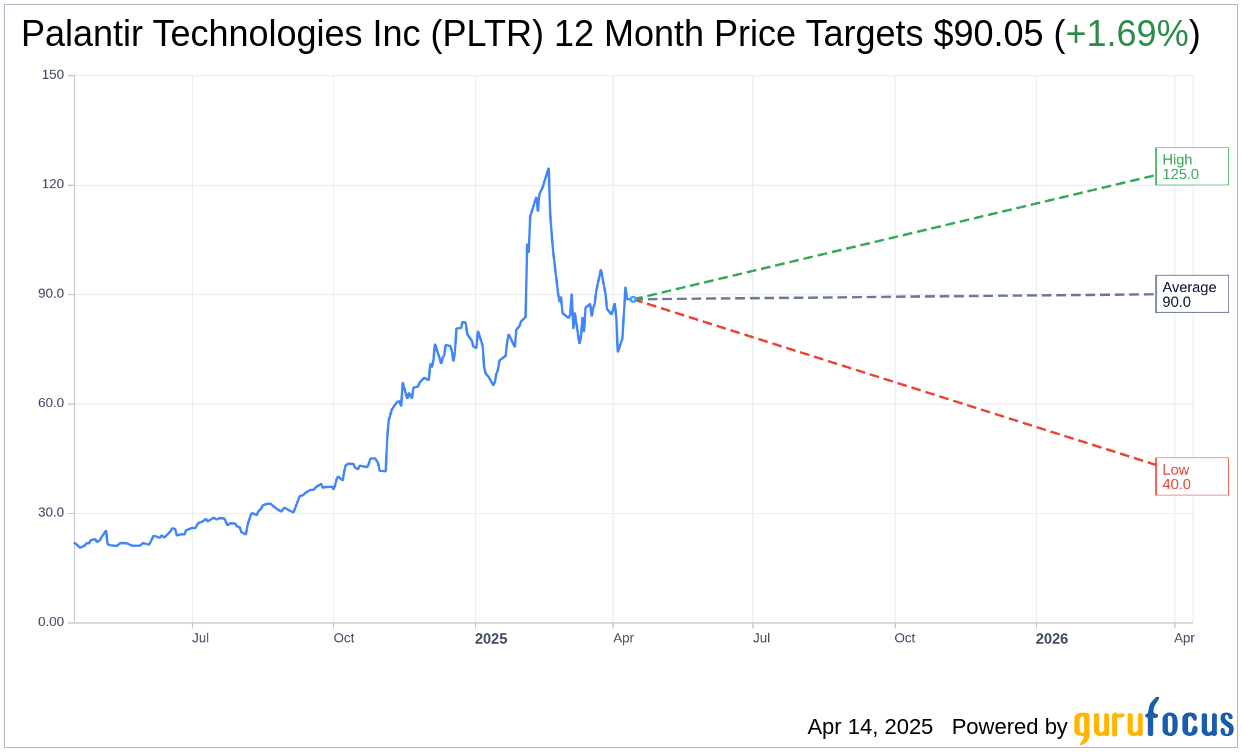

Wall Street analysts have set their sights on Palantir Technologies Inc (PLTR), offering one-year price targets that average $90.05. With a spectrum ranging from a high of $125.00 to a low of $40.00, these targets indicate an anticipated upside of 1.69% from the current price of $88.55. Investors seeking a deeper understanding can explore further details on the Palantir Technologies Inc (PLTR, Financial) Forecast page.

Consensus from 24 brokerage firms paints a picture of skepticism with an average recommendation rating of 2.9, signifying a “Hold” status for the stock. This rating operates on a scale from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

Evaluating GF Value Estimates

According to GuruFocus estimates, Palantir Technologies Inc (PLTR) finds itself in a challenging position based on its GF Value, which projects a value of $26.74 in one year. This suggests a significant downside of 69.8% from the current market price of $88.55. The GF Value reflects an estimation of a stock’s fair trading price, calculated from historical trading multiples, past growth, and future business performance projections. Investors can delve into comprehensive data on the Palantir Technologies Inc (PLTR, Financial) Summary page.