While Cloudflare (NYSE: NET) stock got off to a flying start in 2025, even hitting its 52-week high in mid-February, the shares are down 39% since.

The cybersecurity and cloud solutions provider’s solid fourth-quarter 2024 results had exceeded analysts’ expectations and pointed toward improved growth prospects, thanks to the addition of artificial intelligence (AI)-related offerings. By mid February, the stock was up 63% for the new year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, amid the ongoing stock market turmoil, investors seemed to decide the stock was too expensive and chose to book profits.

The market is now in a risk-off mode as the tariff-induced trade war has increased the chances of a recession. This explains why investors have been looking to preserve capital, and are selling richly valued stocks that have been, in recent months, flying high, thanks to catalysts such as AI.

Yet, the recent slide in high-growth stocks is arguably an opportunity for investors to buy potential long-term winners at relatively attractive multiples.

Is Cloudflare one such stock that you should consider buying? Let’s find out.

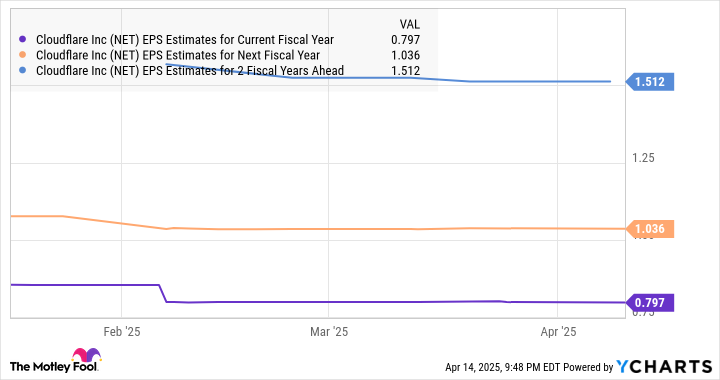

Cloudflare stock is trading at 22 times sales and 131 times forward earnings even after its recent slide. Those multiples are higher than Cloudflare’s price-to-sales ratio and forward earnings ratio at the end of 2024. So, the stock has become more expensive, thanks to the terrific rally it witnessed initially in 2025.

As a result, Cloudflare doesn’t seem worth buying right now. The expensive valuation exposes Cloudflare stock to more volatility, and there is a chance that it could head lower. Should the stock price fall further, resulting in more attractive valuations, the expanding market of the business would suggest a potential buying opportunity.

Let’s look at the reasons why this tech stock could be worth buying at cheaper valuations.

Cloudflare finished 2024 with $1.67 billion in revenue, an increase of 29% from the prior year. This figure is quite small when compared to the $222 billion total addressable market (TAM) size that the company is projecting in 2027. Cloudflare is anticipating a sizable increase in demand for its various services, such as content delivery network, cybersecurity, virtual private network, and AI, among others.

The good part is that Cloudflare has started capitalizing on this massive end-market opportunity by building a solid revenue pipeline for the future. This was evident from the 36% year-over-year increase in its remaining performance obligations (RPO) in the fourth quarter of 2024. This metric refers to the total value of a company’s contracts that are yet to be fulfilled.

Story Continues