India’s dependence on imported crude oil and natural gas grew further in 2024-25 (FY25) as the gap between consumption growth and subdued domestic hydrocarbon production continued to widen. The country’s oil import dependency for the full financial year touched yet another record high, while reliance on imported natural gas was at a four-year high, per latest data from the petroleum ministry.

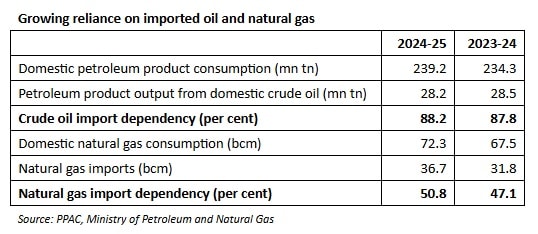

India’s oil import dependency for the financial year ended March was 88.2 per cent, up from 87.8 in the previous fiscal (FY24), as per provisional data from the oil ministry’s Petroleum Planning & Analysis Cell (PPAC). Import dependency in the case of natural gas was at 50.8 per cent in FY25, up from 47.1 per cent in FY24.

India’s energy demand has been growing swiftly, resulting in rising crude oil and natural gas imports. This is fuelled by factors like growing energy-intensive industries, increased vehicle sales, a rapidly expanding aviation sector, growing consumption of petrochemicals, and a rising population.

Growing reliance on imported oil and natural gas

Growing reliance on imported oil and natural gas

Reliance on imported oil has been growing continuously over the past few years, except in FY21, when demand was suppressed due to the COVID-19 pandemic. The country’s oil import dependency stood at 87.8 per cent in FY24, 87.4 per cent in FY23, 85.5 per cent in FY22, 84.4 per cent in FY21, 85 per cent in FY20, and 83.8 per cent in FY19.

India is the world’s third-largest consumer of crude oil and high import dependency makes the Indian economy vulnerable to global oil price fluctuations. It also has a bearing on the country’s trade deficit, foreign exchange reserves, the rupee’s exchange rate, and inflation rate, among others. The government wants to reduce India’s reliance on imported crude oil but sluggish domestic oil output in the face of incessantly growing demand for petroleum products has been the biggest impediment.

As for natural gas, the government wants to increase its consumption and share in the country’s primary energy mix to 15 per cent by 2030 from over 6 per cent at present. The rationale behind the push for natural gas, even though it would lead to higher imports of the fuel, is rather simple.

Natural gas is far less polluting than conventional hydrocarbons like crude oil and coal, and is usually cheaper than oil. It is also seen as a key transition fuel. To be sure though, the government has also been pushing India’s oil and gas companies to increase domestic production of natural gas in a bid to keep import dependency levels under check.

Story continues below this ad

India’s crude oil imports rose to 242.4 million tonnes in FY25 from 234.3 million in FY24, while domestic production declined slightly to 28.7 million tonnes from 29.4 million tonnes, per PPAC data. The country’s gross oil import bill for the financial year rose nearly 3 per cent year-on-year to $137 billion.

Natural gas imports rose 15.4 per cent year-on-year to 36.7 billion cubic metres (bcm) in FY25, and cost $15.2 billion against $13.4 billion a year ago. Domestic natural gas output in FY25 was 35.6 bcm, slightly lower than 35.7 bcm in FY24.

Total domestic consumption of petroleum products in FY25 was 239.2 million tonnes, of which just 28.2 million tonnes came from domestically produced crude oil, resulting in a self-sufficiency level of 11.8 per cent, per PPAC data. As for natural gas, the total domestic consumption in FY25 was 72.3 bcm, while imports stood at 36.7 bcm.

In early 2015, the government had set a target to reduce reliance on oil imports to 67 per cent by 2022 from 77 per cent in 2013-14, but the dependency has only grown since. Cutting costly oil imports continues to be a key focus area for the government, which has taken a number of policy measures to incentivise investments in India’s oil and gas exploration and production sector.

Story continues below this ad

Reducing oil imports is also one of the fundamental objectives of the government’s push for electric mobility, biofuels, and other alternative fuels for transportation as well as industries. While there has been a pick-up in electric mobility adoption and blending of biofuels with conventional fuels, it is not enough to offset petroleum demand growth.