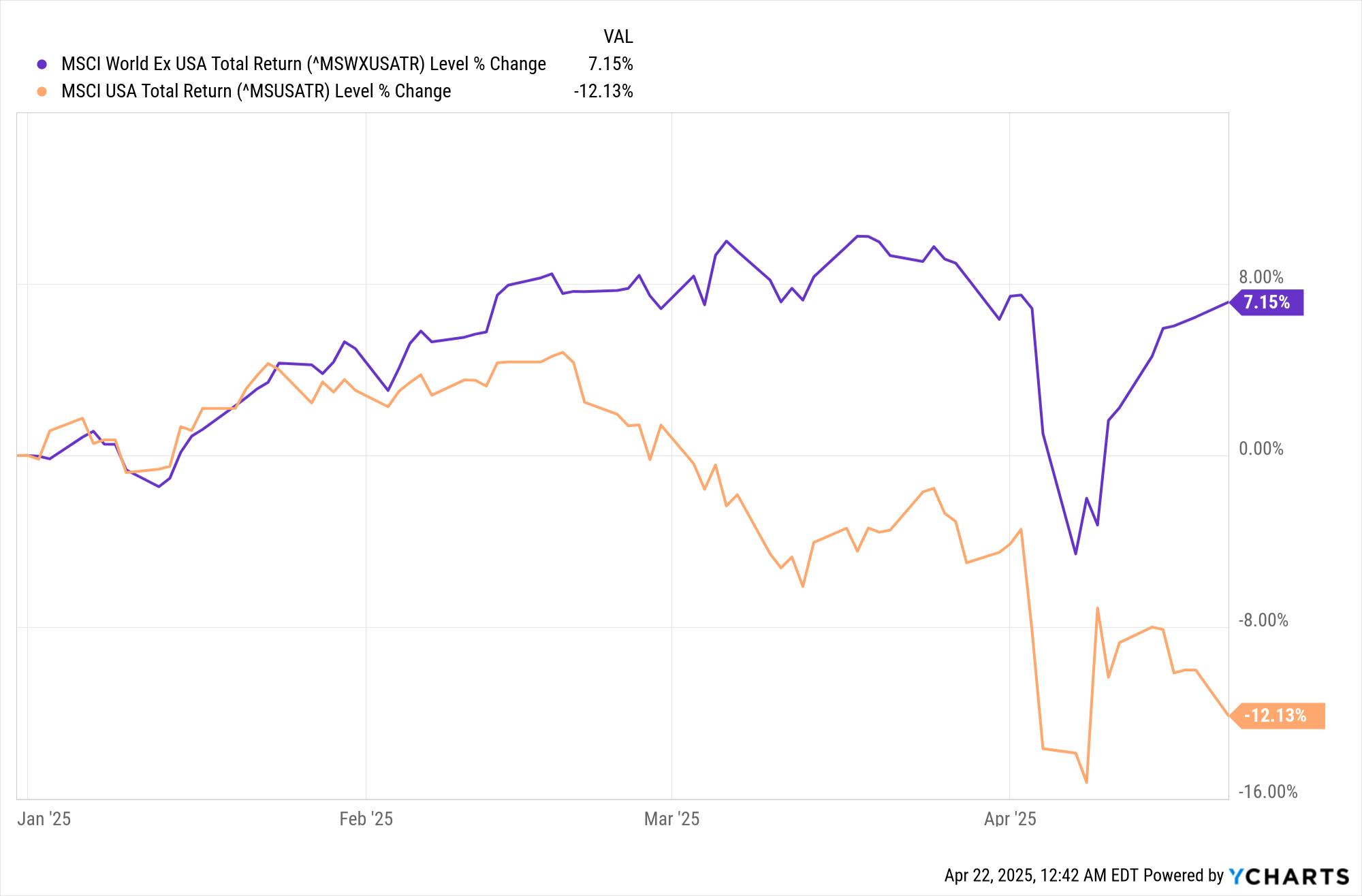

The strong equity market performance of developed, global economies, excluding the U.S., has been well-documented thus far in the year. As observed from the following charts, year-to-date, as of April 21st, 2025, the MSCI World Ex USA Total Return Index has returned 7.15%, while the MSCI USA Total Return Index has returned -12.13%.

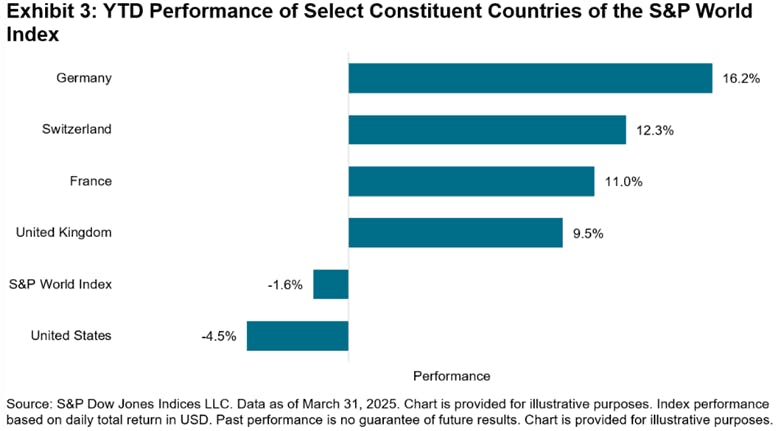

While the top-line performance of both indices allows for an intuitive deduction, looking below the surface provides much more insight. Given the uncertainty stemming from the Trump administration’s policy actions, there has been a rotation away from U.S. assets, with Europe being the beneficiary. As detailed in a recent S&P Global Blog, Germany, the U.K., France, and Switzerland have been the main contributors to the outperformance of the S&P World Ex-U.S. Index. In contrast, the S&P United States Large MidCap was among the worst performers in developed markets, decreasing 4.5%, as of March 2025.

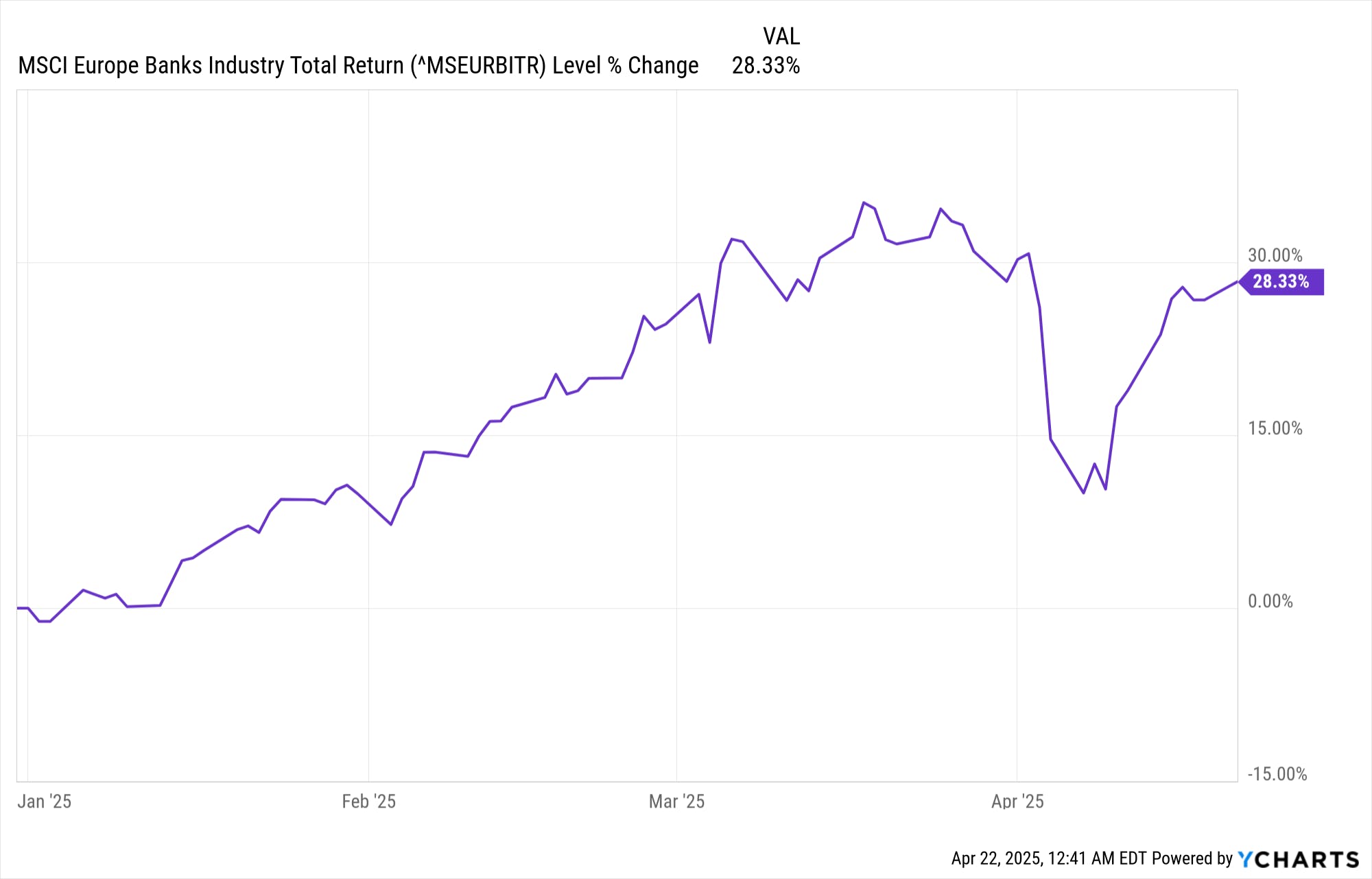

As outlined in the blog, the strong performance of the European bank sector has contributed to the topline returns of the global equities ex-U.S. asset class. As observed from the MSCI European Banks Industry Total Return Index, year-to-date performance has been particularly compelling, even with the drawdown that occurred in recent weeks.

A recent Ernst & Young memo detailed that European banks’ net interest income remained strong in Q4 2024, while revenue growth outpaced cost growth. Though the European Central Bank recently lowered interest rates, the expectation is that the top-line growth drivers for European banks will shift from net interest income to fee income going forward.

Gaining European Banking Exposure

For Canadian investors seeking to gain European banking exposure to their portfolio, the the Evolve European Banks Enhanced Yield ETF (Ticker: EBNK/EBNK.B/EBNK.U) invests in equity securities of the largest European banks on an equally weighted basis, with the added value of a covered call strategy applied to up to 33% of the portfolio. The fund will track the performance of the Solactive European Bank Top 20 Equal Weight Index Canadian Dollar Hedged.

For investors looking to diversify away from North American equities, European equities represent an opportunity to gain exposure to companies with a distinct value proposition and catering to an international market. Given the strong performance of European banks thus far in the year, they could be an additive component within one’s portfolio.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.