Dublin, April 23, 2025 (GLOBE NEWSWIRE) — The “Specialty Carbon Black Market – Global Outlook & Forecast 2024-2029” report has been added to ResearchAndMarkets.com’s offering.

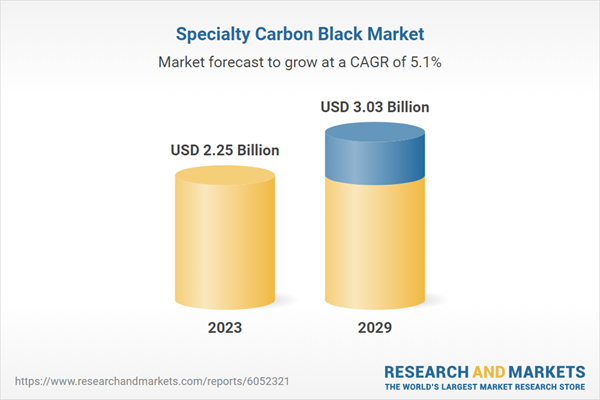

The Specialty Carbon Black Market was valued at USD 2.25 billion in 2023, and is projected to reach USD 3.03 billion by 2029, rising at a CAGR of 5.09%.

The APAC region accounted for the largest global specialty carbon black market, approximately 41% by value, in 2023, largely due to the presence of manufacturing plants. The market growth in this region is fueled by the increasing construction activities in countries such as China, Japan, South Korea, and India. According to Global Construction Perspectives and Oxford Economics, the global construction market is expected to grow by USD 8 trillion by 2030, driven primarily by China, the US, and India. Furthermore, as per Invest India projects construction activity is to expand at a rate of 7.1% annually. The growing demand for specialty carbon black in industries like automotive, electronics, and others further contributes to the market’s growth in the region during the forecast period. Moreover, the rise of the consumer electronics sector in India, South Korea, China, and Japan further propels the market growth in Asia Pacific.

North America holds a significant share of the global specialty carbon black market due to the high penetration of both commercial and residential sectors. The region holds several key industries, including automotive, construction, aerospace, electronics, and packaging. Also, the region’s market growth is driven by the increasing use of ink and toner applications. Additionally, the growing demand for furnace black in various industrial applications such as belts, vibration isolation devices, air springs, and hoses is expected to further propel market expansion in the region. Furthermore, the European specialty carbon black market holds a substantial share, driven by advanced electronic devices, well-established industries, and increasing demand for electric vehicles. Among European countries, Germany led the industry with the largest share, while Spain emerged as the fastest-growing market for specialty carbon black. Innovations in automotive parts manufacturing, increasing demand for sustainable chemicals in construction activities, and a flourishing renewable energy industry are key factors pushing demand for carbon black in the region.

Although Latin America, the Middle East, and Africa hold a smaller market share, these regions are expected to experience significant growth in the global specialty carbon black market. Technological innovations, rapid industrial development, and evolving government policies are driving the expansion of end-use industries in these areas, thereby supporting the market demand. In 2023, Brazil led the industry in Latin America, supported by growth in the construction, electronics, and transportation sectors. With a limited number of manufacturers, the Middle East and Africa rely heavily on imports from Asia Pacific, Europe, and North America.

MARKET TRENDS & ENABLER

Increasing Demand in the Electric & Electronic Industry

Over the years, there has been significant growth in the electrical and electronics sector, driven by the utilization of specialty carbon black in applications such as electromagnetic shielding, semi-conductive cable compounds, viscosity control additives, and pigmentation enhancements. The material’s incorporation in wire and cable manufacturing has been prioritized to mitigate risks of premature failure or electrostatic discharge, particularly in electronic packaging and equipment. Hence, such factors are anticipated to propel the specialty carbon black market during the forecast period. Additionally, the increasing reliance on advanced consumer electronics, electric vehicles, and smart devices globally has shown the necessity of high-quality, conductive, and protective materials, further accelerating the specialty carbon black market expansion. For instance, According to Invest India, the global electronics market is valued at approximately $2 trillion, with India accounting for $118 billion, expected to reach $125 billion by 2025. Thus, such expansion of the electronics market is expected to significantly boost the demand for specialty carbon black during the forecast period.

Technological Advancements

Continuous innovation and technological advancements have been pivotal in expanding the specialty carbon black market. New technologies often lead to enhanced product performance, increased application efficiency, and improved customer satisfaction, thereby driving demand and market growth. For instance, Cabot Corporation has invested in advanced manufacturing processes to develop specialty carbon blacks with superior properties for lithium-ion battery applications, significantly enhancing energy storage capabilities in electric vehicles (EVs). This innovation aligns with the global push toward EV adoption and renewable energy solutions, contributing to the market’s growth. Furthermore, the development of specialty carbon blacks is also driven by the wide usage of smart devices and 5G-enabled electronics. It provides enhanced electromagnetic shielding and heat dissipation, these materials support the growing demand for reliable and efficient electronic components, particularly in markets like India and China, where electronics manufacturing is rapidly expanding. These innovations enhance the functionality of products in various applications, including EVs, electronics, and packaging, and encourage industry players to invest in R&D to stay competitive. As industries such as automotive and electronics continue to grow and evolve, the specialty carbon black market is expected to benefit significantly from this advancement.

VENDORS LANDSCAPE

The global specialty carbon black market is fragmented because of several international and local players who are heavily investing in research and development to diversify their product offerings, driving further market growth. Major players in the market, including Aditya Birla Group (Birla Carbon), Cabot Corporation, Orion, Phillips Carbon Black Limited, Imerys, Mitsubishi Chemical Corporation, and Denka Company, among others are working to boost market demand by investing in R&D efforts.

These companies are also adopting various strategic measures, such as launching new products, entering into contractual agreements, pursuing mergers and acquisitions, increasing investments, and forming collaborations with other organizations to expand their global presence. For instance, Orion Engineered Carbons expanded its production capacity for gas black in Germany in 2023. With this capacity expansion, the company strengthened its leadership in the specialty carbon black market. In 2023, Himadri Speciality Chemical Ltd approved the brownfield expansion of a new specialty carbon black line increasing the total specialty carbon black capacity to 130,000 metric tonnes per annum.

Recent Developments in the Global Specialty Carbon Black Market

In 2024, Himadri Speciality Chemical Ltd announced its plans to invest USD 2.64 billion to expand its specialty carbon black capacity in Singur, West Bengal. The project aims to address rising European demand, driven by an upcoming EU ban on Russian imports. Scheduled for completion in 18 months, the expansion will boost the company’s annual production capacity by 70,000 tonnes, increasing total capacity from 180,000 to 250,000 tons.In 2024, Birla Carbon announced Greenfield Expansions in the APAC region. The company is likely to expand its carbon black capacity by over 240 kilotons in the identified locations of India and Thailand.In 2023, Orion S.A. unveiled its first circular specialty carbon black for polymers at the 2023 Compounding World Expo North America, held in Cleveland. The company will also present carbon blacks, enhancing rheology, UV resistance, and conductivity.In 2023 Orion Engineered Carbons and Ion Specialties partnered for Mexico sales. This partnership aimed to enhance Orion’s presence in the Mexican market by leveraging ION Specialties’ established infrastructure, including warehouses, laboratories, and logistical support.In 2023, Cabot Corporation launched a novel product family REPLASBLAK with certified material. The company launched three products with this launch that are sold as its first certified black master-batch products as (ISCC PLUS) International Sustainability & Carbon Certification.

Key Company Profiles

Aditya Birla GroupCabot CorporationOrion S.A.Himadri Specialty Chemical Ltd.PCBL Chemical Limited

Other Prominent Vendors

Black Bear CarbonContinental Carbon CompanyJiangxi Black Cat Carbon Black Inc., LtdOmsk Carbon GroupImerys Graphite & CarbonOCI Company Ltd.Denka Company LimitedAkrochem CorporationMitsubishi Chemical Group CorporationRalson CarbonPentaCarbonBeilum Carbon Chemical LimitedM J Pigment & AdditivesADL NRG GmbHLehmann & Voss & Co.

Key Attributes:

Report AttributeDetailsNo. of Pages488Forecast Period2023 – 2029Estimated Market Value (USD) in 2023$2.25 BillionForecasted Market Value (USD) by 2029$3.03 BillionCompound Annual Growth Rate5.0%Regions CoveredGlobal

Key Topics Covered:

Premium Insights

Opportunity PocketsRegional InsightsMarket Trends & Enabler Increasing Demand in Electric & Electronic IndustryTechnological Advances Segmentation Analysis Grade TypeProcessApplication Regional InsightsVendors Landscape

Introduction

Specialty Carbon Black vs Rubber Carbon BlackRising Demand from the Wind Energy IndustryRobust Expansion of Marine IndustryStringent Regulations Environmental RegulationsHealth and Safety RegulationsProduct Quality and Standards

Market Opportunities & Trends

Shift Toward SustainabilityIncreasing Consumption of Lithium-Ion BatteriesTechnological Advances

Market Growth Enablers

Increasing Demand in Electric & Electronic IndustryGrowing Demand for Advanced PlasticsRobust Growth of Construction Sector

Market Restraints

High Production CostHazardous Environmental EmissionFluctuations in Raw Material Prices

Segmentation by Grade Type

Segmentation by Formulation

Segmentation by Process

Furnace BlackGas BlackAcetylene BlackThermal BlackOther Processes

Segmentation by Application

PolymersInk & TonersPaints & CoatingsBattery & StoragesOther Applications

Segmentation by End-Users

AutomotivePrinting & PackagingConstructionElectric & ElectronicsWind EnergyOther Users

For more information about this report visit https://www.researchandmarkets.com/r/iwyhfi

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.