Created on April 23, 2025

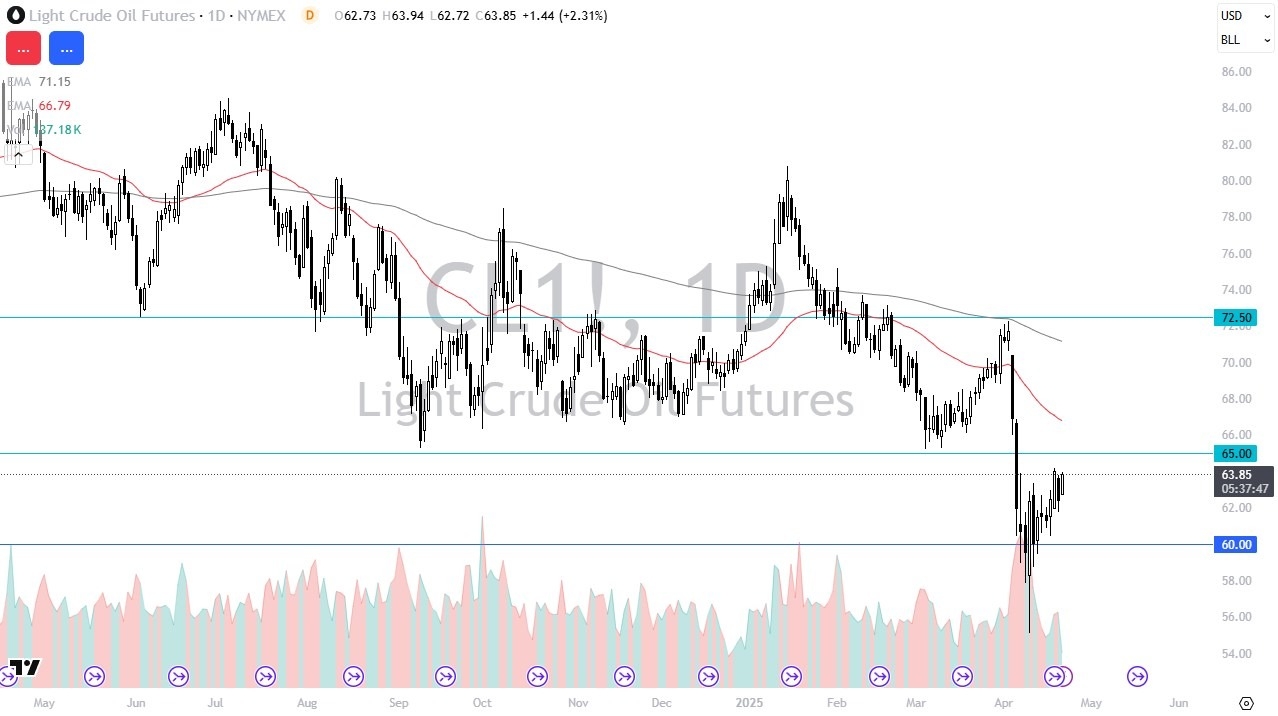

Furthermore, though, you need to keep in mind that the $65 level above is an area that has been important multiple times and previously has been support. So, market memory comes into the picture.

$65 Could Be Important

If we can clear the $65 level, I expect we see more of a grind towards the $72.50 level. Short-term pullbacks, do think attract plenty of value hunters, as previously mentioned, with the $60 level being a massive area going back, historically speaking. And in fact, when you look back multiple years, the area between $60 and $65 has been a point of inflection.

So if we can go to the upside from here, oil will have saved itself as we head into the busier season. And I think one of the key factors might be a resumption of trade and driving season combined. We could see oil spike towards the 50 day EMA initially, followed by the 200 day EMA and then eventually the $72.50 level, which had been important. Oil does tend to trade in ranges, so there is the possibility that we just hang out in this area between $60 and $65. But right now, it certainly looks like the buyers are starting to gain the upper hand, as every time we have pulled back, we’ve seen a squeeze higher.

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.