Air Nostrum, Iberia’s feeder airline (also known as Iberia Regional), operates domestic flights across Spain as well as routes to Portugal, Morocco, Algeria, France, Italy, Germany, Belgium and Switzerland with a fleet of around 20 CRJ 1000s from Madrid.

The carrier also operates intra-Balearic PSO (public service obligation) routes, such as Palma-Ibiza, Palma-Menorca and Ibiza-Menorca, in addition to services from Melilla, an autonomous Spanish city in North Africa, to the Iberian Peninsula with 11 ATR 72-600 turboprops. It connects Melilla with Malaga, Seville, Almería, Granada, Madrid, Barcelona, Palma, Asturias, Santiago, Gran Canaria, the Canary Islands and Tenerife.

Network development

Miguel Oliver, network planning and scheduling director at Air Nostrum, told Airline Routes & Ground Services at Routes Europe 2025 that the carrier’s summer 2025 programme comprises 120 connections.

“Jointly with Iberia we have made a big development,” Oliver explained. “More than new routes, we are developing more frequencies – especially in the summer – to give more connectivity possibilities [from] the hub.

“We have reinforced most of the routes [at Madrid] as well as on the other side of the business with connectivity in the Balearics. We have opened routes with Palma from, for instance, Castellón which is an airport in Valencia, Rioja and Andorra – a very small airport opened recently that we use to connect Andorra in the mountains in the north.”

Air Nostrum’s summer 2025 schedule includes 120 connections (Image credit: Adobe Stock)

Air Nostrum’s summer 2025 schedule includes 120 connections (Image credit: Adobe Stock)

Air Nostrum has also increased connectivity in Melilla with new destinations such as Santiago and Tenerife, as well as adding more frequencies between Madrid, Malaga, Palma and Barcelona. These airports previously had slot limitations, said Oliver, but extended their timetables, which has enabled the carrier to improve connectivity – and “it’s working quite well”, he added.

On Air Nostrum’s route network strategy, Oliver explained that for the time being the carrier has “nothing new” planned for Europe because “everything is already served”. But he said Iberia is developing new services abroad, such as Madrid-Orlando, for next winter and two new destinations in Brazil.

“We are complementing their new destinations,” said Oliver. “They need feeding, so that’s how we operate… We have a lot of presence in France, Italy and also Germany, so [our strategy is] to keep the network connected, to feed the new destinations that Iberia opens.”

As the launch customer for the Airbus A321XLR, Iberia is looking to develop a long-range narrowbody network, which requires more feeder services – and Air Nostrum stands ready in support.

ACMI in demand

Airlines highlighted at Routes Europe that supply chain challenges are continuing to disrupt the aviation industry. In Oliver’s view, aircraft delivery delays and engine shortages are the largest problem the sector faces at present.

He said: “The main challenge that not only us, but all the airlines experience, is the supply chain. That’s the big elephant in the room, nobody is talking about it, but we know it’s there.

“[We don’t] use Boeing or Airbus, we don’t have Pratt & Whitney engines. But I’ll tell you my point of view, because we are an ACMI provider… We could talk about sustainability; we could talk about digitalisation, inter-modality or the strong competition between the low-cost carriers.

Miguel Oliver, network planning and scheduling director at Air Nostrum (Image credit: Air Nostrum)

Miguel Oliver, network planning and scheduling director at Air Nostrum (Image credit: Air Nostrum)

“These are secondary issues. The big one is that airlines don’t have enough capacity to serve the market. But the demand is there – at least Air Nostrum has got the demand.”

Besides Air Nostrum’s core operations, the carrier’s sister company CityJet provides wet lease operations for SAS, Lufthansa and others. It handed CityJet these services last year after their 2023 merger that saw the founding of the Strategic Alliance of Regional Airlines (SARA), which Oliver described as a “mini IAG group of regional airlines”.

He said Air Nostrum has been inundated lately with ACMI queries from airlines across Europe, with requests varying from two to 10 aircraft.

“We have seen a big demand for wet lease agreements,” he said. “There is a big problem because there are big delays with aircraft deliveries at Boeing and Airbus. There are also big engine problems.”

The result is that airlines are now struggling with lack of capacity.

“The big challenge today, and this is something I’m telling the airports, is ‘sorry, I cannot fly. Although I’d like to fly more, I don’t have enough aircraft because I have to deploy my aircraft for other airlines who are having delays, having maintenance problems, who are suffering delays for spare parts’,” said Oliver.

“If you have a bird strike, to get that spare part it becomes a real difficulty. For our maintenance people, they ask for estimates and don’t get an estimate from the manufacturer, so that’s the big challenge now.”

Oliver warned these challenges have resulted in rising demand for ACMI solutions – but that airlines seeking wet lease agreements could be struggling to fulfil their additional capacity requirements this summer. If they do, they face inflated costs, he said.

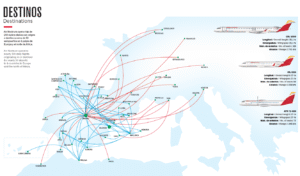

Air Nostrum’s route network (Source: Air Nostrum)

Air Nostrum’s route network (Source: Air Nostrum)

Air Nostrum, like its peers, sees demand up when larger carriers begin to feel capacity constraints during peak seasons and/or there are aircraft shortages. But Air Nostrum is “obviously” benefitting from these wider market disruptions, said Oliver. “This summer, if you are an airline and you need to go and look for a wet lease provider, everything is sold.

“You don’t have anything. Everyone is getting wet lease agreements. And if you find one that is available, it will cost you a lot of money because that’s the only capacity remaining.”

If airlines can’t find a wet lease provider, Oliver warned they will “have to cancel some operations, as Ryanair did. Ryanair announced it was leaving Spain and reducing 800,000 seats” in January.

“Why? They said it was because airport taxes are very high. But that’s not completely true – we know that’s not true. It’s because they should have [had] 29 aircraft delivered, but have only had nine… It’s because of lack of capacity.”

Future plans

Air Nostrum may not be directly affected by the ongoing delays at Airbus and Boeing. But supply chain disruption and geopolitical instability have fostered an unpredictable landscape.

On the carrier’s network plans for the next 12 months, Oliver said they’re “difficult to predict”, but that its strategy is to maintain agile. Air Nostrum is not planning any drastic developments, he added.

Oliver said Air Nostrum’s network plans are “difficult to predict” due to uncertainty (Image credit: Adobe Stock)

Oliver said Air Nostrum’s network plans are “difficult to predict” due to uncertainty (Image credit: Adobe Stock)

“The only thing you can plan in your life is the next 10 minutes. Talking about 2026 especially, this degree of uncertainty we have today with geopolitical instability and also the supply chain, it’s difficult to predict.

“I was listening at the conference to [Vueling CEO] Carolina Martinoli. One of the questions she was asked was ‘do you feel comfortable in aviation?’. You can never feel comfortable in aviation. When you’re in aviation, you’re always used to living in turmoil.

“We started our operations in 1994. In those more than 30 years we have gone through 9/11 in 2001, the financial crisis in 2008 and the second in 2012, we went through the Covid-19 crisis.

“We just last year went through the DANA [Depresión Aislada en Niveles Altos or ‘Isolated Upper-Level Depression’] crisis in Valencia, which saw our headquarters flooded. We lost two of our four buildings.”

Oliver added that the lesson Air Nostrum has learned through navigating these crises is to remain flexible to ensure operational resilience. “We’re survivors,” he said, with reference to what he described as a high mortality rate for regional airlines.

The airline has diversified to expand its business portfolio, with part ownership of Iryo – a Spanish high-speed rail service – and the creation of PLYSA, an aerial firefighting company.

But, he said: “For the next year, we are not planning anything drastic. We are going to wait and see our position – see what the global situation is – and then obviously we will adapt [accordingly]. We are worried, obviously, but we have managed difficult situations before, and we think we’ll be able to manage the next challenge that comes.”