Market Overview 2025-2033

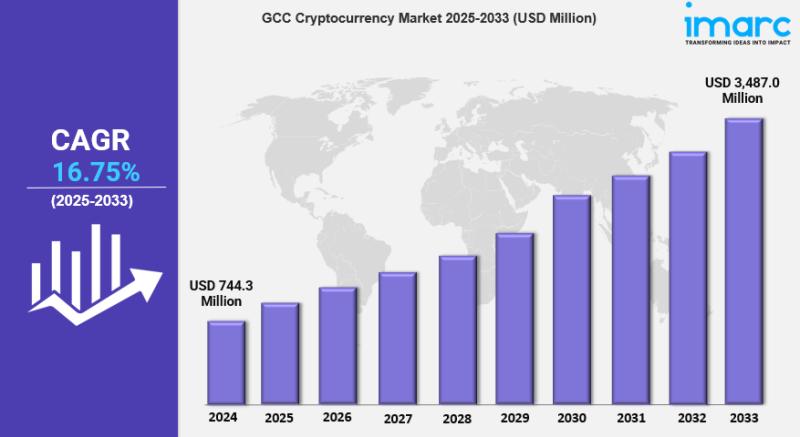

The GCC cryptocurrency market size was valued at USD 744.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,487.0 Million by 2033, exhibiting a CAGR of 16.75% from 2025-2033. The market is experiencing significant growth mainly driven by increasing digital transformation, government blockchain initiatives, and rising interest in decentralized finance. With robust internet penetration and a tech-savvy population, the GCC is emerging as a key hub for cryptocurrency adoption and blockchain technology development.

Key Market Highlights:

✔️ Strong growth driven by regulatory developments & digital transformation

✔️ Increasing adoption of blockchain technology across financial sectors

✔️ Rising interest in crypto investments and digital asset diversification

Request for a sample copy of this report: https://www.imarcgroup.com/gcc-cryptocurrency-market/requestsample

GCC Cryptocurrency Market Trends and Drivers:

The GCC cryptocurrency market is poised for significant growth, driven by increasing government support and regulatory frameworks. As countries in the Gulf Cooperation Council recognize the potential of blockchain technology and cryptocurrencies, they are actively developing regulations to foster innovation while ensuring consumer protection. By 2025, it is expected that a clearer regulatory landscape will encourage more institutional investments and mainstream adoption of cryptocurrencies.

Governments are also exploring the use of digital currencies for various applications, including cross-border transactions and the digitization of national currencies. This supportive environment is likely to attract both local and international players, enhancing the overall market dynamics and encouraging the development of innovative financial products and services.

Another key dynamic shaping the GCC cryptocurrency market is the rising interest among retail investors and the general public. With the proliferation of digital wallets and trading platforms, individuals are increasingly engaging in cryptocurrency trading and investment. By 2025, it is anticipated that educational initiatives and awareness campaigns will further demystify cryptocurrencies, making them accessible to a broader audience.

Social media and online communities are playing a crucial role in this trend, as they provide platforms for sharing information and experiences related to cryptocurrency investments. As more people become familiar with the benefits and risks associated with digital assets, the demand for cryptocurrencies is expected to rise significantly, leading to increased market activity and liquidity.

The integration of cryptocurrencies into various sectors, such as finance, retail, and tourism, is another dynamic influencing the GCC cryptocurrency market. By 2025, businesses across these sectors are expected to adopt cryptocurrencies as a means of payment, enhancing transaction efficiency and reducing costs. This trend is particularly relevant in the tourism sector, where international travelers may prefer using cryptocurrencies for transactions, given their borderless nature.

Additionally, partnerships between traditional financial institutions and cryptocurrency platforms are likely to emerge, facilitating seamless transactions and encouraging wider acceptance. As cryptocurrencies become more ingrained in everyday transactions, their utility will drive further demand and solidify their position within the GCC’s economic landscape.

Buy Report Here: https://www.imarcgroup.com/checkout?id=9012&method=940

GCC Cryptocurrency Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Type:

• Bitcoin

• Ethereum

• Bitcoin Cash

• Ripple

• Litecoin

• Dashcoin

• Others

Analysis by Component:

• Hardware

• Software

Analysis by Process:

• Mining

• Transaction

Analysis by Application:

• Trading

• Remittance

• Payment

• Others

Country Analysis:

• Saudi Arabia

• UAE

• Qatar

• Bahrain

• Kuwait

• Oman

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Speak to an analyst : https://www.imarcgroup.com/request?type=report&id=9012&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.