From the record surge in renewable diesel use and BEV registrations to a 50% spike in natural gas trucks in 2024 and growing hydrogen use, fleets are embracing diverse decarbonization strategies — even as uncertainty clouds the policy landscape and federal support shrinks.

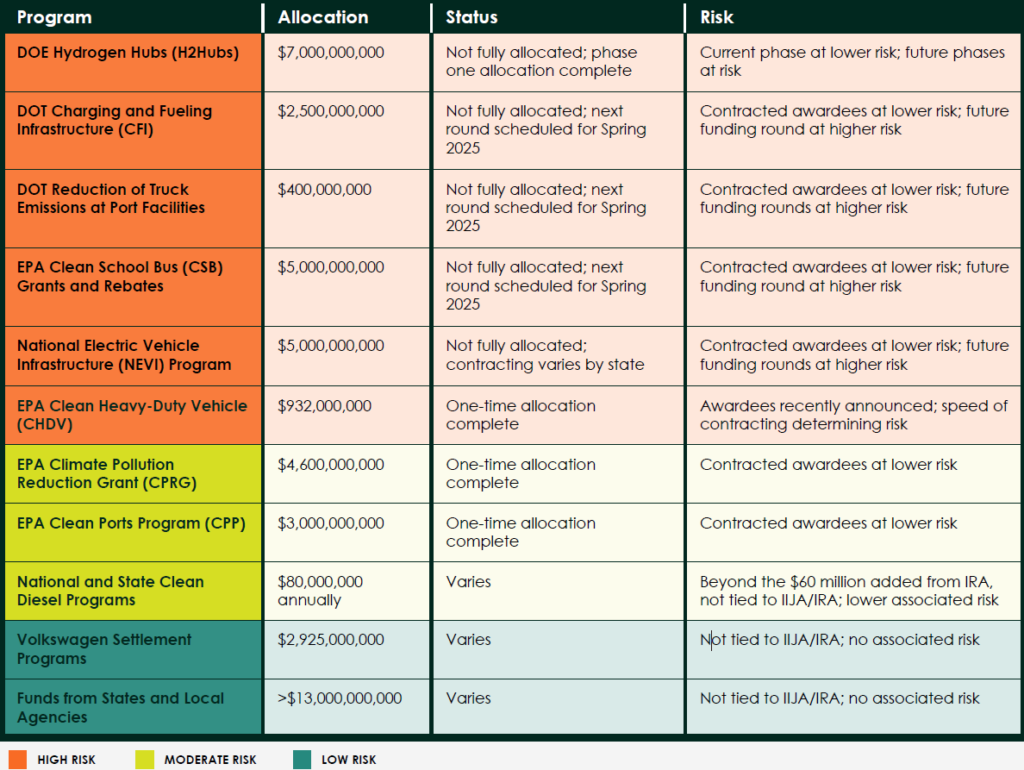

While the lack of federal funding during the Trump administration adds uncertainty, fleets still have access to substantial state and local financing for clean vehicle technologies.

Those are just a few of the findings in the latest, sixth annual State of Sustainable Fleets report, released April 28 at the Advanced Clean Transportation (ACT) Expo. The report captures how the U.S. market is evolving and adapting cleaner technology while responding to what researchers now call a time of “peak uncertainty.”

Survey responses from nearly 200 operators and data from across the U.S. show adoption is growing not only in California, but nationwide and across multiple fuel types and sectors.

Renewable diesel, RNG

Renewable diesel (RD) and renewable natural gas (RNG) continue to lead among commercially viable alternatives. RD production rose 28% in the first half of the year compared to the same period in 2023. By June 2024, production reached 1.51 billion gallons, surpassing 2023 total output of 1.18 billion gallons.

When combined with biodiesel, RD replaced 70% of conventional diesel used in California. Overall, a record 39% of fleets surveyed reported using RD, up 12% since 2022.

And it’s no longer just a California story. Todd Ellis, vice-president of sales and marketing at Chevron, told journalists during a briefing that the renewable diesel market is expanding steadily across the country due to its availability, reliability and really the “low to no infrastructure investments.”

Battle Motors’ RNG-powered trucks at Hexagon Agility facility in California. (Photo: Krystyna Shchedrina)

Battle Motors’ RNG-powered trucks at Hexagon Agility facility in California. (Photo: Krystyna Shchedrina)

“As an example, Washington and Oregon are two states that are actively implementing their low carbon fuel standard programs. New Mexico has recently enacted a program. So that’s where we’re seeing – a lot of product flow into those incentivized markets. Simultaneously, we’re also working with fleets across the country who have low carbon initiatives, programs [and] goals,” Ellis said.

“We’ve been working with a lot of fleets in the Midwest, North Coast, even the East Coast, to help them meet their goals with renewable diesel. And so, as we see more state programs come online, I expect that to expand going to those other markets.”

Using RD as a diesel replacement can also result in maintenance savings of up to US$0.02 per mile, the TRC report found.

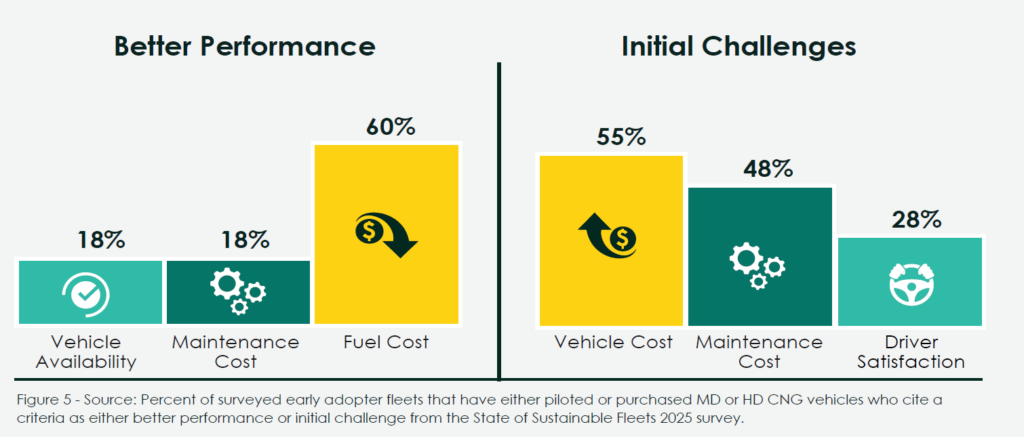

(Image: State of Sustainable Fleets report, 2025)

(Image: State of Sustainable Fleets report, 2025)

Meanwhile, RNG availability and fleet demand expanded significantly. In the past six years, RNG use grew by 234%, according to the industry group Transport Project. By the end of 2024, RNG industry was set to see more than 400 operational RNG facilities – 130 under construction, and 233 planned – representing a potential 60% capacity increase. The number of natural gas stations offering RNG increased by 63% last year. There are approximately 1,200 heavy-duty natural gas fueling stations in the U.S. Of these, 633 are public and 346 of those dispense RNG.

Fleet use of natural gas vehicles (NGVs) rebounded after several slow years. Class 8 NG tractor registrations jumped 50% year-over-year, to 2,317 units, boosted in part by the release of Cummins’ new 15-liter X15N engine. Refuse fleets saw a 43% jump in NGV registrations. Nearly two thirds, or 65% of fleets who use natural gas vehicles in our annual survey report using RNG, and they estimate that accounts for an average of 82% of their natural gas fueling, TRC said during the media briefing.

As of Sept. 2024, 40 fleets had placed orders for trucks equipped with the X15N, and about 30% of those fleets had not used natural gas previously.

BEVs hit record high

Battery-electric vehicle (BEV) adoption also continued to rise in 2024, with registrations reaching an all-time high of 41,472 units. Commercial cargo vans and pickup trucks accounted for 92% of new registrations, with 14,785 cargo vans, a 4% increase, and 23,188 trucks, up 95%.

Meanwhile, Class 8 electric tractor registrations climbed 29% to 881 units. They continue to gain traction in drayage and regional freight operations. In 2024, over one-fifth (22%) of regional logistics fleets in the annual survey reported operating at least one BEV.

Still, battery pack costs for medium- and heavy-duty vehicles remain around $190/kWh for manufacturers outside of China—well above the $100/kWh parity benchmark and $133/kWh seen internationally. Fleets also report delays and high costs tied to utility interconnects and grid capacity upgrades.

Hydrogen shows promise and warning signs

While hydrogen remains a small segment of the clean vehicle market, interest grew in 2024. Fleets using hydrogen fuel cell electric trucks have reported key benefits, with 56% citing excellent range and driver satisfaction compared to diesel trucks.

With longer ranges, fast refueling, and a smaller fueling footprint, hydrogen fuel cells are also well-suited for transit and drayage operations, which have been early adopters. Over 90 Class 8 hydrogen tractors entered service.

Yet two early hydrogen truck manufacturers — Nikola and Hyzon — collapsed financially by early 2025, raising alarms about the fragility of the sector. Nikola led the charge in Class 8 tractor sales, reporting 200 in 2024 before bankruptcy in early 2025.

Still, OEMs such as Hyundai, a Kenworth and Toyota partnership, and a Daimler and Volvo partnership intend to bring hydrogen trucks to market over the next several years.

Before bankruptcy, Nikola had already developed new mobile fueling stations that enabled regular operations for its fuel cell electric truck customers, primarily in Southern California, said Nate Springer, vice-president of market development at TRC during the media briefing. However, despite these deployments, the report found no significant declines in hydrogen fuel prices, and long-term cost competitiveness remains a concern.

TRC warns that the hydrogen sector is particularly vulnerable to federal funding disruptions. The future of the Department of Energy’s $7 billion Hydrogen Hubs initiative is uncertain, and without substantial research and development (R&D) support, it can come to a halt.

“It is an industry, among all of those covered in state of sustainable fleets that faces the greatest risk of pause or dramatic slowdown in the near future. It is an industry that is an earlier stage development than all others and would most benefit from federal research and development coordination,” Springer said. “Most industry experts are unlikely to carry the full research and development agenda forward as effectively. This is one to watch, and we are going to learn more in the coming months.”

(Image: State of Sustainable Fleets report, 2025)

(Image: State of Sustainable Fleets report, 2025)

Paul Rosa, senior vice-president of procurement and fleet planning for Penske Truck Leasing, compared the current hydrogen market to where battery electric vehicles were in 2019, suggesting it’s still in an early stage of development and infrastructure building, adding that the sector may be able to avoid some missteps if it learns from the rollout of electric trucks.

“We are very optimistic and very positive on hydrogen, but it’s going to take time,” he said. “I mean, it’s no secret that the TCO on a battery electric vehicle is not where it needs to be for many fleets to say, ‘I’m going to go and do that’, and in most cases, hydrogen vehicle is going to be [even] a little bit higher cost than a battery electric.”

Speaking about Hyzon and Nikola, Rosa said, “I don’t think that’s a surprise, not because they didn’t have a product that would work. On the contrary, the product wasn’t the issue. It was the ecosystem around it. It was the ability to get hydrogen. It was the ability to have filling stations.”

“In our business, R&D activities and investments can’t change based on today’s news.”

Keith Brandis, VTNA

Keith Brandis, at vice-president of policy and regulatory affairs at Volvo Trucks North America, agreed with Rosa, saying that for those dipping their toes in new technology, industry partnerships are paramount. As a BEV manufacturer, Volvo, for example, learned a lot about the technology from its partners, which allowed them to improve it.

“We worked with the charging providers and installers and learned the painful lessons of, you know, we have to get prepared for the long lead times of some electrical gear,” he said. “But also, importantly, start talking to first responders, getting them prepared for what it looked like, what to do when you see the truck for the first time, working with community colleges to train technicians for handling these trucks, get the right service tools and information so that our dealers could focus on uptime.”

As fleets continue adopting a range of clean technologies, Brandis said that adoption patterns and abilities do not depend solely on fuel type but also on a fleet’s specific operational needs. He emphasized that medium-duty segments, particularly those with predictable, low-mileage duty cycles, could see some of the sharpest growth in 2025.

While acknowledging the growing uncertainty facing fleets, Brandis emphasized that OEMs like Volvo are staying the course with long-term decarbonization investments. Volvo itself continues to advance its three-pillar strategy: battery-electric vehicles, hydrogen fuel cell trucks, and efficient internal combustion engines running on low-carbon fuels.

“You can imagine in our business, R&D activities and investments can’t change based on today’s news,” he said. “We have to look over the horizon. We have to be prepared for what’s to come.”