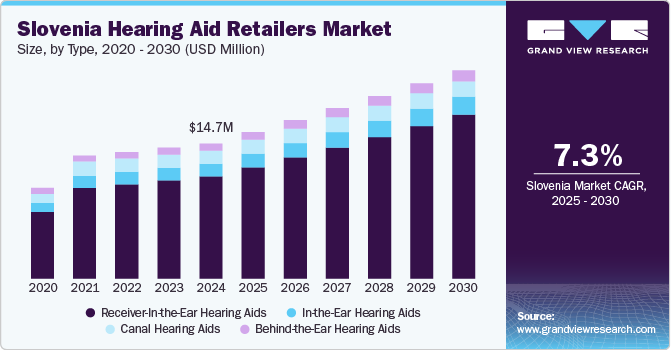

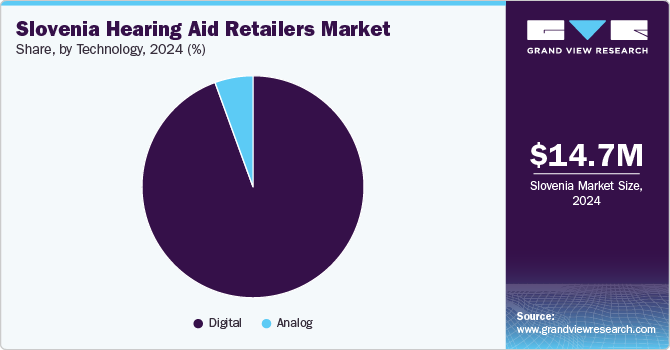

The Slovenia hearing aid retailers market size was estimated at USD 14.70 million in 2024 and is projected to grow at a CAGR of 7.32% from 2025 to 2030. The market growth is attributed to the increasing adoption of hearing aid devices, growing awareness regarding technologically advanced devices for auditory impairment, and the increasing prevalence of hearing loss due to the growing geriatric population.

In March 2021, the Deaf and Hard of Hearing Clubs Association of Slovenia published a report according to which there were about 1500 deaf or hearing-impaired persons in Slovenia (from a population of 2 million). About 1000 of them use the Slovenian sign language as their first language.

The market is currently experiencing a transformation driven by technological advancements, including AI-powered devices, Bluetooth connectivity, and noise-cancellation features. As a result, there is a growing inclination among consumers towards hearing aids that not only provide discreet designs and enhanced sound quality but also incorporate additional health monitoring functionalities. These evolving preferences reflect a broader movement towards innovative solutions that cater to the diverse needs of users.

The increasing demand for upgradable hearing aids is emerging as a crucial factor that meets consumer needs and contributes to reducing the environmental footprint associated with traditional hearing aid manufacturing and disposal. Recent innovations in hearing aid technology have enabled manufacturers to design devices that can be upgraded rather than replaced entirely. By shifting towards upgradable models, the overall carbon footprint associated with production processes can be reduced. For instance, one of the country’s leading retailers, AuidoBM offers Unitron’s software upgradable hearing aids.

Furthermore, supportive by government initiatives, healthcare conferences, and increasing access to affordable hearing solutions contribute to a more informed consumer base in the country. For instance, the International Conference on Auditory Rehabilitation and Hearing Aids Technology is likely to be held in the country in July 2025.

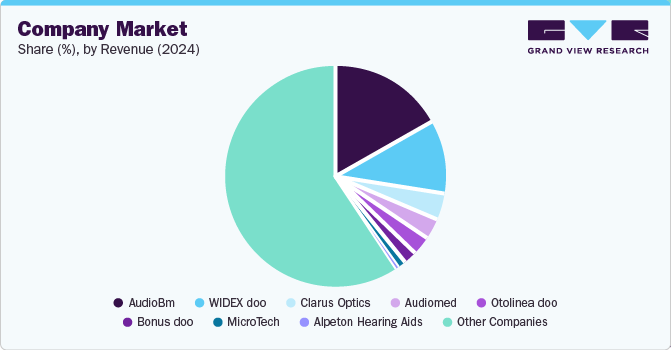

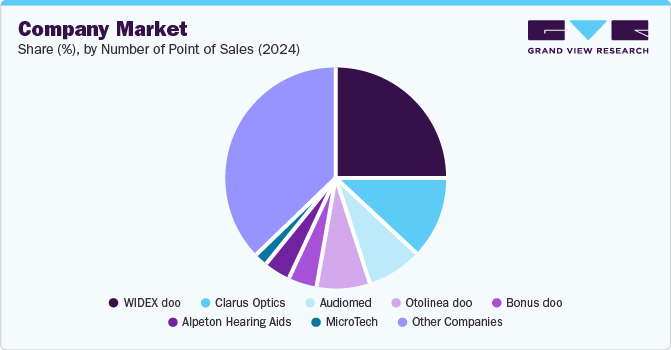

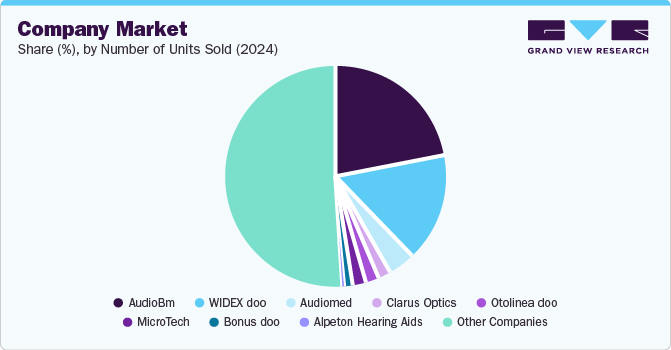

In 2024, the market is driven by key factors such as revenue performance, extensive distribution networks, and high unit sales, which reflect both financial strength and consumer demand.

Pricing Analysis

Pricing Analysis

Pricing Elasticity Insights

Low-End Segment: Failure in product feature updates lead to significant commoditization.

Low-End: Highly elastic, with price adjustments directly impacting demand.

Mid-Range Segment: Increased price pressure in low-end segment benefits the mid-range segment as consumers demand for enhanced product value.

Mid-Range: Moderately elastic; price increases balanced by added technological value.

High-End Segment: Premiumization reflecting technological upgrades and rising demand for connected devices.

High-End: Inelastic demand ensures stable margins, targeting affluent and tech-savvy consumers.

Revenue Streams and Business Models In Slovenia

Subscription Model:

Slovenia’s economic climate, marked by inflation impacting disposable income, presents an opportunity for Neuroth to expand its market share through a subscription model for hearing aids. This model would make high-quality hearing aids more accessible, potentially increasing sales volume. Additionally, incorporating remote adjustments and telehealth consultations into subscriptions can enhance user experience and lower operational costs, making the service more attractive in a cautious spending environment.

Omni-channel Model:

Slovenia’s digital landscape for e-commerce and digital hearing aids is uneven; urban areas benefit from improved online access, while rural regions face slower internet adoption, limiting their technology access. An omni-channel strategy enhances customer engagement, allowing consumers to explore products online and try them in-store, boosting satisfaction and loyalty. To support rural customers, Neuroth could introduce local pop-up events or collaborate with health providers. Meanwhile, WIDEX doo’s hybrid services help reduce operational costs and expand their customer base.

In-house Insurance Model:

There is a growing trend of consumers opting for mid-tier and refurbished products, creating an opportunity for Neuroth to introduce in-house insurance for hearing aids. This unique selling proposition can differentiate Neuroth from competitors, attracting price-sensitive customers and helping capture a larger market share. Additionally, analyzing claims data from the insurance program can provide insights into common issues with specific hearing aid models, allowing for ongoing improvements in product design and quality control.

Credit Model:

Countries’ smaller market and dependence on imports make offering hearing aids on credit a strategic move for Neuroth to boost market share and alleviate cost pressures. Credit options can improve cash flow, enhance supplier negotiations, and increase inventory turnover. AUDIO BM’s loan model supports consumer retention and accessibility, while Audiomed’s installment payments enhance customer satisfaction.

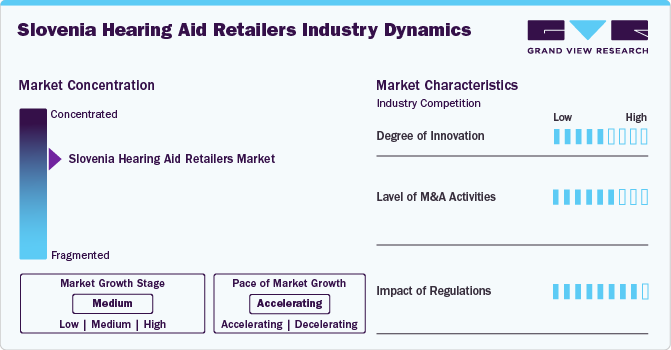

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, level of merger & acquisition, impact of regulation, and market expansion. The degree of innovation is medium, the level of merger & acquisition activities is low, the impact of regulations on the market is high, the market expansion is medium.

The market exhibits a moderate degree of innovation, driven by increasing consumer demand for advanced auditory solutions, rising awareness of hearing health, health monitoring and a strong focus on digital transformation. For instance, Smart hearing aids from retailers such as MicroTech and Audiomed include fall detection technology that uses motion sensors to determine if the wearer has fallen. These hearing aids are also equipped with a cognitive health monitoring feature that tracks speech patterns, social engagement, and auditory processing abilities. This data can help identify early signs of cognitive decline, such as in conditions such as Alzheimer’s or dementia.

The merger and acquisition activity level in the market is currently limited, reflecting a broader trend observed in many emerging markets. The hearing aids sector in Slovenia is characterized by a relatively small number of players, which can hinder significant consolidation efforts typically seen in more mature markets. However, there is potential for growth as hearing health awareness increases and the aging population expands.

Regulatory developments, particularly the implementation of the Medical Device Regulation (MDR) and EU recognition procedures for professional qualifications, have significantly influenced the market. Enhanced safety standards and streamlined qualification recognition across EU/EEA countries have bolstered consumer confidence and facilitated a more dynamic and competitive retail environment. Moreover, the MDR’s emphasis on safety and performance has encouraged innovation among manufacturers, allowing retailers to offer advanced digital and telehealth-integrated hearing aids.

Type Insights

The receiver-in-the-ear hearing aids segment led the market with the largest revenue share of 75.45% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be attributed to the increasing consumer preference for discreet, high-performance, and technologically advanced devices. RITE models, RITE models are thinner and smaller than the classic hearing aids. For instance, the WIDEX Moment Sheer sRIC R D hearing aids are small and discreet devices suitable for mild to severe hearing loss.

The behind-the-ear hearing aids segment is expected to grow at the fastest CAGR over the forecast period. Continuous innovation in BTE hearing aids, such as improved sound quality, noise reduction features, Bluetooth connectivity, and rechargeable batteries, is driving segmental growth. Moreover, increasing product launches and approvals will drive the market growth. For instance, MicroTech offers behind-the-ear (BTE) hearing aids in Slovenia. These aids are designed for users with face masks, offering an on-demand boost for speech audibility and automatic optimization for social distancing and background noise.

Technology Insights

The digital segment led the market with the largest market revenue share of 94.69% in 2024. The digital segment is experiencing significant growth driven by technological advancements, increasing awareness of hearing health, and a rising prevalence of hearing impairments in the country. Digital hearing aids have evolved significantly, incorporating features such as noise reduction, directional microphones, and Bluetooth connectivity, which enhance sound quality and user experience compared to traditional analog models. Innovations in technology have also led to the development of AI-powered sound processing capabilities that allow for adaptive learning and personalized sound adjustments. Furthermore, the introduction of over-the-counter hearing aids has made these devices more accessible and affordable for many consumers, further driving demand in the market.

The analog segment is expected to grow at the fastest CAGR over the forecast period, driven by its cost-effectiveness and simplicity. Analog hearing aids are often priced more affordably than their digital counterparts, making them an appealing option for consumers who have basic hearing needs or are looking for budget-friendly solutions. Furthermore, analog hearing aids are known for their straightforward operation; they amplify sound uniformly without complex programming, making them user-friendly for those who may not be technologically savvy.

Key Companies & Market Share Insights

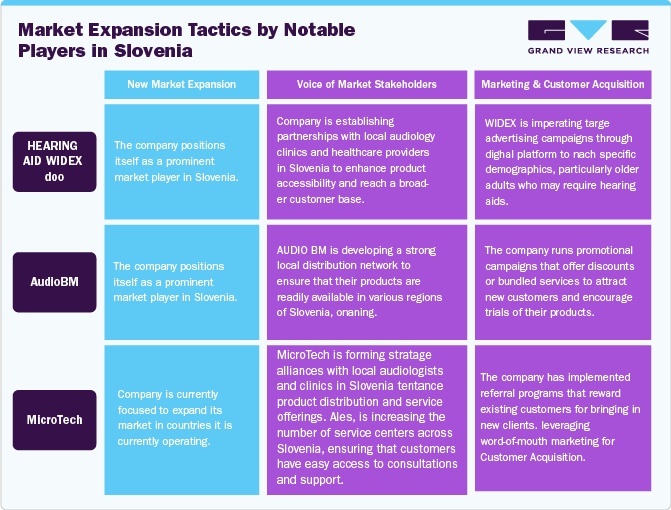

The market is highly consolidated, dominated by three major national chains: Neuroth, WIDEX doo, and AudioBM.The remaining market share is fragmented, consisting of independent audiologists and smaller retail groups. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions.

Neuroth

WIDEX doo

AudioBM

MicroTech

Audiomed

Otolinea doo

Bonus doo

Alpeton Hearing Aids

Clarus Optics

Slovenia Hearing Aid Retailers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.93 million

Revenue forecast in 2030

USD 22.69 million

Growth rate

CAGR of 7.32% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2023

Forecast data

2025 – 2030

Quantitative units

Revenue in USD million/billion, Volume in Units, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology

Country scope

Slovenia

Key companies profiled

Neuroth; WIDEX doo; AudioBM; MicroTech; Audiomed; Otolinea doo; Bonus doo; Alpeton Hearing Aids; Clarus Optics

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Slovenia Hearing Aid Retailers Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Slovenia hearing aid retailers market report based on type, and technology:

Type Outlook (Revenue, USD Million, 2018 – 2030)

Technology Size Outlook (Revenue, USD Million, 2018 – 2030)