Apr 30, 2025

IndexBox has just published a new report: China – Petroleum Bitumen – Market Analysis, Forecast, Size, Trends And Insights.

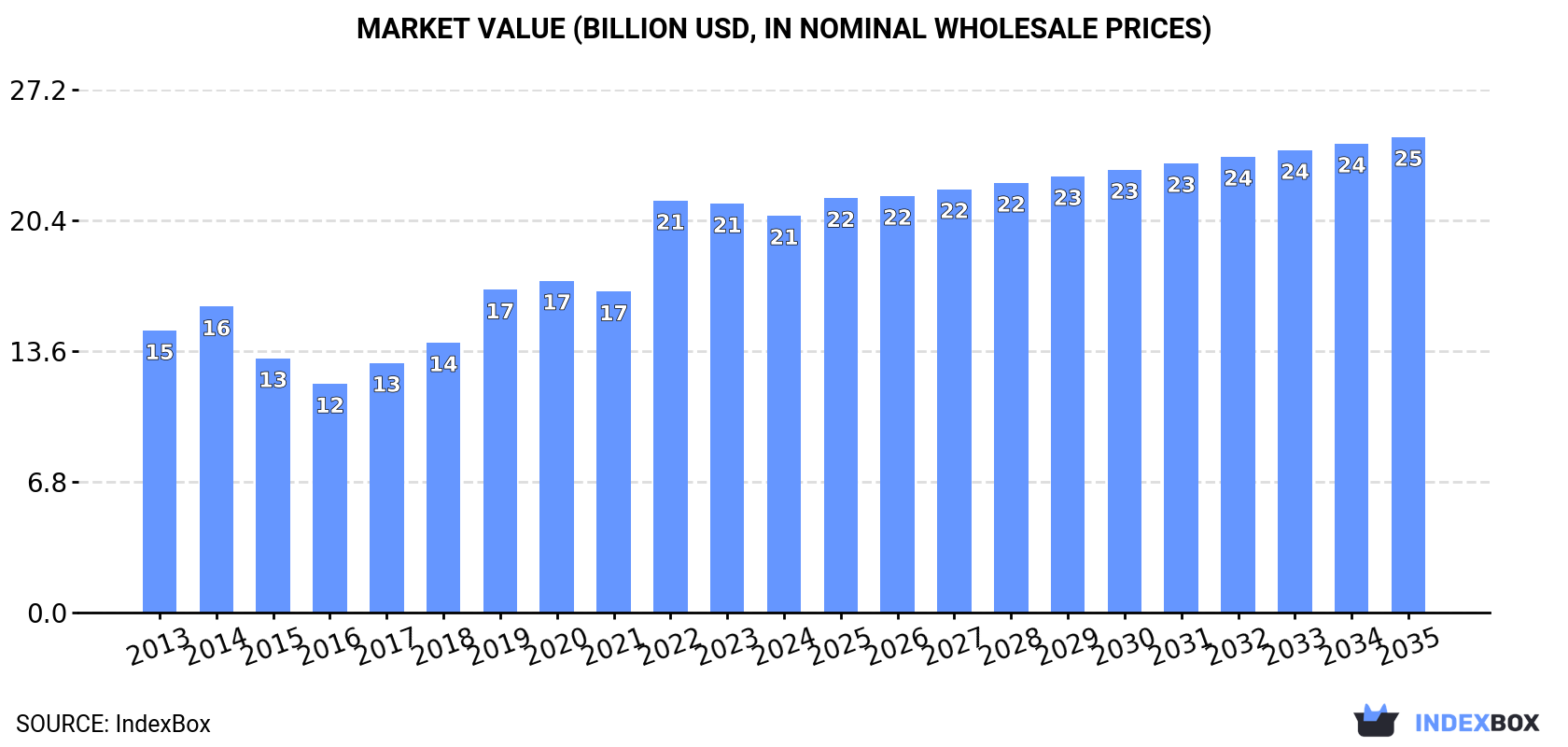

The article discusses the projected upward consumption trend of petroleum bitumen in China, with the market volume expected to reach 34M tons and value to hit $24.7B by the end of 2035. Despite a decelerating growth rate, the market is anticipated to steadily expand over the forecast period.

Market Forecast

Driven by increasing demand for petroleum bitumen in China, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +0.1% for the period from 2024 to 2035, which is projected to bring the market volume to 34M tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +1.7% for the period from 2024 to 2035, which is projected to bring the market value to $24.7B (in nominal wholesale prices) by the end of 2035.

ConsumptionChina’s Consumption of Petroleum Bitumen

ConsumptionChina’s Consumption of Petroleum Bitumen

In 2024, approx. 34M tons of petroleum bitumen were consumed in China; surging by 2.3% on the previous year. In general, the total consumption indicated moderate growth from 2013 to 2024: its volume increased at an average annual rate of +4.3% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, consumption increased by +3.3% against 2021 indices. Over the period under review, consumption reached the maximum volume at 37M tons in 2020; however, from 2021 to 2024, consumption remained at a lower figure.

The value of the petroleum bitumen market in China contracted slightly to $20.7B in 2024, dropping by -2.9% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Overall, the total consumption indicated a noticeable increase from 2013 to 2024: its value increased at an average annual rate of +3.2% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, consumption decreased by -3.7% against 2022 indices. As a result, consumption attained the peak level of $21.4B. From 2023 to 2024, the growth of the market remained at a lower figure.

ProductionChina’s Production of Petroleum Bitumen

In 2024, production of petroleum bitumen in China totaled 31M tons, flattening at 2023 figures. Overall, the total production indicated strong growth from 2013 to 2024: its volume increased at an average annual rate of +5.0% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, production decreased by -7.6% against 2020 indices. The pace of growth was the most pronounced in 2017 when the production volume increased by 19% against the previous year. Petroleum bitumen production peaked at 33M tons in 2020; however, from 2021 to 2024, production failed to regain momentum.

In value terms, petroleum bitumen production fell to $19.2B in 2024 estimated in export price. In general, production showed a noticeable expansion. The most prominent rate of growth was recorded in 2022 when the production volume increased by 38% against the previous year. As a result, production reached the peak level of $20.5B. From 2023 to 2024, production growth failed to regain momentum.

ImportsChina’s Imports of Petroleum Bitumen

In 2024, supplies from abroad of petroleum bitumen increased by 14% to 3.4M tons, rising for the second year in a row after two years of decline. Overall, imports continue to indicate a relatively flat trend pattern. The most prominent rate of growth was recorded in 2017 with an increase of 26% against the previous year. As a result, imports reached the peak of 5M tons. From 2018 to 2024, the growth of imports remained at a somewhat lower figure.

In value terms, petroleum bitumen imports reduced modestly to $1.4B in 2024. Over the period under review, imports, however, saw a noticeable reduction. The most prominent rate of growth was recorded in 2017 when imports increased by 48%. Imports peaked at $2.3B in 2014; however, from 2015 to 2024, imports failed to regain momentum.

Imports By Country

The United Arab Emirates (1.2M tons), South Korea (879K tons) and Singapore (710K tons) were the main suppliers of petroleum bitumen imports to China, with a combined 81% share of total imports. Oman, Thailand, Iraq, Russia and Malaysia lagged somewhat behind, together accounting for a further 15%.

From 2013 to 2024, the biggest increases were recorded for Oman (with a CAGR of +301.1%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, the United Arab Emirates ($405M), South Korea ($398M) and Singapore ($338M) were the largest petroleum bitumen suppliers to China, with a combined 81% share of total imports. Oman, Thailand, Iraq, Russia and Malaysia lagged somewhat behind, together accounting for a further 16%.

In terms of the main suppliers, Oman, with a CAGR of +347.0%, saw the highest growth rate of the value of imports, over the period under review, while purchases for the other leaders experienced more modest paces of growth.

Import Prices By Country

In 2024, the average petroleum bitumen import price amounted to $409 per ton, with a decrease of -13% against the previous year. Over the period under review, the import price continues to indicate a perceptible curtailment. The most prominent rate of growth was recorded in 2022 when the average import price increased by 30% against the previous year. The import price peaked at $622 per ton in 2013; however, from 2014 to 2024, import prices remained at a lower figure.

Average prices varied somewhat amongst the major supplying countries. In 2024, amid the top importers, the countries with the highest prices were Thailand ($483 per ton) and Singapore ($475 per ton), while the price for the United Arab Emirates ($336 per ton) and Iraq ($346 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Oman (+11.4%), while the prices for the other major suppliers experienced mixed trend patterns.

ExportsChina’s Exports of Petroleum Bitumen

After two years of growth, shipments abroad of petroleum bitumen decreased by -17.5% to 473K tons in 2024. Overall, exports, however, posted a buoyant expansion. The growth pace was the most rapid in 2018 with an increase of 101% against the previous year. As a result, the exports reached the peak of 775K tons. From 2019 to 2024, the growth of the exports failed to regain momentum.

In value terms, petroleum bitumen exports declined sharply to $308M in 2024. Over the period under review, exports, however, enjoyed a prominent expansion. The most prominent rate of growth was recorded in 2018 when exports increased by 139% against the previous year. The exports peaked at $409M in 2023, and then declined sharply in the following year.

Exports By Country

Malaysia (125K tons), Vietnam (104K tons) and Australia (80K tons) were the main destinations of petroleum bitumen exports from China, with a combined 65% share of total exports.

From 2013 to 2024, the most notable rate of growth in terms of shipments, amongst the main countries of destination, was attained by Malaysia (with a CAGR of +155.1%), while the other leaders experienced more modest paces of growth.

In value terms, Malaysia ($92M), Australia ($65M) and Vietnam ($53M) appeared to be the largest markets for petroleum bitumen exported from China worldwide, together comprising 68% of total exports.

Malaysia, with a CAGR of +152.2%, saw the highest rates of growth with regard to the value of exports, in terms of the main countries of destination over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Export Prices By Country

In 2024, the average petroleum bitumen export price amounted to $652 per ton, dropping by -8.6% against the previous year. In general, the export price showed a mild shrinkage. The pace of growth was the most pronounced in 2022 when the average export price increased by 52%. Over the period under review, the average export prices attained the maximum at $803 per ton in 2013; however, from 2014 to 2024, the export prices remained at a lower figure.

There were significant differences in the average prices for the major foreign markets. In 2024, amid the top suppliers, the country with the highest price was Japan ($4,133 per ton), while the average price for exports to Thailand ($457 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for supplies to Japan (+19.7%), while the prices for the other major destinations experienced more modest paces of growth.