Crude oil prices declined by around 1.5 percent on Friday, erasing nearly all the gains registered the previous day, as market participants remained cautious about taking positions ahead of the scheduled Saturday (May 3) meeting of the Organization of the Petroleum Exporting Countries (OPEC+) and its allies. The meeting will also include non-OPEC ministers to finalize decisions on oil production for June. Notably, crude oil prices recorded their largest weekly decline in a month.

Data compiled by Polymerupdate Research showed that benchmark Brent crude futures for near-month delivery on the Intercontinental Exchange (ICE) fell by 1.4 percent, or US$ 0.84 a barrel, to US$ 61.29 a barrel on Friday, down from US$ 62.13 a barrel the previous day. Friday’s decline nearly offset the gains made on Thursday. It is noteworthy that the Brent crude contract posted an 8 percent loss over the week—the most significant weekly drop in a month.

Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) declined by 1.6 percent, or $0.95 per barrel, to US$ 58.29 a barrel on Friday, compared to US$ 59.24 a barrel at the previous close. The decline in WTI futures wiped out the gains from the previous trading session, marking a 7.7 percent weekly drop—the steepest since March.

An analyst from Anand Rathi Investment Services stated, “Oil prices fell as persistent U.S.-China trade tensions weighed heavily on demand sentiment. Market sentiment remained fragile due to conflicting signals regarding the status of trade negotiations, raising fears of weaker global economic growth and reduced oil demand. Meanwhile, expectations of a potential acceleration in OPEC+ production hikes at the upcoming meeting further pressured prices, with growing concerns about the group’s production discipline. Geopolitical risks, including ongoing U.S.-Iran nuclear talks, continued to simmer, although trade concerns overshadowed these developments in influencing the oil market.”

Wait and watch

Wait and watch

Market participants adopted a wait-and-watch approach ahead of the scheduled OPEC+ and non-OPEC+ ministers’ meeting on Saturday. Broad expectations suggest that the crude oil producers’ coalition will increase output in June, following similar moves in April and May. A clear division has emerged among coalition members, with some advocating for maintaining production cuts while others, like Kazakhstan, are firm on raising output. Notably, OPEC+ ministers aim to keep crude oil prices elevated.

The OPEC+ coalition continues to face challenges in maintaining output discipline, as some members have voluntarily committed to raising production. Kazakhstan’s new oil minister recently stated that the country would prioritize its national interests over those of OPEC+, signaling a broader willingness among certain members to push for production hikes.

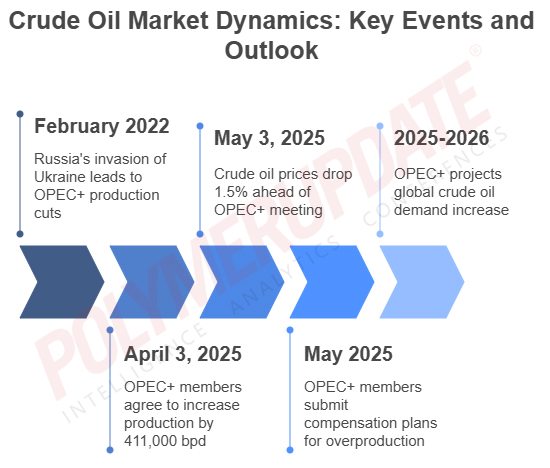

This stance conflicts with the coalition’s commitment to production discipline. On April 3, eight OPEC+ members—Algeria, Iraq, Kazakhstan, Kuwait, Oman, Russia, Saudi Arabia, and the United Arab Emirates—agreed to proceed with their earlier plan to phase out output cuts by increasing production by 411,000 barrels per day (bpd) in May. Initially, the coalition had planned to begin restoring output with a smaller increase of 138,000 bpd starting in May. This agreement has amplified bearish sentiment in the market, which was already weighed down by U.S. President Donald Trump’s announcement of sweeping tariffs.

After two consecutive months of production increases in April and May, the OPEC+ coalition members are now set to assess the fuel oil supply situation and make a final decision on the group’s output discipline. Saudi Arabia, a leading member of the OPEC+ coalition, has initiated bilateral and multilateral discussions with its allies to persuade them to maintain production discipline. Reports indicate that Saudi Arabia has informed coalition members of its unwillingness to further support the oil market with additional supply cuts, stating that the Kingdom is prepared to endure a prolonged period of low prices.

Rising US inventories

On Wednesday, the United States Energy Information Administration (EIA) reported a larger-than-expected decline in crude oil inventories. According to the EIA, crude oil inventories fell by 2.7 million barrels for the week ended April 25, 2025, following a modest increase of 0.2 million barrels during the previous week. Analysts had expected crude oil inventories to decrease by 0.6 million barrels.

Currently at 440.4 million barrels, U.S. crude oil inventories are 6 percent below the five-year average for this time of year. The report also revealed that gasoline inventories declined by 4 million barrels last week and are approximately 4 percent below the five-year average for the same period last year. Meanwhile, distillate fuel inventories, which include heating oil and diesel, increased by 0.9 million barrels last week but remain about 13 percent below the five-year average for this time of year.

Overproduction

OPEC+ members have pledged to offset ongoing production cuts by addressing overproduction beyond their quotas by 2026. The coalition has been gradually reducing oil production by 4.57 million barrels per day (bpd) for over two years, following Russia’s invasion of Ukraine in February 2022. The OPEC+ cartel confirmed that members—including Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman—have submitted individual compensation plans to the coalition’s office.

Since the first OPEC+ agreement in 2016, the coalition and its non-OPEC allies have faced challenges with overproduction by several members, undermining the effectiveness of production cuts and creating uncertainty about the actual OPEC+ supply to the market. The latest compensation plans propose the most significant monthly compensations to occur between May and October 2025, with smaller compensations expected in the subsequent year.

Demand under pressure

In its latest monthly publication, the Oil Market Report (OMR), OPEC+ projected global crude oil demand to increase by 1.30 million barrels per day (bpd) to 105.05 million bpd in 2025 and by 1.28 million bpd in 2026. Both projections reflect a reduction of 150,000 bpd compared to last month’s estimates. OPEC+’s closely watched OMR also revised its global economic growth forecasts, now estimating a growth rate of 3 percent for 2025, down from the earlier projection of 3.1 percent.

Similarly, the growth forecast for 2026 has been lowered to 3.1 percent, compared to the previously projected 3.2 percent. Last month, OPEC+ noted that trade concerns could contribute to market volatility but chose to maintain its forecasts at the time, pending further clarity on the global economic outlook.

Meanwhile, the Paris-based International Energy Agency (IEA) has issued a warning that global crude oil demand in 2025 is expected to grow at its slowest pace in five years, with a projected increase of just 730,000 bpd. This represents a reduction of 300,000 bpd compared to earlier forecasts, as escalating trade tensions continue to weigh on the global economy. Notably, the IEA had forecast last month that crude oil demand in 2025 would rise by 1.03 million bpd.

Outlook

Crude oil prices are likely to remain under pressure in the medium term due to weak demand and oversupply forecasts. The sluggish sentiment stems from concerns about global economic growth amid the ongoing tariff war, particularly between the United States and China, the world’s largest and second-largest economies.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com