Russian oil flows to India touched a 9-month high in April primarily due to the abundant availability of Moscow’s crude for exports as well as the low oil prices, with the latter ensuring sufficient number non-sanctioned tankers to haul the oil to Indian ports without falling foul of international curbs.

April also saw India’s oil imports from the United States rise to an eight-month high, evidently on account of strategic trade considerations amid the evolving geopolitical and geoeconomic scenario.

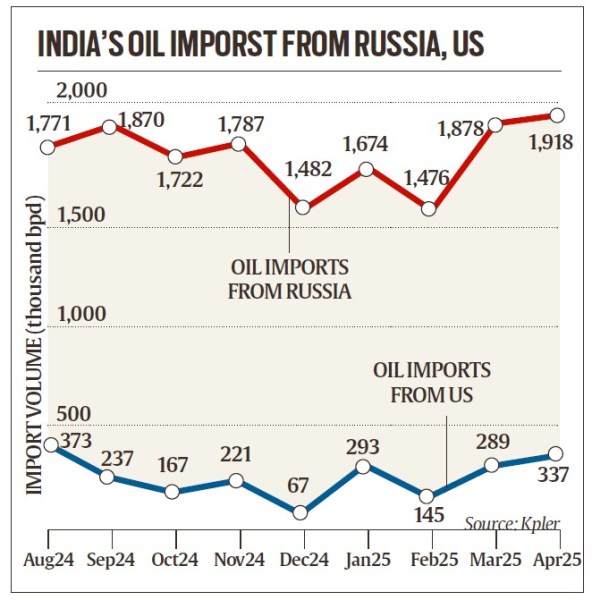

India’s Russian oil imports in April rose 2.1 per cent over March to 1.92 million barrels per day (bpd), even as overall oil imports contracted 7.3 per cent sequentially to 4.88 million bpd, per provisional tanker data from commodity market analytics firm Kpler. The share of Russian crude in India’s oil import basket rose to 39.3 per cent in April from 35.7 per cent in March.

“Russia’s strong showing was underpinned by a confluence of economic, operational, and geopolitical factors. The pricing advantage of (Russia’s flagship crude grade) Urals—trading at a discount to West African and Middle Eastern barrels—was a key driver, supporting improved refinery gross margins. Sanctions enforcement remains porous, allowing Indian refiners to secure stable supplies (of Russian oil).

Additionally, drone attacks on Russian refineries in Q1 (January-March) disrupted domestic processing, temporarily boosting (Russia’s) crude exports,” said Sumit Ritolia, lead research analyst, refining & modeling at Kpler.

Urals crude, the mainstay of New Delhi’s oil imports from Moscow, continues to trade at a discount to rival grades from India’s traditional suppliers in West Asia. While discounts have shrunk considerably over time, they remain lucrative for India’s refiners as the country depends on imports to meet over 85 per cent of its crude oil needs.

With Urals trading below the Western price cap of $60 per barrel, tanker and insurance availability has not been a concern as the price cap mechanism enforced by G7 countries allows Western shippers and insurers to participate in Russian oil trade if the oil is priced below the cap.

Story continues below this ad

Industry insiders expect Indian refiners and Russian oil suppliers and traders to continue adjusting to the latest sanctions and devise ways to buy Russian oil without any sanctions risk in the near to medium term. Indian refiners have publicly stated that they are ready and willing to buy Russian oil if the transactions, suppliers, traders, shippers, and insurers involved are not under sanctions.

According to Kpler’s estimates, Russian crude’s share in India’s oil import mix is expected to remain elevated in the 30–35 per cent range over the coming months, barring a sharp recovery in Russia’s domestic refinery throughput, which may begin tightening Moscow’s exports modestly beyond May. The data points to a modest rebound in Russian refining throughput by 100,000–300,000 bpd over the next few months, which could reduce exports by a similar margin. Oil imports from Iraq—India’s second-biggest source of crude—fell 5.7 per cent month-on-month to 838,000 bpd, while those from third-largest supplier Saudi Arabia slipped 4.6 per cent sequentially to 539,000 bpd.

Iraq’s share in India’s April oil imports was 17.2 per cent, while that of Saudi Arabia was 11.1 per cent.

Rising imports from US

India’s oil imports from the US rose 16.5 per cent sequentially in April to 337,000 bpd, the highest since August of last year. The US retained its spot as India’s fifth-largest supplier of crude oil, with a market share of nearly 7 per cent in April.

Story continues below this ad

According to industry insiders, the recent rise in India’s oil imports from the US are indicative of New Delhi looking to mitigate trade imbalances with Washington amid the Donald Trump administration’s tariff actions against much of the world. Trump wants to increase American oil and gas exports, and India — a top oil and gas importer globally — is a lucrative market.

“By boosting imports of US crude oil and natural gas, India endeavours to foster a more balanced trade relationship and avert further tariff escalations… State-run refiners, including Indian Oil Corporation and Bharat Petroleum, have been at the forefront of this increase, accounting for over 70 per cent of the imports. This shift underscores a strategic pivot towards US energy sources, aligning with broader trade objectives,” Ritolia said.

Industry watchers indicate that American crude offers a viable option for Indian refiners, providing high-quality, light-sweet grades that are well suited for Indian refineries. Apart from sending positive signals to Washington amid trade tensions, increased oil imports from the US also help India reduce its reliance on its traditional suppliers in West Asia.