(Bloomberg) — Another report showing the US economy entered the trade war on solid footing pushed stocks away from session lows, while bond yields rose amid speculation the Federal Reserve will stay on hold this week.

Most Read from Bloomberg

A rebound in industrial shares helped the S&P 500 erase most of a slide that earlier approached 1%. Data showing a pick-up in growth at US service providers helped assuage concerns of a recession even as the outcome of President Donald Trump’s trade war has yet to be felt. In fact, the same report showed a jump in materials prices – signaling potential inflation pressures.

Attention will soon shift to Wednesday’s Fed decision after bond traders dialed back rate-cut bets that had steadily mounted as Trump’s trade war unleashed havoc in financial markets.

Subscribe to the Stock Movers Podcast on Apple, Spotify and other Podcast Platforms.

As long as the economy holds firm, the central bank can more easily justify the standing pat. While Jerome Powell and his colleagues would typically welcome the latest inflation cooling, higher US duties on imports risk upending the progress on that front.

“Uncertainty rules amid a trade war and the ever-changing landscape of tariffs, but with the hard data on consumer spending and employment still hanging in there, the Fed will remain firmly planted on the sidelines,” said Greg McBride at Bankrate.

The S&P 500 fell 0.3%. The Nasdaq 100 slid 0.4%. The Dow Jones Industrial Average added 0.1%. The yield on 10-year Treasuries rose five basis points to 4.36%. The Bloomberg Dollar Spot Index fell 0.2%.

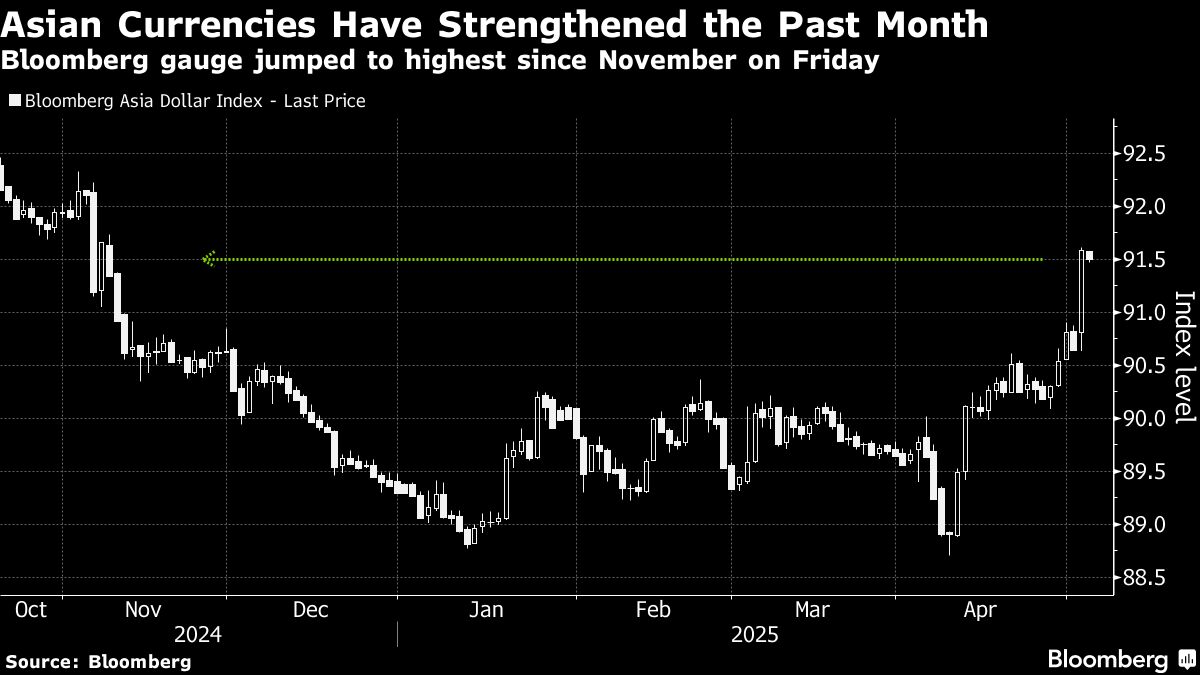

Oil sank as OPEC+ agreed to a bumper output increase. Taiwan’s dollar surged the most since 1988 on bets authorities might allow it to appreciate to help reach a trade deal with the US.

Treasury Secretary Scott Bessent touted the US as the “premier destination” for global capital and argued that the Trump administration’s policies will solidify that position — countering the so-called sell America theme that materialized last month.

Concerns about the international appeal of dollar-based assets materialized last month during a selloff in US stocks in the wake of Trump’s announcement of steep reciprocal tariffs on major trading partners. Contrary to typical practice, US Treasuries also tumbled — failing to play the haven asset role it has in the past.

Story Continues