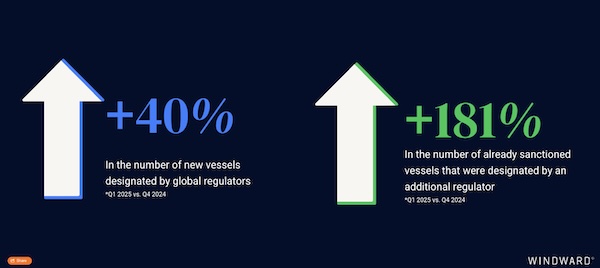

Q1 2025 featured the highest number of sanctioned vessels since 2022 and the largest number of both new and alignment designations of maritime companies by global regulators since early 2023.

We saw changing tariffs and the beginning of a global trade war, and the EU unveiled its 16th sanctions package on Russia, targeting ports, financial institutions, and vessels tied to circumvention. There was also a major change in how vessels experiencing GPS jamming started appearing on tracking maps and three new GPS jamming hotspots emerged.

This report delves into the volatile landscape of geopolitical tensions and sanctions regimes, offering Maritime AI-generated insights so you can better understand and quantify the scope of disruption and new trends.

Vessel & Company Sanctions

Q1 2025 showed the highest number of sanctioned vessels since 2022 – both new vessels that were not previously designated and vessels that were already sanctioned by one regulator and have now been designated by additional ones

88% of newly sanctioned vessels are tankers, clearly indicating the focus of regulators worldwide

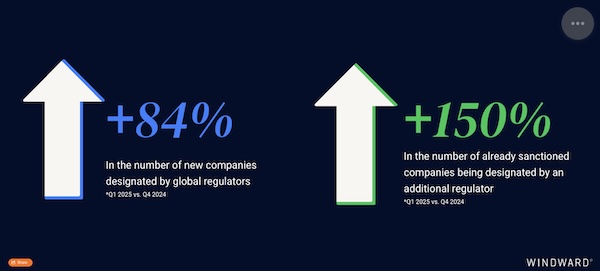

Q1 2025 marks the highest number of both new designations and alignment designations of maritime companies by global regulators, since the peak in company designations by regulators in early 2023

70% of newly sanctioned companies are located in five countries:

Hong Kong

Seychelles

China

Russia

Marshall Islands

GPS Jamming

The average distance vessels “jump” to when their AIS is jammed grew from 600 km in Q4 2024, to a staggering 6,300 km in Q1 2025

This distance completely disrupts trade and safety measures at sea, making it nearly impossible to track vessels within any realistic or relevant geographical vicinity

Three new jamming hubs were detected by Windward’s dedicated GPS jamming team and models in Q1 2025:

Sudan in the Red Sea – from 0 affected vessels in Q4 2024, to more than 180 affected vessels in Q1 2025

Djibouti in the Gulf of Aden – from 0 affected vessels in Q4 2024, to more than 30 affected vessels in Q1 2025

From the Black Sea to the Gulf of Guinea – from 0 affected vessels in Q4 2024, to more than 120 affected vessels in Q1 2025

GPS Jamming Patterns

The main GPS jamming patterns we saw in Q4 were dense areas and smaller circles

These evolved in Q1 2025 to larger and more defined areas and straight lines

Dark/Gray Fleets

The Comoros flag seems to be on the rise again in Q1 2025, with a 16% increase in flag changes to Comoros since Q4 2024

A similar increase was last seen in Q1 of 2024, also following sanctions released for the Russia/Ukraine 2-year mark

Tariffs’ Effect on Trade Lanes

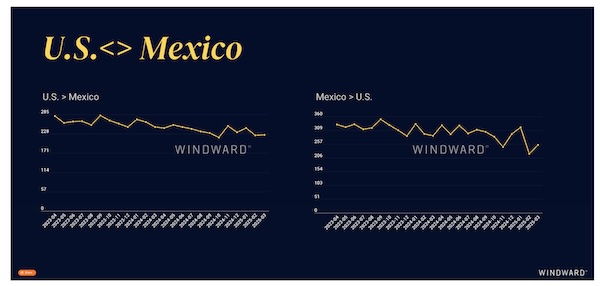

Tanker-driven trade showed steady declines from late 2023, followed by a sharp disruption in March 2025 — likely tied to energy-related policy shifts

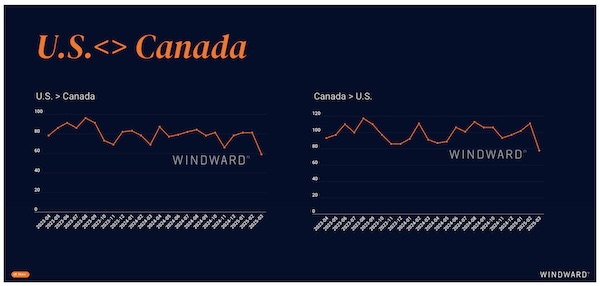

A stable pattern through 2024 gave way to a sudden drop in March 2025, driven almost entirely by reduced tanker activity — potentially linked to oil tariffs

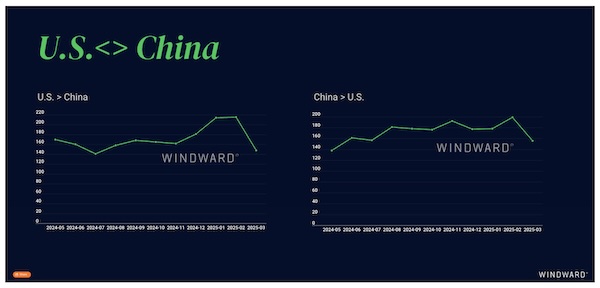

After a buildup in late 2024 and early 2025 — likely front-loading ahead of expected tariffs — both container and bulk flows dropped sharply in March 2025

General Learnings

March 2025 marks a clear disruption across all major U.S. trade lanes, with significant declines in port calls – particularly tanker- and container-heavy routes – signaling the material impact of evolving tariff enforcement

Tanker flows are the leading indicator for North American trade (U.S.–Mexico, U.S.–Canada); changes in oil-related policies or tariffs have a direct and disproportionate effect on total trade volume

In U.S.–China trade, the data reflects preemptive shipping behavior (front-loading), especially for containers and bulk goods – highlighting how businesses adjust operational timing in anticipation of policy changes

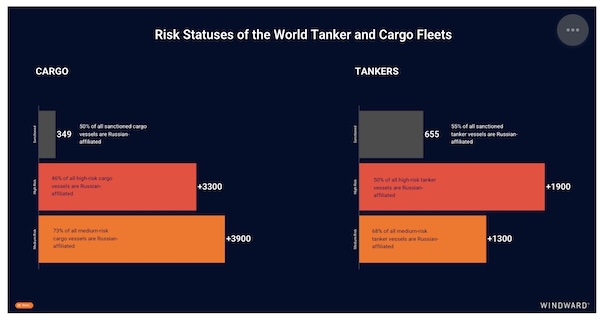

Risk Status & Cleared Risk

Out of all sanctioned vessels during 2024, Windward flagged 99% as risky PRIOR to their official designation

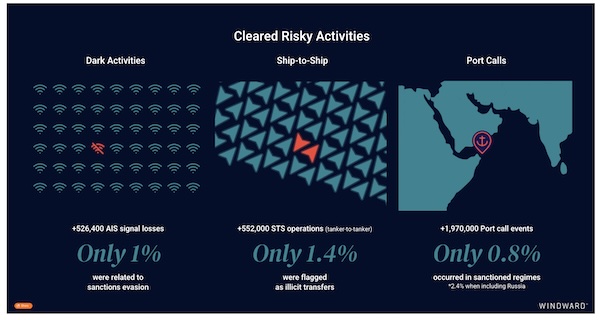

Cleared Risk

92% of vessels engaged in sanctions-related dark activities are associated with either Iran or Russia

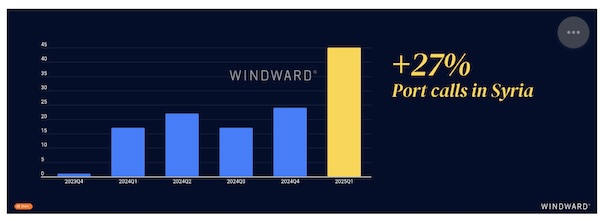

Q1 2025 showed an increase of 27% in port calls in Syria compared to Q4 2024. This may be related to the leadership change in the country, as well as the commercial lease change of the port – it was previously Russian-leased

There was an 87% increase in the number of unique vessels engaged in these port calls

Q1 2025 marked an increase in the number of vessels not affiliated with the Russia regime that have visited Syria – the highest number of not-affiliated vessels in Syria in the past few years

How to Keep Your Head Above Water During a Turbulent Period

As maritime risks evolve, organizations must move beyond traditional monitoring and adopt AI-driven, proactive risk management. Sanctions, deceptive shipping practices, and geopolitical shifts demand more than reactive responses – they require intelligence that uncovers hidden threats before they escalate. Without the right tools, businesses risk false positives, financial losses, regulatory penalties, and operational disruption.

In an era of increasing complexity, those who embrace AI-driven decision-making can stay ahead of evolving risks and navigate global trade with confidence.

Source: Windward