Key Insights:

Occidental Petroleum (OXY, Financial) is expected to report a significant EPS increase of 20.6% year-over-year. Analysts project a revenue growth of 15.6%, reaching $6.91 billion. The stock is considered undervalued with a potential upside, despite recent pressures.Occidental Petroleum’s Earnings Expectations

As Occidental Petroleum (OXY) gears up to announce its first-quarter earnings on May 7th, analysts are optimistic. The projected earnings per share (EPS) stand at $0.76, reflecting a notable 20.6% increase compared to the same period last year. Alongside this, revenue is anticipated to rise by 15.6%, reaching an impressive $6.91 billion. Despite recent challenges, such as potential clean energy funding cuts, Occidental’s stock appears undervalued with promising upside potential. This optimism is backed by the company’s historical performance, having exceeded EPS forecasts 75% of the time over the past two years.

Wall Street Analysts Forecast

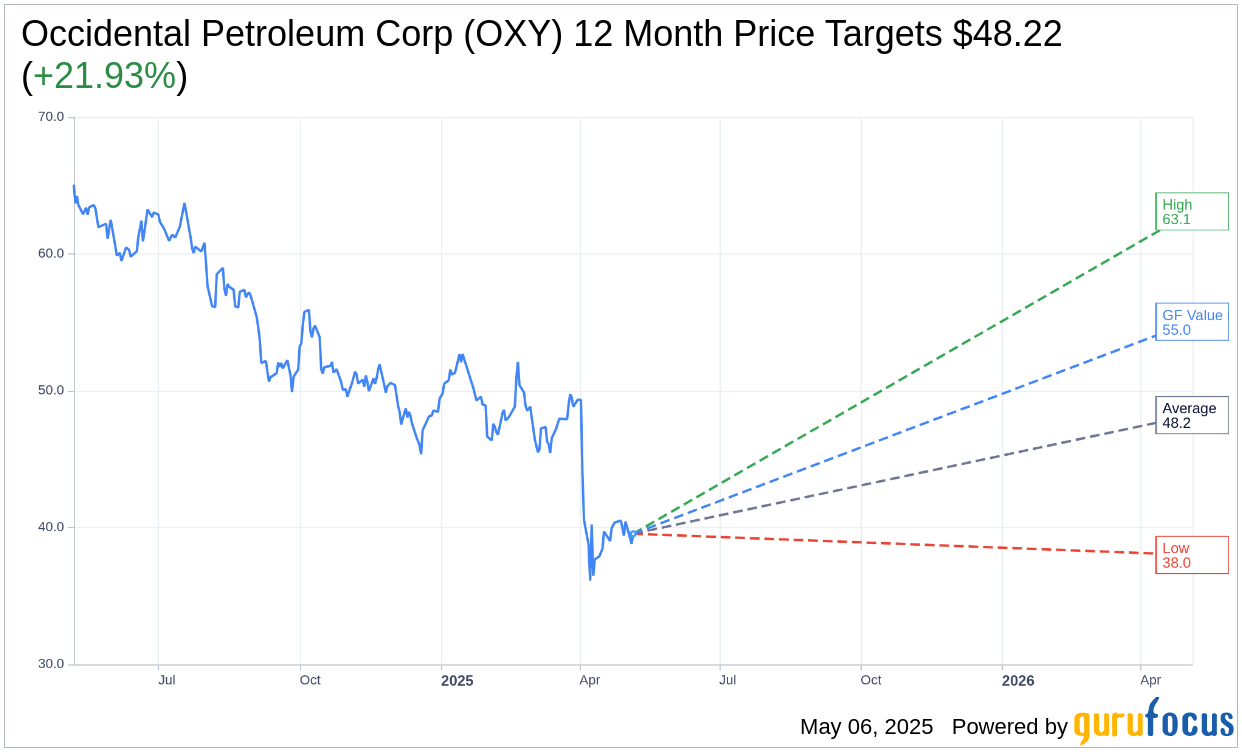

Wall Street analysts have shared their one-year price targets for Occidental Petroleum Corp (OXY, Financial), with the consensus target price averaging at $48.22. This represents a potential upside of 21.93% from the current share price of $39.55. The price targets range broadly, with a high of $63.11 and a low of $38.00, illustrating varied perspectives on the company’s future performance. For a comprehensive overview of these estimates, visit the Occidental Petroleum Corp (OXY) Forecast page.

Brokerage Recommendations

The consensus recommendation from 26 brokerage firms positions Occidental Petroleum Corp (OXY, Financial) with an average rating of 2.8, corresponding to a “Hold” status. In this rating system, 1 indicates a “Strong Buy” and 5 signifies a “Sell.” This neutral stance suggests a cautious optimism about the stock’s future trajectory, reflecting a balanced view between potential risks and opportunities.

GF Value and Stock Valuation

According to GuruFocus metrics, the estimated GF Value for Occidental Petroleum Corp (OXY, Financial) over the next year is $55.05. This indicates a substantial upside of 39.19% from the current trading price of $39.55. The GF Value represents GuruFocus’ assessment of the stock’s fair trading value, derived from historical trading multiples, past business growth, and future business performance estimates. Investors seeking more detailed analysis can explore the Occidental Petroleum Corp (OXY) Summary page on GuruFocus.