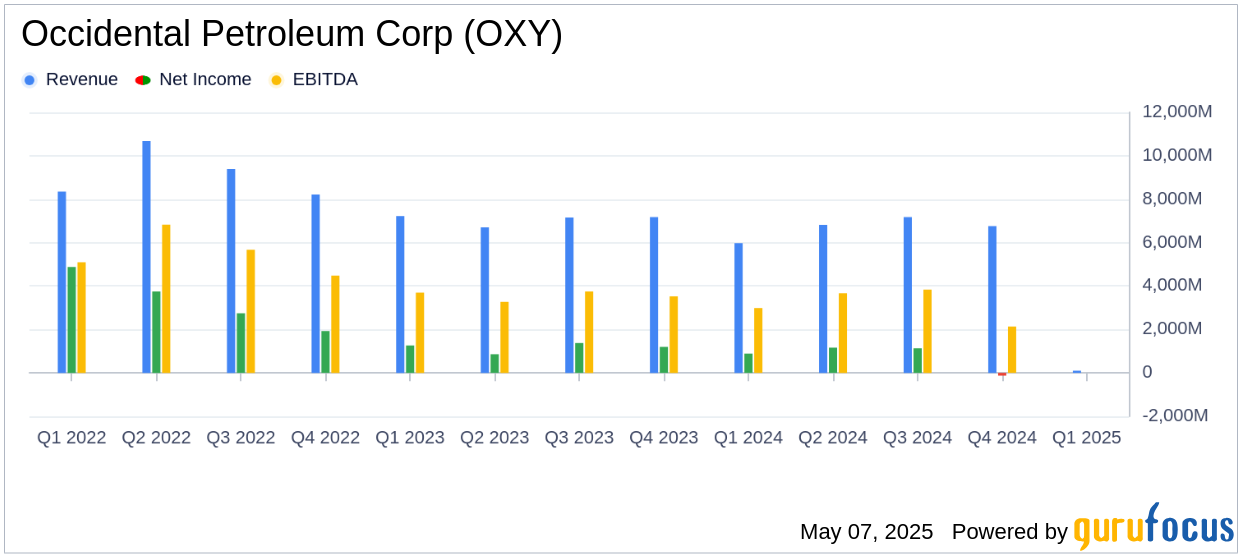

Occidental Petroleum Corp (OXY, Financial) released its 8-K filing on May 7, 2025, reporting a robust first quarter performance that exceeded analyst expectations. The company, an independent exploration and production entity with operations across the United States, Latin America, and the Middle East, reported net income attributable to common stockholders of $766 million, or $0.77 per diluted share, surpassing the estimated earnings per share (EPS) of $0.71. Adjusted earnings per diluted share stood at $0.87, further highlighting the company’s strong financial performance.

Company Overview and Operational Highlights

Occidental Petroleum Corp (OXY, Financial) is a significant player in the oil and gas industry, with net proved reserves of nearly 4 billion barrels of oil equivalent as of the end of 2023. The company’s net production averaged 1,327 thousand barrels of oil equivalent per day in 2024, with a balanced production ratio of approximately 50% oil and natural gas liquids and 50% natural gas.

Performance and Challenges

The first quarter of 2025 saw Occidental achieving a total company production of 1,391 thousand barrels of oil equivalent per day (Mboed), aligning with the mid-point of its guidance. The company also closed asset sales worth $1.3 billion and repaid $2.3 billion in debt, showcasing its commitment to financial discipline and debt reduction. However, challenges such as lower sales volumes and fluctuating commodity prices remain potential hurdles for the company.

Financial Achievements and Industry Impact

Occidental’s strong operational performance resulted in an operating cash flow of $2.1 billion and a free cash flow before working capital of $1.2 billion. The company’s ability to generate substantial cash flow is crucial in the capital-intensive oil and gas industry, enabling it to fund operations, reduce debt, and invest in future growth.

Key Financial Metrics

In the first quarter, Occidental’s oil and gas pre-tax income was $1.7 billion, up from $1.2 billion in the previous quarter, driven by higher domestic realized commodity prices. The average worldwide realized crude oil price increased by 2% to $71.07 per barrel, while natural gas liquids prices rose by 19% to $25.94 per barrel. These metrics are vital as they directly impact the company’s revenue and profitability.

Metric Q1 2025 Q4 2024 Oil and Gas Pre-Tax Income $1.7 billion $1.2 billion Average Realized Crude Oil Price $71.07 per barrel – Average Realized Natural Gas Liquids Price $25.94 per barrel -Commentary and AnalysisIn the first quarter, our teams’ sustained focus on operational excellence unlocked additional efficiencies and supported the delivery of resilient free cash flow,” said President and Chief Executive Officer Vicki Hollub. “We continue to rapidly advance towards our debt reduction goals, and we believe our deep, diverse portfolio of high-quality assets positions us for success in any market environment.”

Occidental’s strategic focus on operational efficiency and debt reduction is evident in its financial results. The company’s ability to exceed earnings expectations and generate substantial free cash flow underscores its resilience and adaptability in a volatile market environment. As Occidental continues to optimize its operations and reduce costs, it is well-positioned to navigate industry challenges and capitalize on growth opportunities.

Explore the complete 8-K earnings release (here) from Occidental Petroleum Corp for further details.