(Bloomberg) — Donald Trump’s administration is set to shrink the ranks at the top US financial regulators by more than 2,300 workers, a group that includes bank examiners, criminal investigators and economists.

Most Read from Bloomberg

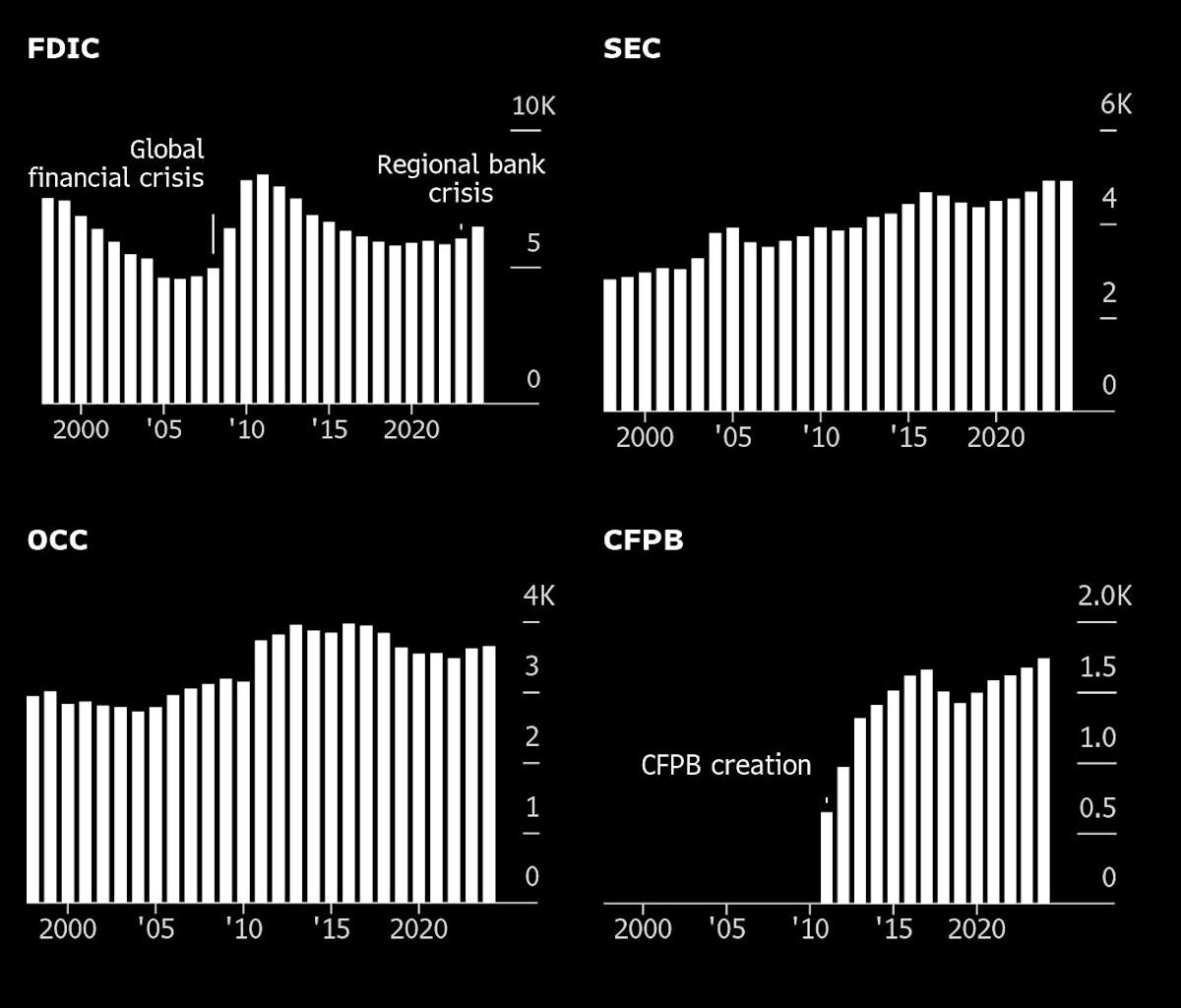

The cuts are the steepest in decades for the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency and the Securities and Exchange Commission, the primary agencies responsible for oversight of banks, trading houses and the public markets.

At the same time, the agencies are rapidly juggling their remaining staff and adjusting policies. The OCC has said it will combine supervision teams that were previously tailored to banks by size, and the SEC has reorganized its regional offices. The FDIC has yet to announce significant changes, but officials are rethinking its approach to bank supervision, according to people familiar with internal discussions.

Defenders of the downsizing, which includes buyouts, layoffs, early retirements and hiring freezes, see it as part of the administration’s stated goal of rolling back rules to boost growth and unleash lending. The agencies shrunk during Trump’s first term, too, by about 1,000 employees from 2016 to 2020 — half the level of reductions proposed since his second inauguration.

But to critics, fewer examiners and investigators are a harbinger of weaker oversight and an invitation to excessive risk-taking, particularly as Trump’s trade policies have caused extreme market swings, and calls of an impending recession have some banks bracing for higher credit losses.

Even in the best of times, “overburdened and under-experienced staff could be unable to recognize brewing risks to the financial system,” said Michele Alt, a former official at the Office of the Comptroller of the Currency and now a partner at the financial-services advisory firm Klaros Group.

The current administration instituted the government-wide job cuts as part of a broader campaign to save $1 trillion in federal spending. That rationale confounds critics, who note that the top banking and markets watchdogs don’t receive taxpayer funding: They pay for themselves — and sometimes turn a profit — through fees, licensing revenue and fines to firms they oversee.

Since 2015, the FDIC collected $74 billion more than it spent, most of which accrues to the agency’s bedrock insurance fund that protects depositors during bank failures. The OCC has run a $107 million surplus during the same period.

Story Continues