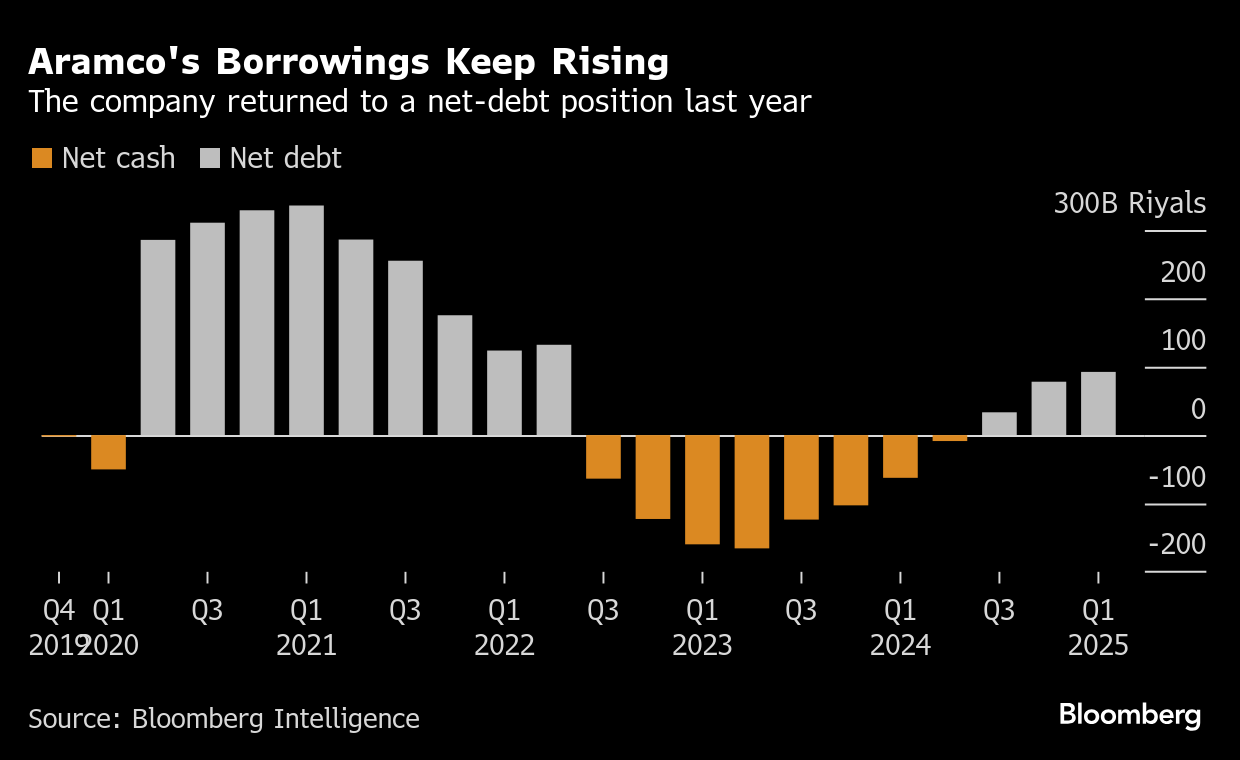

(Bloomberg) — Saudi Aramco’s net debt rose to the highest in almost three years, piling pressure on the finances of the world’s biggest oil exporter even as it cut its massive dividend.

Net debt climbed 18% to 92.4 billion riyals ($24.6 billion) in the first quarter from the end of last year, according to a statement Monday. The increase comes as the company again failed to fully cover the total payout with free cash flow. Still, its borrowing levels are below many other major oil firms, leaving it with significant headroom to take on more.

Dividends from the world’s biggest oil company are crucial for Saudi state finances and key to funding Crown Prince Mohammed bin Salman’s ambitious plan to transform the economy by developing industries like technology and tourism. With the budget forecast to be in deficit over the coming years, the kingdom is expected to increasingly lean of borrowing to fund the transformation.

Aramco’s gearing ratio — a measure of its indebtedness — rose to 5.3% at the end of March from 4.5% at the end of last year. That compares with an average of 14% for international oil companies last year, Aramco said.

Chief Financial Officer Ziad Al-Murshed said in November that the company plans to sell more debt after issuing $9 billion in dollar and Islamic bonds last year.

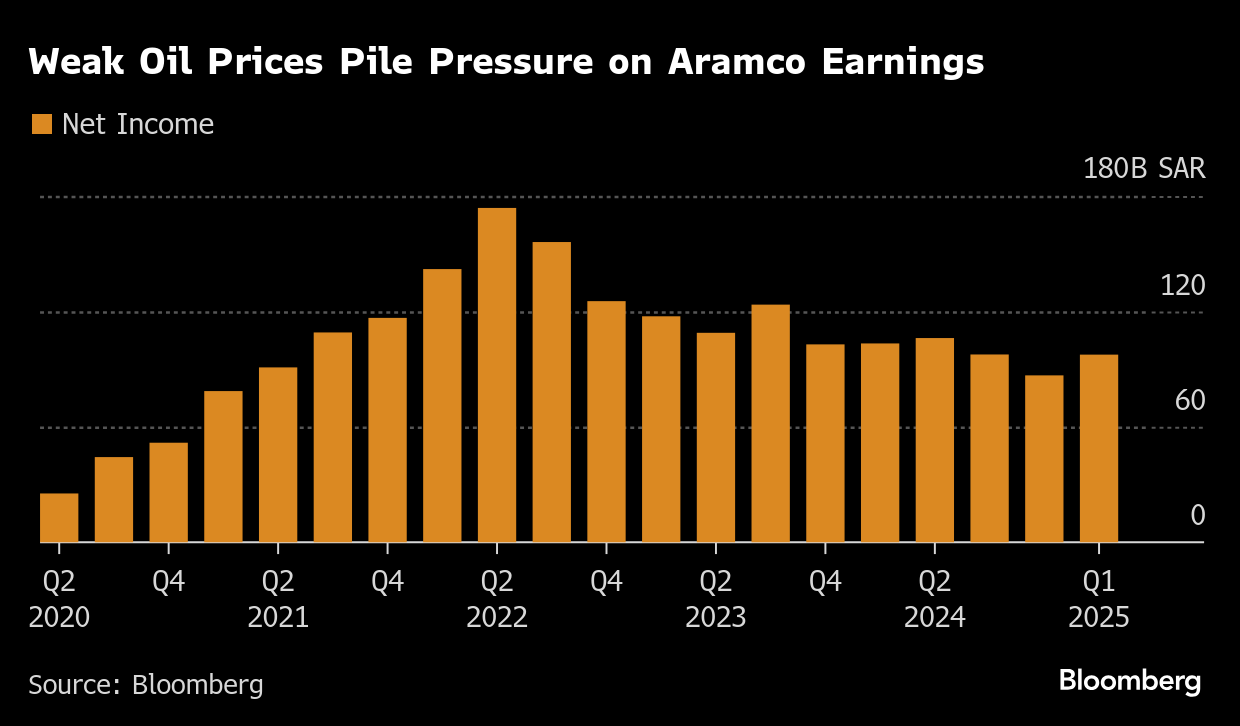

Oil’s decline since April is likely to inflict more pain both on Aramco and the government, whose debt levels jumped by the most on record in the first quarter. Over the past five weeks, Riyadh led the OPEC+ coalition through two bigger-than-scheduled supply hikes, which together with US President Donald Trump’s trade war, briefly crashed oil futures to a four-year low below $60 a barrel in London. Trump is visiting the Middle East this week, with his first stop in Saudi Arabia.

Brent crude is trading near $66 in London, significantly below the over $90 that the International Monetary Fund estimates the kingdom needs to balance its spending. Aramco sold crude at an average price of $76.30 a barrel in the first quarter, compared with $83 a year earlier, according to the statement.

On Sunday, Aramco reported a 4.6% decline in first-quarter net income and reduced its dividend by about a third to $21.36 billion. Free cash flow — the money left over from operations after accounting for investments and expenses — declined 16% to $19.2 billion compared with a year earlier.

The company said earlier this year that the total payout for 2025 would be about $85 billion, compared with around $124 billion the previous year. Aramco burned through cash to maintain the massive annual distribution, the world’s biggest at the time. In the process, it flipped the balance sheet into a net-debt position last year, from over $27 billion in net cash at the end of 2023.

Part of that total dividend was a performance-linked payout that distributed the benefits of its bumper profits from 2022. Aramco dramatically scaled back that component after completing the distribution of those earnings at the end of last year.

(Updates with borrowing headroom from the second paragraph.)

©2025 Bloomberg L.P.