May 17, 2025

IndexBox has just published a new report: EU – Braces, Suspenders And Garters – Market Analysis, Forecast, Size, Trends And Insights.

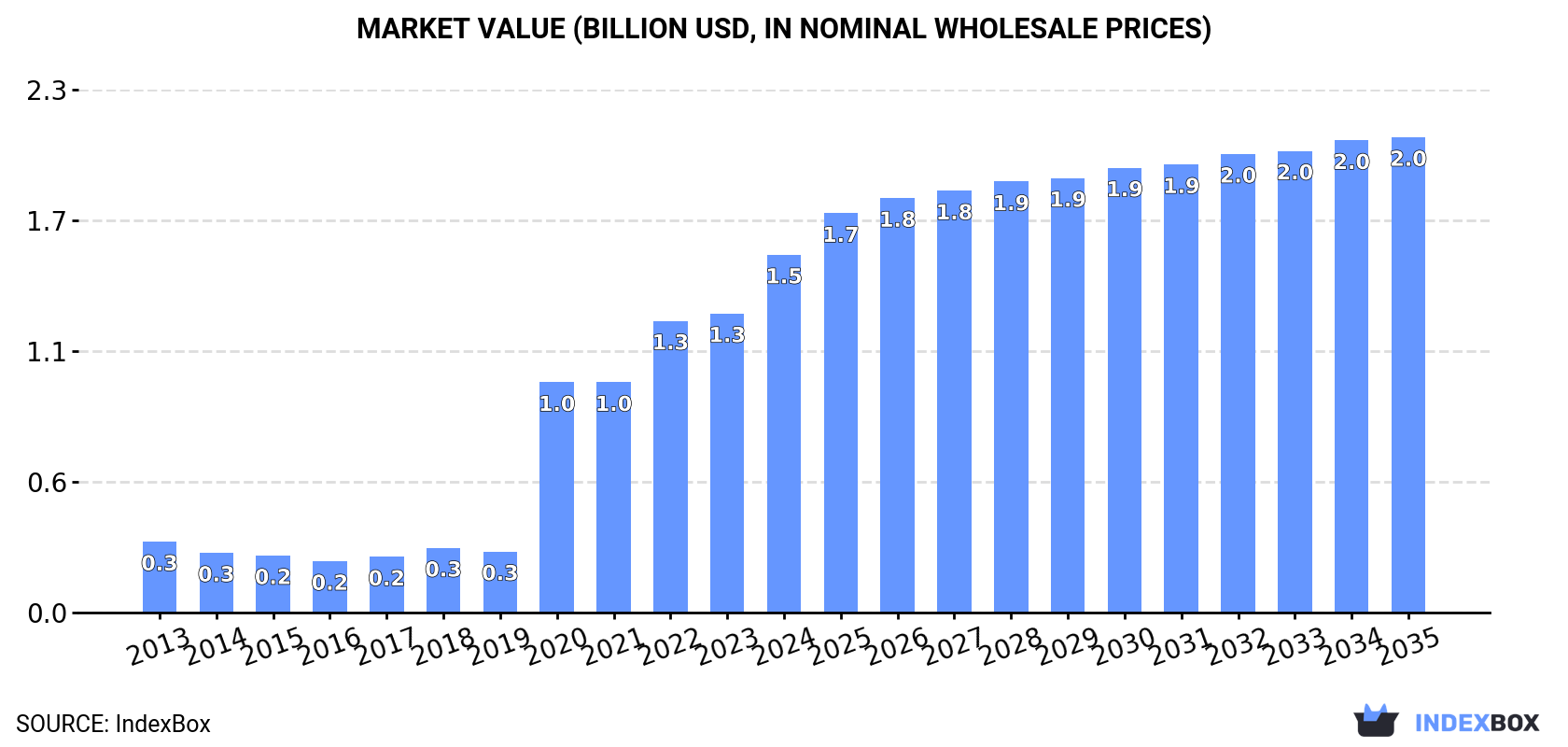

The European market for braces, suspenders, and garters is experiencing a surge in demand, driving an upward consumption trend expected to continue over the next decade. Market performance is forecasted to slow down, with a projected CAGR of +2.1% in volume and +2.6% in value from 2024 to 2035. By the end of 2035, the market is anticipated to reach 79M units and $2B in nominal prices, showcasing a steady growth trajectory.

Market Forecast

Driven by increasing demand for braces, suspenders and garters in the European Union, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +2.1% for the period from 2024 to 2035, which is projected to bring the market volume to 79M units by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.6% for the period from 2024 to 2035, which is projected to bring the market value to $2B (in nominal wholesale prices) by the end of 2035.

ConsumptionEuropean Union’s Consumption of Braces, Suspenders And Garters

ConsumptionEuropean Union’s Consumption of Braces, Suspenders And Garters

For the third consecutive year, the European Union recorded growth in consumption of braces, suspenders and garters, which increased by 28% to 63M units in 2024. Overall, consumption continues to indicate a buoyant expansion. Over the period under review, consumption hit record highs in 2024 and is expected to retain growth in years to come.

The revenue of the braces and garters market in the European Union soared to $1.5B in 2024, rising by 20% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). In general, consumption showed a remarkable increase. The level of consumption peaked in 2024 and is expected to retain growth in the immediate term.

Consumption By Country

The countries with the highest volumes of consumption in 2024 were the Netherlands (13M units), Poland (13M units) and Italy (7.9M units), with a combined 53% share of total consumption.

From 2013 to 2024, the most notable rate of growth in terms of consumption, amongst the main consuming countries, was attained by the Netherlands (with a CAGR of +41.9%), while consumption for the other leaders experienced more modest paces of growth.

In value terms, the largest braces and garters markets in the European Union were the Netherlands ($283M), Poland ($256M) and France ($229M), together accounting for 50% of the total market.

The Netherlands, with a CAGR of +39.4%, recorded the highest rates of growth with regard to market size in terms of the main consuming countries over the period under review, while market for the other leaders experienced more modest paces of growth.

The countries with the highest levels of braces and garters per capita consumption in 2024 were the Netherlands (750 units per 1000 persons), Belgium (487 units per 1000 persons) and Poland (333 units per 1000 persons).

From 2013 to 2024, the biggest increases were recorded for the Netherlands (with a CAGR of +41.1%), while consumption for the other leaders experienced more modest paces of growth.

ProductionEuropean Union’s Production of Braces, Suspenders And Garters

Braces and garters production declined to 32M units in 2024, shrinking by -5.4% on the year before. In general, production, however, showed a buoyant expansion. The most prominent rate of growth was recorded in 2020 when the production volume increased by 321% against the previous year. The volume of production peaked at 34M units in 2023, and then shrank in the following year.

In value terms, braces and garters production surged to $720M in 2024 estimated in export price. Over the period under review, production, however, posted prominent growth. The pace of growth appeared the most rapid in 2020 when the production volume increased by 441% against the previous year. Over the period under review, production hit record highs at $859M in 2021; however, from 2022 to 2024, production failed to regain momentum.

Production By Country

The countries with the highest volumes of production in 2024 were the Netherlands (9M units), Poland (8.9M units) and Italy (7.1M units), with a combined 77% share of total production. The Czech Republic, Bulgaria, Romania and Germany lagged somewhat behind, together accounting for a further 14%.

From 2013 to 2024, the biggest increases were recorded for Bulgaria (with a CAGR of +76.9%), while production for the other leaders experienced more modest paces of growth.

ImportsEuropean Union’s Imports of Braces, Suspenders And Garters

After seven years of growth, supplies from abroad of braces, suspenders and garters decreased by -9.1% to 66M units in 2024. In general, imports, however, showed a buoyant expansion. The pace of growth was the most pronounced in 2020 when imports increased by 574%. The volume of import peaked at 73M units in 2023, and then contracted in the following year.

In value terms, braces and garters imports declined rapidly to $211M in 2024. Over the period under review, imports continue to indicate a perceptible curtailment. The most prominent rate of growth was recorded in 2022 when imports increased by 20% against the previous year. As a result, imports reached the peak of $299M. From 2023 to 2024, the growth of imports failed to regain momentum.

Imports By Country

In 2024, Poland (14M units), the Netherlands (9.6M units), France (9.5M units), Germany (9M units) and Belgium (6.3M units) represented the largest importer of braces, suspenders and garters in the European Union, making up 73% of total import. It was distantly followed by Spain (3.7M units) and Italy (3.3M units), together mixing up a 10% share of total imports.

From 2013 to 2024, the biggest increases were recorded for Poland (with a CAGR of +45.5%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, the largest braces and garters importing markets in the European Union were Germany ($39M), France ($36M) and the Netherlands ($31M), with a combined 50% share of total imports. Poland, Spain, Belgium and Italy lagged somewhat behind, together comprising a further 26%.

Poland, with a CAGR of +8.1%, recorded the highest growth rate of the value of imports, among the main importing countries over the period under review, while purchases for the other leaders experienced mixed trends in the imports figures.

Import Prices By Country

In 2024, the import price in the European Union amounted to $3.2 per unit, dropping by -19.2% against the previous year. In general, the import price continues to indicate a deep reduction. The pace of growth appeared the most rapid in 2014 an increase of 44%. Over the period under review, import prices reached the maximum at $41 per unit in 2018; however, from 2019 to 2024, import prices remained at a lower figure.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was Germany ($4.3 per unit), while Poland ($1.4 per unit) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Italy (-7.7%), while the other leaders experienced a decline in the import price figures.

ExportsEuropean Union’s Exports of Braces, Suspenders And Garters

In 2024, after four years of growth, there was significant decline in overseas shipments of braces, suspenders and garters, when their volume decreased by -38.4% to 36M units. In general, exports, however, posted a prominent expansion. The pace of growth was the most pronounced in 2020 when exports increased by 709%. The volume of export peaked at 58M units in 2023, and then fell dramatically in the following year.

In value terms, braces and garters exports dropped dramatically to $175M in 2024. Overall, exports recorded a noticeable reduction. The most prominent rate of growth was recorded in 2021 with an increase of 15%. Over the period under review, the exports attained the maximum at $279M in 2013; however, from 2014 to 2024, the exports remained at a lower figure.

Exports By Country

In 2024, Poland (10M units), distantly followed by the Netherlands (5.4M units), Germany (4.4M units), the Czech Republic (3M units), France (2.9M units), Italy (2.5M units) and Spain (1.9M units) represented the main exporters of braces, suspenders and garters, together making up 85% of total exports.

From 2013 to 2024, the most notable rate of growth in terms of shipments, amongst the key exporting countries, was attained by Poland (with a CAGR of +49.1%), while the other leaders experienced more modest paces of growth.

In value terms, Germany ($32M), Poland ($27M) and the Netherlands ($20M) constituted the countries with the highest levels of exports in 2024, with a combined 45% share of total exports.

Poland, with a CAGR of +13.3%, recorded the highest rates of growth with regard to the value of exports, among the main exporting countries over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Export Prices By Country

In 2024, the export price in the European Union amounted to $4.9 per unit, with an increase of 21% against the previous year. In general, the export price, however, recorded a abrupt descent. The level of export peaked at $55 per unit in 2013; however, from 2014 to 2024, the export prices failed to regain momentum.

There were significant differences in the average prices amongst the major exporting countries. In 2024, amid the top suppliers, the country with the highest price was Germany ($7.3 per unit), while Poland ($2.7 per unit) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by the Czech Republic (-12.1%), while the other leaders experienced a decline in the export price figures.