Occidental Petroleum (OXY) and its innovative subsidiary, 1PointFive, have taken a significant step by signing an agreement with ADNOC to investigate a prospective $500 million joint venture. This ambitious project aims to establish a cutting-edge direct air capture facility in South Texas. The facility is designed to capture an impressive 500,000 metric tons of carbon dioxide annually, showcasing Occidental’s commitment to sustainable energy solutions.

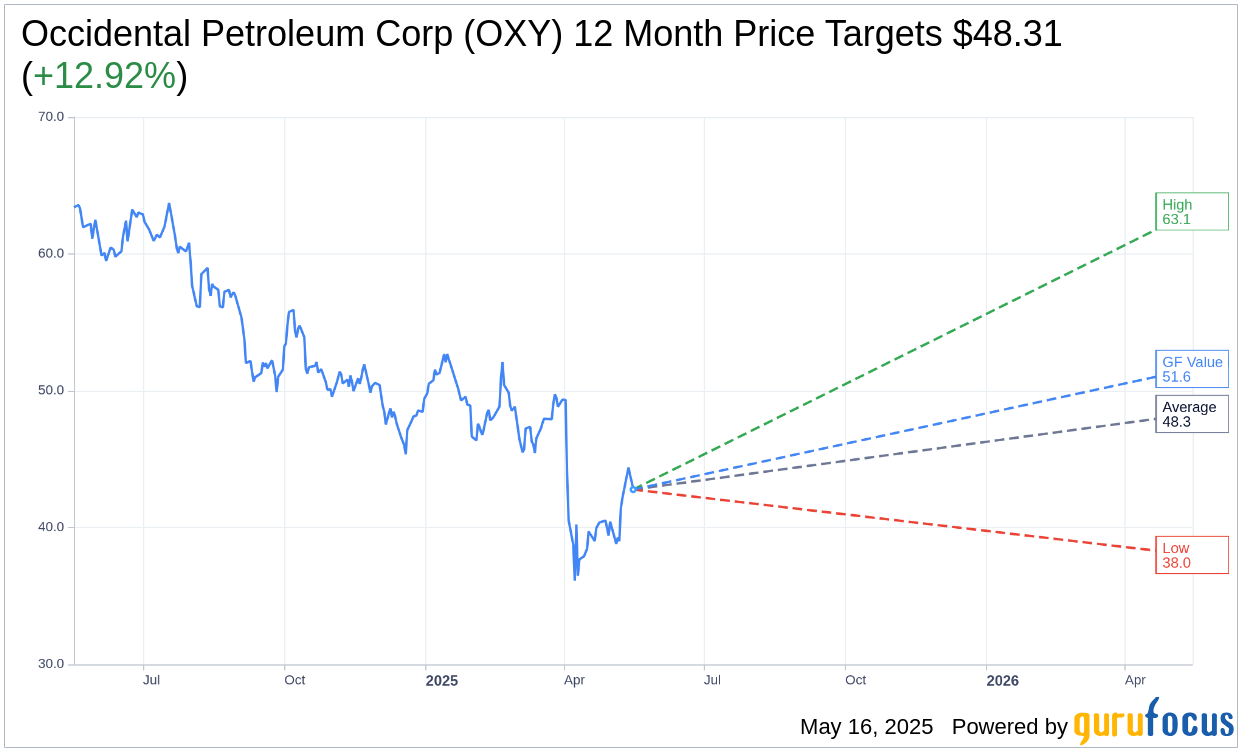

Wall Street Analysts Forecast

According to projections from 23 analysts, Occidental Petroleum Corp (OXY, Financial) has an average target price of $48.31 for the next year. This forecast includes a high estimate of $63.11 and a low estimate of $38.00. The average target price suggests a potential upside of 12.92% from the current trading price of $42.78. Investors looking for more detailed projections can visit the Occidental Petroleum Corp (OXY) Forecast page.

The consensus among 26 brokerage firms rates Occidental Petroleum Corp (OXY, Financial) at 2.8, reflecting a “Hold” status on a scale where 1 means Strong Buy and 5 means Sell. This rating provides a balanced outlook on the stock’s potential performance.

Understanding GF Value’s Potential

Based on GuruFocus estimates, the projected GF Value for Occidental Petroleum Corp (OXY, Financial) is pegged at $51.60, indicating a substantial potential upside of 20.62% from its current price of $42.7799. The GF Value represents GuruFocus’s assessment of the fair trading value of the stock. This valuation considers the historical trading multiples, past business growth, and future performance estimates. Investors interested in a comprehensive understanding can explore more on the Occidental Petroleum Corp (OXY) Summary page.