The European Union will propose to G7 finance ministers to lower the price cap on Russian crude from the current $60 per barrel to $50, European Economic Commissioner Valdis Dombrovskis said. Established in December 2022, the G7 oil price cap prevents Western-allied companies from providing shipping, insurance, and related services for Russian crude sold above $60 per barrel. The main objective of the price cap is to cripple Russia’s ability to fund its war in Ukraine, while also maintaining reasonable flows of Russian oil to global markets to prevent a supply crisis.

However, many analysts argue the price cap has become less effective because Russia now largely reroutes its exports through a so-called “shadow fleet” of tankers that evade maritime oversight. Moscow relies on this fleet to bypass the oil price cap and sell its crude above the threshold.

“This is something which we flagged from the Commission’s side in the context of the 18th sanctions package,” Dombrovskis said, as reported by Reuters. “I would expect some interest also from other G7 partners in this regard and some discussion.”

Russia’s shadow fleet consists of approximately 500, mostly poorly insured and aging tankers that ship crude to countries such as India and China, in defiance of Western sanctions. These tankers, estimated to carry as much as 85% of Russia’s oil exports—which bring in a third of Russia’s export revenues—typically have opaque ownership structures and lack top-tier insurance or safety certification. Most belong to anonymous or newly formed shell companies based in jurisdictions such as Dubai, further complicating accountability.

Related: Goldman Raises Oil Demand Outlook

The majority of shadow tankers sail across the Baltic Sea, a route considered critical for Russia’s energy exports. The shadow fleet uses various tactics to avoid detection, including ship-to-ship transfers in international waters, spoofed location data, and fake ship identification numbers. Some estimates suggest that approximately three shadow tankers carrying Russian crude pass through European waters each day, including the Danish straits and the Channel. Some experts estimate the shadow fleet may now include as many as 700 tankers.

However, Lithuanian National Security Advisor K?stutis Budrys has highlighted the ambiguity surrounding the law on interdiction in international waters, warning that trying to stop the shadow fleet could risk an all-out military confrontation with Russia. Last week, a Russian fighter jet briefly entered Estonia’s airspace, in what some experts suspect was a reprisal for the Estonian military escorting a tanker named Jaguar out of the country’s economic waters. The Estonian navy acted quickly, believing the ship posed a threat to nearby underwater cables, and checked its status and registration. The Russian jet entered Estonian airspace without permission.

Whether the latest EU sanctions will deliver the desired results remains to be seen. Back in January, the Finnish Border Guard reported that Russia’s oil shipments via the Baltic Sea declined by 10% during the last quarter of 2024, largely due to the impact of EU sanctions. Finland’s Coast Guard closely monitors the shadow fleet. The decline may also be related to U.S. sanctions: Last year, the Biden administration sanctioned Russia’s Surgutneftgas and Gazprom Neft, two companies responsible for about 25% of Russian oil exports, shipping an average of 970,000 barrels per day in 2024.

“In the last four or five months of last year, we saw a roughly 10% decline in the amount of oil leaving from Russia,” Finnish Border Guard’s Head of Maritime Safety Mikko Hirvi told Reuters. “That is of course very good, but on the other hand, older vessels have been added to the traffic on the Baltic Sea at the same time. The vessels in operation are in worse condition than before,” he added. However, Hirvi conceded that the decline might only be temporary.

A recent study found that limiting Russia’s shadow fleet may be more effective than simply lowering the oil price cap:

“While all sanctions reduce the present value of Russia’s profits, we find that the tighter the ceiling and the tighter the enforcement, the less harm sanctions impose—contradicting conventional wisdom based on the Hotelling lemma. However, policies to reduce the shadow fleet’s size may increase the sanction’s effectiveness.”

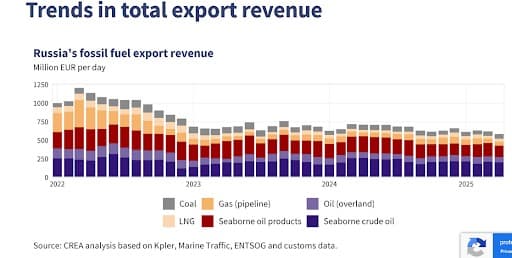

Source: CREA

An April report by the Centre for Research on Energy and Clean Air (CREA) found that Russia’s shadow fleet is shrinking. According to the report, shadow tankers transported 65% of Russian crude exports in April, down from 81% in January. Russia’s fossil fuel export revenues declined 6% month-on-month to EUR 585 million per day in April, while export volumes rose marginally by 1%.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com