ConocoPhillips (COP) is embarking on a significant venture, securing a long-term contract to supply liquefied natural gas (LNG) to China’s Guangdong Pearl River by 2028. This strategic agreement is set to deliver 300,000 metric tons annually and marks a pivotal moment as the first U.S.-China LNG contract since tariffs in 2025.

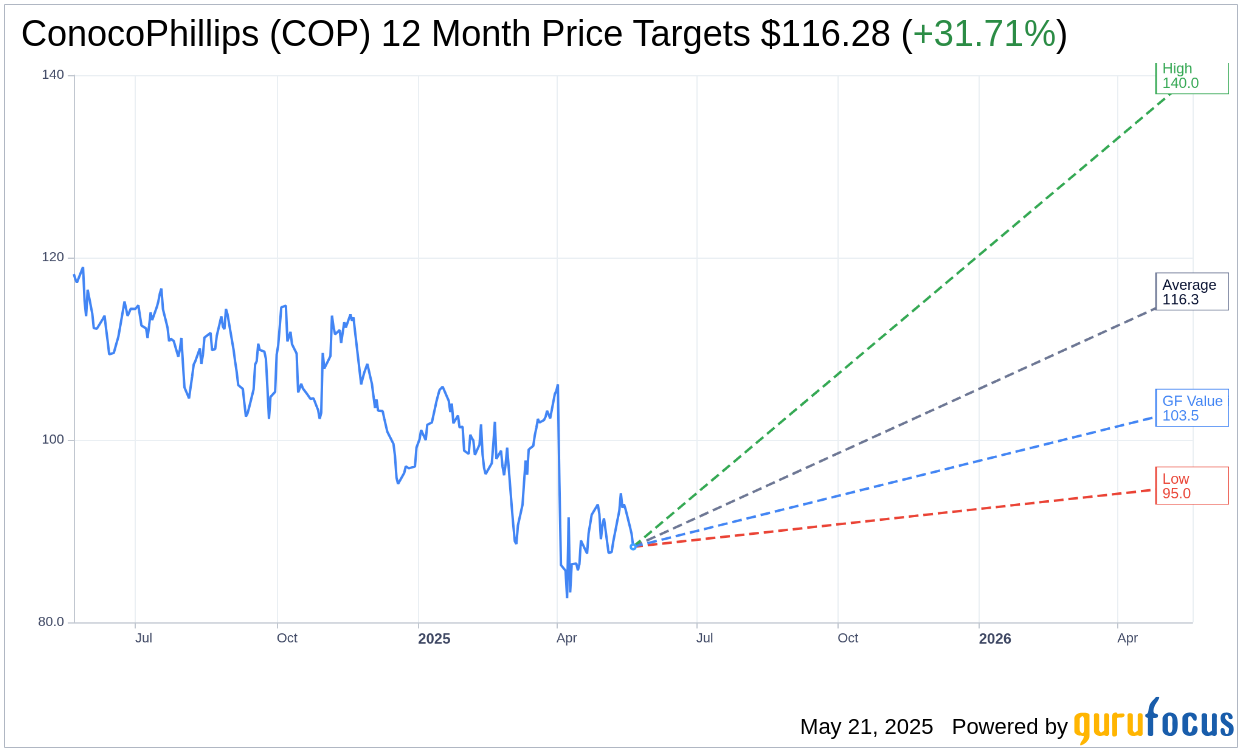

Analyst Price Forecasts for ConocoPhillips

According to projections from 25 analysts, ConocoPhillips (COP, Financial) is expected to reach an average price target of $116.28 over the next year. Forecasts show a potential high of $140.00, while the lowest estimate is $95.00. This median target suggests a robust upside of 31.69% from the current trading value of $88.30. Investors looking for more detailed forecast data can explore the ConocoPhillips (COP) Forecast page.

Brokerage Recommendations

From the consensus of 28 brokerage firms, ConocoPhillips’s (COP, Financial) average recommendation stands at 1.9, translating to an “Outperform” rating. This evaluation is on a scale from 1 to 5, where 1 indicates Strong Buy and 5 signifies Sell, reflecting a positive industry sentiment towards COP’s performance and strategic positioning.

Evaluating the GF Value of ConocoPhillips

GuruFocus provides a detailed financial metric known as the GF Value, estimating ConocoPhillips’s (COP, Financial) fair market value at $103.53 in the coming year. This estimate points to a potential upside of 17.25% from the current price of $88.3. The GF Value is derived from COP’s historical trading multiples, past performance growth, and future business projections. For a comprehensive overview, visit the ConocoPhillips (COP) Summary page.