What’s going on here?

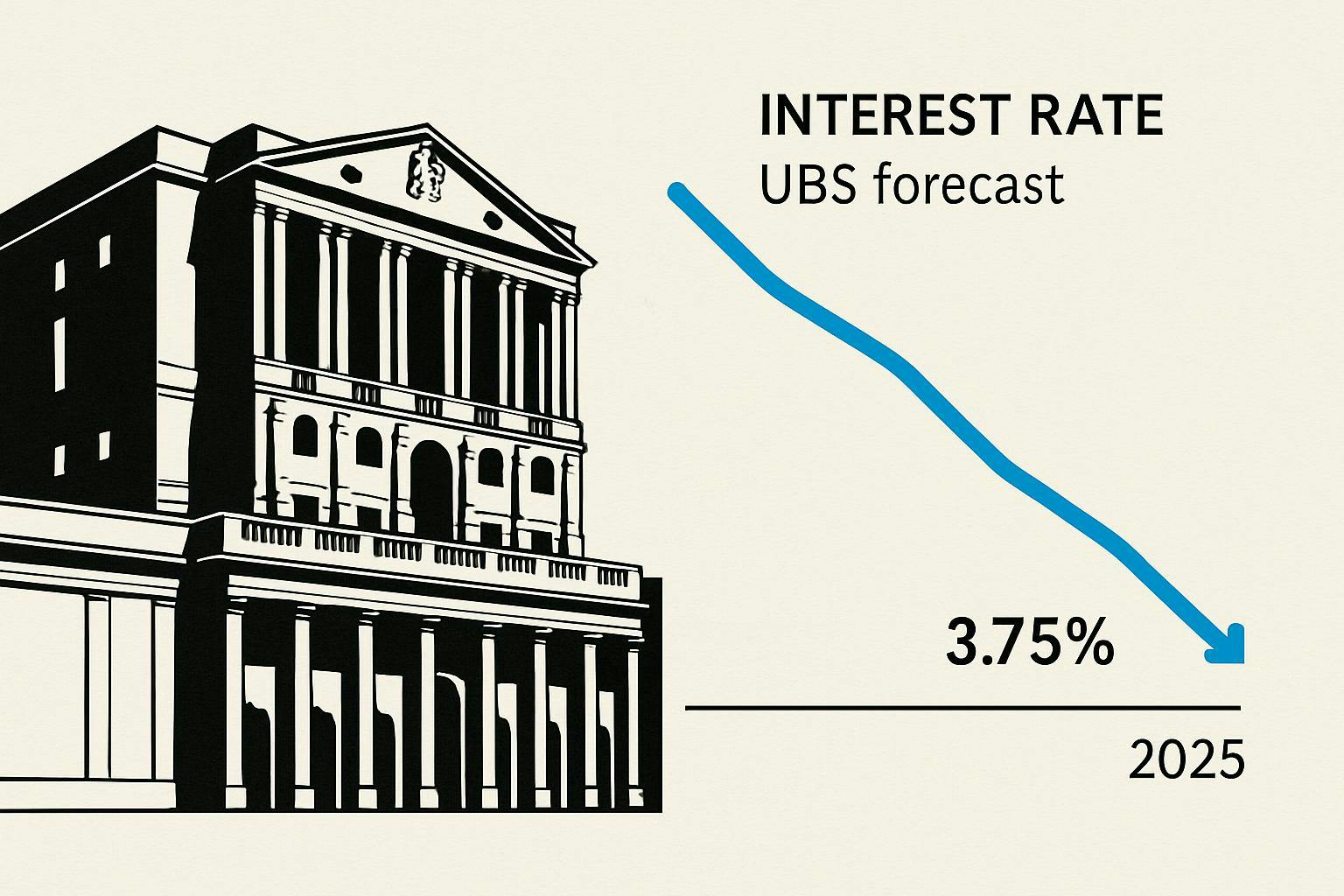

UBS is forecasting that the Bank of England will trim interest rates to 3.75% by year-end to tackle inflation and wage growth challenges.

What does this mean?

UBS anticipates the Bank of England will walk a tightrope as it faces rising inflation and strong wage growth. After cutting rates in May, the central bank is expected to pause in June before lowering them again in August and November 2025. This strategy aims to address ongoing inflation in services while offsetting potential disinflation from US tariffs. But with unpredictable tariff effects and other external influences, there’s an air of uncertainty about these plans. If the economic landscape becomes more pressured than expected, the Bank could hasten rate cuts beyond UBS’s quarterly forecast.

Why should I care?

For markets: Interest rate maneuvers poised to shift market tides.

UBS’s projections set the stage for shifting market dynamics as investors prepare for the Bank of England’s monetary policy changes. A lower Bank Rate implies cheaper borrowing, which might boost investment and spending. Still, ongoing inflation and tariff uncertainties add complexity, encouraging caution among investors. It’s essential to monitor the Bank’s decisions closely as they could affect bond yields and currency values.

The bigger picture: Navigating through a labyrinth of global economic challenges.

UBS’s projected rate changes come amid complex global issues like inflation variations and changing tariff policies. The Bank of England’s actions symbolize broader efforts to stabilize economic growth in a tumultuous global environment. While rate cuts may aim to energize a sluggish economy, global uncertainties, such as shifting trade relations and geopolitical tensions, could change these aims. This scenario calls for a keen focus on international economic partnerships and monetary strategies to anticipate future market conditions.