What’s going on here?

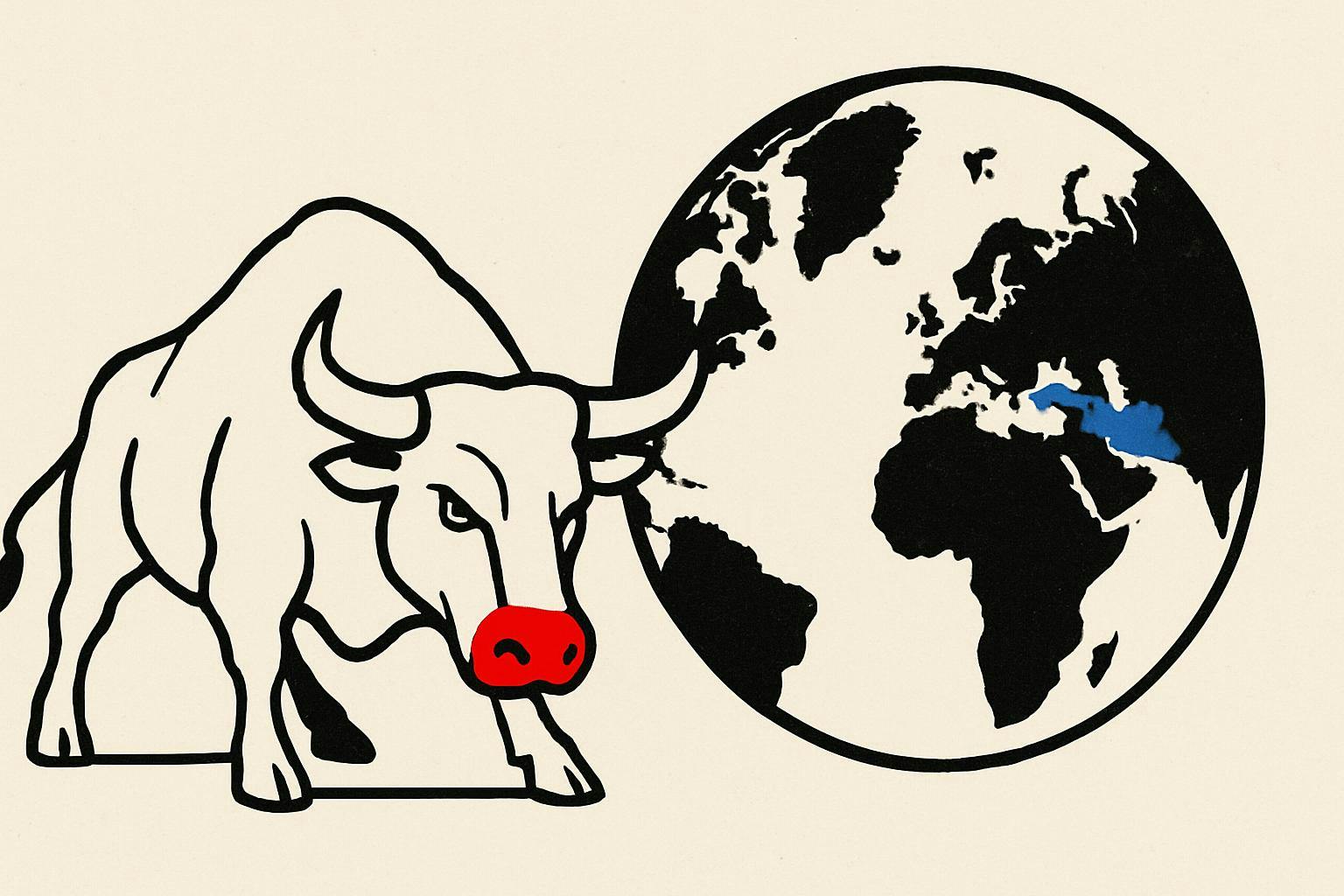

US equity futures dipped as investors brace for geopolitical fallout from US-Iran talks in Rome and Trump’s tariff threats targeting Apple’s foreign-made iPhones and the EU.

What does this mean?

Markets have reacted sharply to the recent US-Iran nuclear talks and Trump’s announcement about looming tariffs on foreign-manufactured goods. With futures for the Dow, S&P 500, and Nasdaq taking a hit, there’s growing anxiety over global trade relationships. The tariff threats—25% on Apple’s foreign-manufactured iPhones and a potential 50% on EU products—could reopen trade disputes, significantly impacting tech giants like Apple and EU-US relations. Oil prices also dipped by 1.2%, affecting Brent and West Texas Intermediate crude, reflecting market concerns. The economic uncertainty is compounded by anticipated declines in US new home sales to 694,000 units in April, while global markets showed mixed reactions depending on regional sensitivities to these developments.

Why should I care?

For markets: Tensions put pressure on tech and trade.

Investor nerves are heightened as potential tariffs threaten the tech sector’s equilibrium. Apple’s production in China may face steep cost increases, affecting share performance and potentially impacting tech-heavy portfolios. Geopolitical and trade uncertainties are casting ripples across global markets, with Germany’s DAX experiencing a significant 2.4% drop.

The bigger picture: Global economic chess game.

The macroeconomic landscape is evolving as US-Iran discussions and US-EU trade tensions induce market volatility. Trump’s possible easing of nuclear regulations temporarily boosted Uranium Energy and Centrus Energy shares, but other sectors are grappling with instability. Regional disparities in global markets underline vulnerabilities and strengths amid fluctuating geopolitical strategies and economic policies.