Data compiled by Asia’s leading information service provider, Polymerupdate Research, revealed that benchmark Brent crude futures for near-month delivery on the InterContinental Exchange (ICE) rose by 0.54 percent, or US$ 0.34 a barrel, to settle at US$ 64.78 a barrel on Friday, up from US$ 64.44 a barrel in the previous session. Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) increased by 0.54 percent, or US$ 0.33 a barrel, closing at US$ 61.53 a barrel on Friday, compared to US$ 61.20 a barrel in the prior session.

An analyst from Kedia Stocks and Commodities Research commented, “Discussions ahead of the June 1 meeting include a potential increase of 411,000 barrels per day (bpd), which, if confirmed, could outpace demand growth and exert further pressure on prices. Geopolitical developments also influenced the market, with the anticipation of the fifth round of nuclear talks between the U.S. and Iran easing fears of conflict-driven supply disruptions in the Middle East, particularly in light of reports suggesting potential Israeli strikes on Iranian nuclear facilities.”

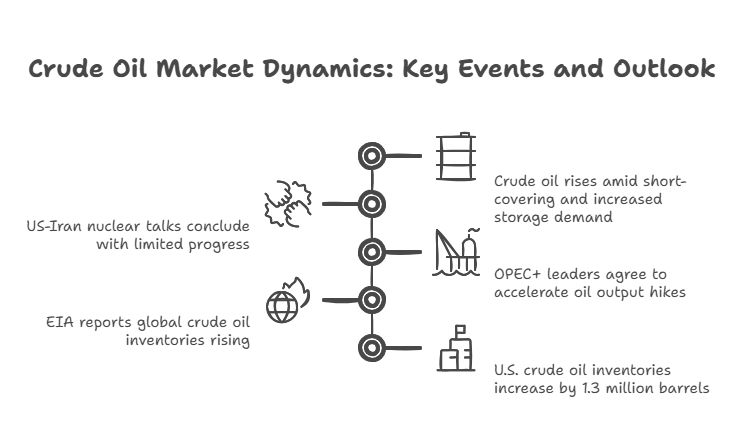

US-Iran nuclear talks

Oman, acting as the mediator, announced limited progress in the nuclear negotiations between the United States and Iran held in Rome on Friday. The fifth round of talks, conducted between Iran’s Foreign Minister Abbas Araghchi and U.S. President Donald Trump’s Middle East envoy Steve Witkoff, aimed to resolve a decade-long dispute over Tehran’s nuclear program. Following the meeting at the Omani embassy in Rome’s Camilluccia district, Omani mediator Badr al-Busaidi stated, “The fifth round of Iran-U.S. talks concluded today in Rome with some, but not conclusive, progress. We hope to clarify the remaining issues in the coming days.”

Speaking to Iranian state television, Araghchi remarked, “The talks have been one of the most professional rounds of negotiations so far. While an agreement has not been reached, the Iranian side is not discouraged. We have firmly stated Iran’s position. The fact that we are now on a reasonable path, in my view, is itself a sign of progress. The proposals and solutions will be reviewed in respective capitals, and the next round of talks will be scheduled accordingly.”

The ongoing talks focus on preventing Iran from producing nuclear weapons. If successful, international sanctions on Iran would be eased, allowing Tehran to produce and export more oil to the international market, including China. Notably, U.S. sanctions on Tehran’s oil production and transportation have significantly impacted China’s “teapot” refineries. However, both sides have recently adopted tough public stances. The United States has threatened Iran with additional actions, while Israel is reportedly preparing for potential missile strikes on Iranian facilities. Witkoff categorically stated that Iran would not be permitted to pursue uranium enrichment.

Storage demand

In a significant boost for producers, the International Energy Agency (IEA) has slightly revised its global crude oil demand growth forecast for 2025 upward to 740,000 bpd, an increase of 20,000 bpd compared to its previous outlook. A key indicator of this trend is the rising storage demand in the United States, the world’s largest crude oil producer and consumer. Reports indicate that U.S. crude oil storage demand has surged in recent weeks, reaching levels last observed during the Covid-19 pandemic. Leading storage broker The Tank Tiger attributed this spike in U.S. storage demand to an unprecedented increase in energy availability, particularly from the Organization of the Petroleum Exporting Countries and allies (OPEC+).

OPEC+ leaders have agreed to accelerate oil output hikes for the second consecutive month in June, targeting overproducing members, even as energy prices hover around production cost levels. Some OPEC+ leaders have suggested that output increases may continue in July, potentially restoring up to 2.2 million bpd of supply to the market by November. The primary goal of OPEC+ leaders is to reclaim their cumulative market share in global oil supply, which has drastically declined by approximately 5 percent due to cumulative production cuts of 5.5 million bpd implemented since Russia’s invasion of Ukraine in February 2022.

Brent crude futures dropped to a four-year low of US$ 58.40 a barrel in April amid fears of excessive output from OPEC+ members. This oversupply coincides with a global economic slowdown driven by former U.S. President Donald Trump’s imposition of steep tariffs on trade partners, which elicited retaliatory measures from other trading nations. The falling prices have prompted participants to build inventories in anticipation of a price recovery. The Tank Tiger estimates a sudden surge in crude oil storage demand, projecting it to double to 3 million barrels in June, compared to May.

Worrying stockpiling

The latest report from the U.S. Energy Information Administration (EIA), released on May 15, estimated total global crude oil inventories rising for the second consecutive month to 7.7 million barrels in March. According to the EIA, global inventories are projected to increase further by an average of 720,000 barrels per day (bpd) this year and accelerate to 930,000 bpd next year. The report also noted that global onshore crude oil inventories rose by over 100 million barrels to 3.127 billion barrels between mid-April and mid-May. This marks the highest level for onshore inventories since the COVID-19 pandemic, excluding the seasonal peak in July 2023.

In the United States, crude oil inventories experienced a surprise increase of 4 million barrels during the week ending May 9, following a 4.287-million-barrel build reported by the American Petroleum Institute (API). The EIA also reported declines in gasoline and distillate stocks. U.S. crude oil inventories rose by 1.3 million barrels to 443.2 million barrels in the week ending May 16. Meanwhile, crude oil storage in China, the world’s largest importer, reached a record high of 1.127 billion barrels in May, reflecting a concerted effort by the government and refineries to build stockpiles.

Outlook

Crude oil is caught between strong bullish and bearish fundamentals. While excess supply has pressured prices in the international market, stockpiling demand has sustained bullish sentiment. Considering the underlying factors on both sides, crude oil prices are expected to trade within a narrow range, at least in the near future. Crude oil has been moving in a narrow range for the last couple of weeks due to these competing bullish and bearish factors.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com