Key Highlights:

Diamondback Energy and other shale producers are reducing drilling in the Permian Basin due to falling oil prices. Wall Street analysts set a one-year average price target for FANG at $184.25, suggesting a significant potential upside. Currently rated as “Outperform” by analysts, with a GF Value estimate predicting a 14.79% increase from its present valuation.Diamondback Energy and the Permian Basin Dynamics

Diamondback Energy (NASDAQ: FANG) is among several U.S. shale producers scaling back drilling operations in the Permian Basin. This strategic move, highlighted by Goldman Sachs, comes in response to the current market turbulence triggered by declining oil prices. The decision is underscored by a substantial reduction in rig counts, reflecting a broader industry trend as companies navigate uncertain market conditions.

Wall Street Analysts Forecast

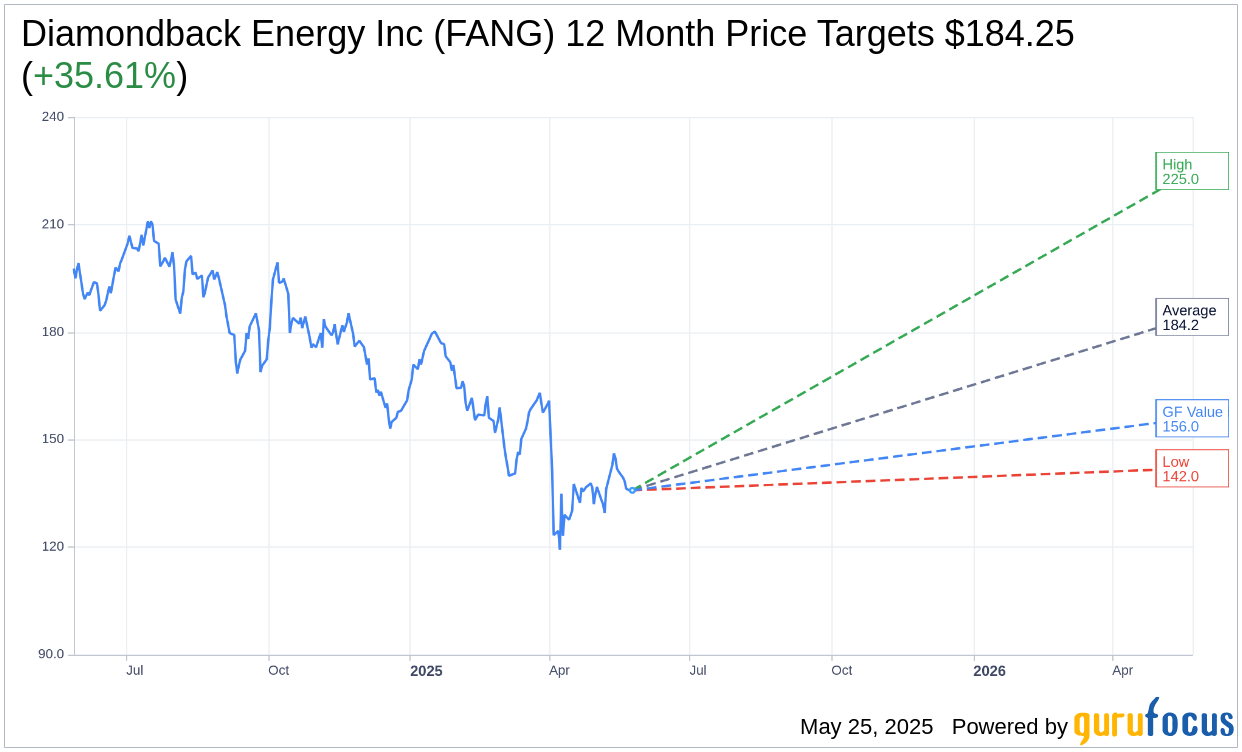

Analysts have provided their insights with 29 experts setting a one-year average price target for Diamondback Energy Inc (FANG, Financial) at $184.25. This figure represents a high estimate of $225.00 and a low of $142.00, suggesting an impressive upside potential of 35.61% from the current share price of $135.86. Investors interested in more detailed estimates can explore the full data on the Diamondback Energy Inc (FANG) Forecast page.

Brokerage Firm Recommendations

The consensus among 31 brokerage firms places Diamondback Energy Inc (FANG, Financial) at an average brokerage recommendation of 1.8, translating to an “Outperform” rating. The rating scale, ranging from 1 (Strong Buy) to 5 (Sell), indicates positive sentiment for potential investors considering this stock.

GuruFocus GF Value Analysis

GuruFocus provides a calculated GF Value for Diamondback Energy Inc (FANG, Financial) at $155.96 over the coming year, forecasting a plausible upside of 14.79% from its present price of $135.86. This GF Value estimation is derived from historical trading multiples, the company’s previous growth patterns, and projections of future business performance. For a comprehensive analysis, visit the Diamondback Energy Inc (FANG) Summary page.