For years central banks have been discussing whether cryptocurrencies represent a financial stability risk. The usual conclusion is there’s potential for risk owing to cryptocurrency volatility, but adoption is relatively low and linkages to traditional finance (TradFi) are limited. In its latest financial stability report, the European Central Bank (ECB) still notes limited adoption, but sees a growing appetite for digital assets and the potential for significantly more interconnectedness. One of its biggest concerns is a lack of visibility into the activities of non bank financial institutions, which it considers as creating a blind spot for potential contagion.

ECB consumer crypto survey

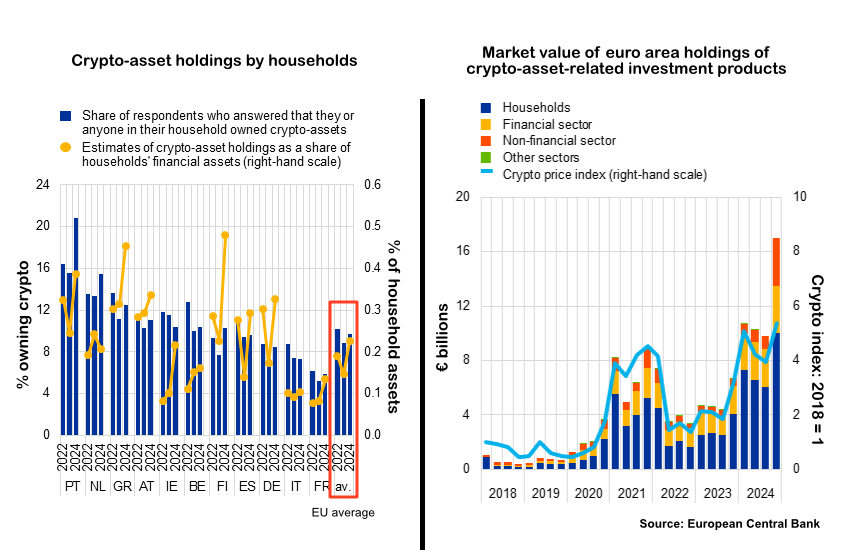

According to a November 2024 ECB survey, 9.7% of households owned some crypto-assets, but the amount is pretty small for most: 54% reported holding under €1,000 and 91% said they invested less than €20,000. Overall the ECB extrapolated this to total holdings of €75 billion or about 3% of the total market capitalization for cryptocurrencies. This only accounts for 0.23% of EU household financial assets. The figures vary significantly between regions. For example, 21% of Portuguese households reported owning crypto, compared to 6% for France.

These ECB figures contrast with crypto industry surveys. For example, a very recent report from crypto exchange Gemini says that 21% of French survey respondents hold crypto in 2025, up from 18% in 2024. The ECB found around 7% of Italian households have invested, compared to Gemini’s 19%. Part of the difference could be methodology. The ECB asked the survey respondent about themselves or household members, whereas Gemini’s survey just asked the respondent. However, the ECB’s methodology is likely to inflate its figures because some respondents reply affirmatively even though they personally are not crypto holders.

Circling back to the ECB survey, the question about intent to invest in cryptocurrencies indicates potential for significant growth. Of those already holding crypto, around 56% planned to invest more. And 10% of households that have not yet invested intend to buy some.

TradFi crypto exposures

Beyond household adoption, the ECB also examined how traditional financial institutions are increasingly exposed to cryptocurrency markets. It reported bank cryptocurrency custody as growing from €400 million in 2023 to €4.7 billion in 2024*.

Another area of potential interconnectedness is crypto firms placing deposits at banks. However, the ECB only registered €1.2 billion of deposits in total in 2024, which is less than half of the peak amount in 2021. It will monitor the potential growth in stablecoin deposits.

One area that has seen significant growth is the volume of crypto-asset investment products, which the ECB considers could be more attractive to traditional financial intermediaries. Hence, it views this as an avenue for greater interconnectedness.

The ECB concluded that “the combination of rising crypto-asset prices and traditional financial institutions entering the crypto-asset market raises possibilities for substantial contagion channels from crypto-assets to traditional finance to open up.”

* We’d note a big discrepancy compared to Basel Committee custody figures that showed €5.3 billion at the end of 2023 and €7.3 billion for June 2024, which may be explained by Basel’s European figures including the UK and Switzerland. However, that would imply that custody in the UK and Switzerland declined from €4.9 billion in 2023 to €2.6 billion in 2024, which seems unlikely.