Williams Companies Inc (WMB) is making strategic moves by planning to restart the development of two crucial natural gas pipelines in New York. The company’s initiative comes after constructive talks between former President Trump and New York Governor Kathy Hochul. The Constitution Pipeline and Northeast Supply Enhancement projects are designed to enhance the transportation of Appalachian gas to the Northeast U.S., which could significantly impact regional energy supply dynamics.

Analyst Price Targets and Forecasts

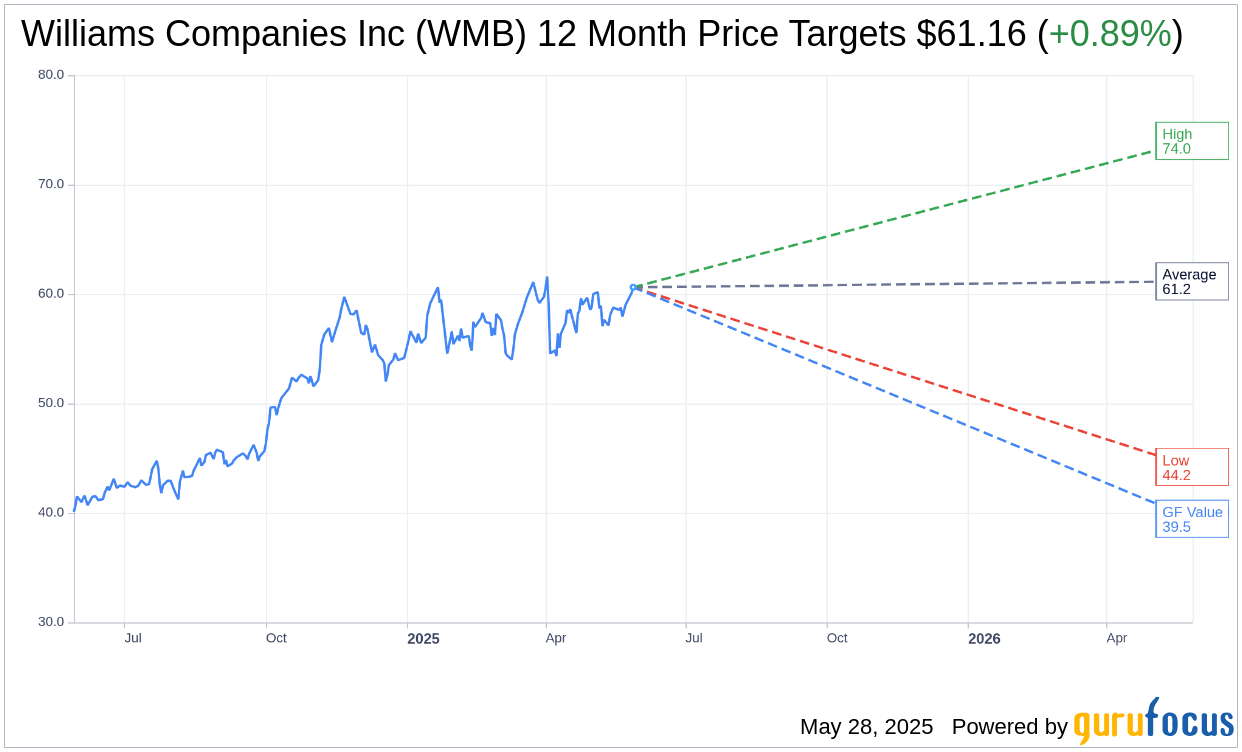

According to projections by 18 Wall Street analysts, Williams Companies Inc is expected to reach an average price target of $61.16 over the next year. This forecast includes a potential high of $74.00 and a low estimate of $44.21, suggesting a slight upside of 0.89% from its current trading price of $60.62. You can explore more detailed analysis on the Williams Companies Inc (WMB, Financial) Forecast page.

Brokerage Recommendations

The consensus among 21 brokerage firms places Williams Companies Inc at an average brokerage recommendation of 2.2, indicating an “Outperform” status. The recommendation scale spans from 1, symbolizing a Strong Buy, to 5, indicating a Sell, reflecting a generally positive outlook within the investing community.

GF Value Estimation and Implications

The GF Value for Williams Companies Inc is estimated to be $39.47 in the coming year. This figure suggests a potential downside of 34.89% from its current price of $60.62. The GF Value metric, developed by GuruFocus, assesses the fair trading value of a stock based on historical trading multiples, prior business growth, and future performance estimates. For a comprehensive analysis, visit the Williams Companies Inc (WMB, Financial) Summary page.

Investors considering Williams Companies Inc should weigh these forecasts alongside their investment strategy, keeping in mind the potential opportunities and risks highlighted by current analyst and GuruFocus estimates.